15 Nj Salary Tax Calculator Facts: Essential Guide For All Residents

Understanding New Jersey’s Salary Tax Calculator

New Jersey, often referred to as the Garden State, is home to a diverse population and a thriving economy. As a resident, it’s crucial to have a clear understanding of the state’s tax system, especially when it comes to calculating your salary tax. Here, we present a comprehensive guide to help you navigate the process effortlessly.

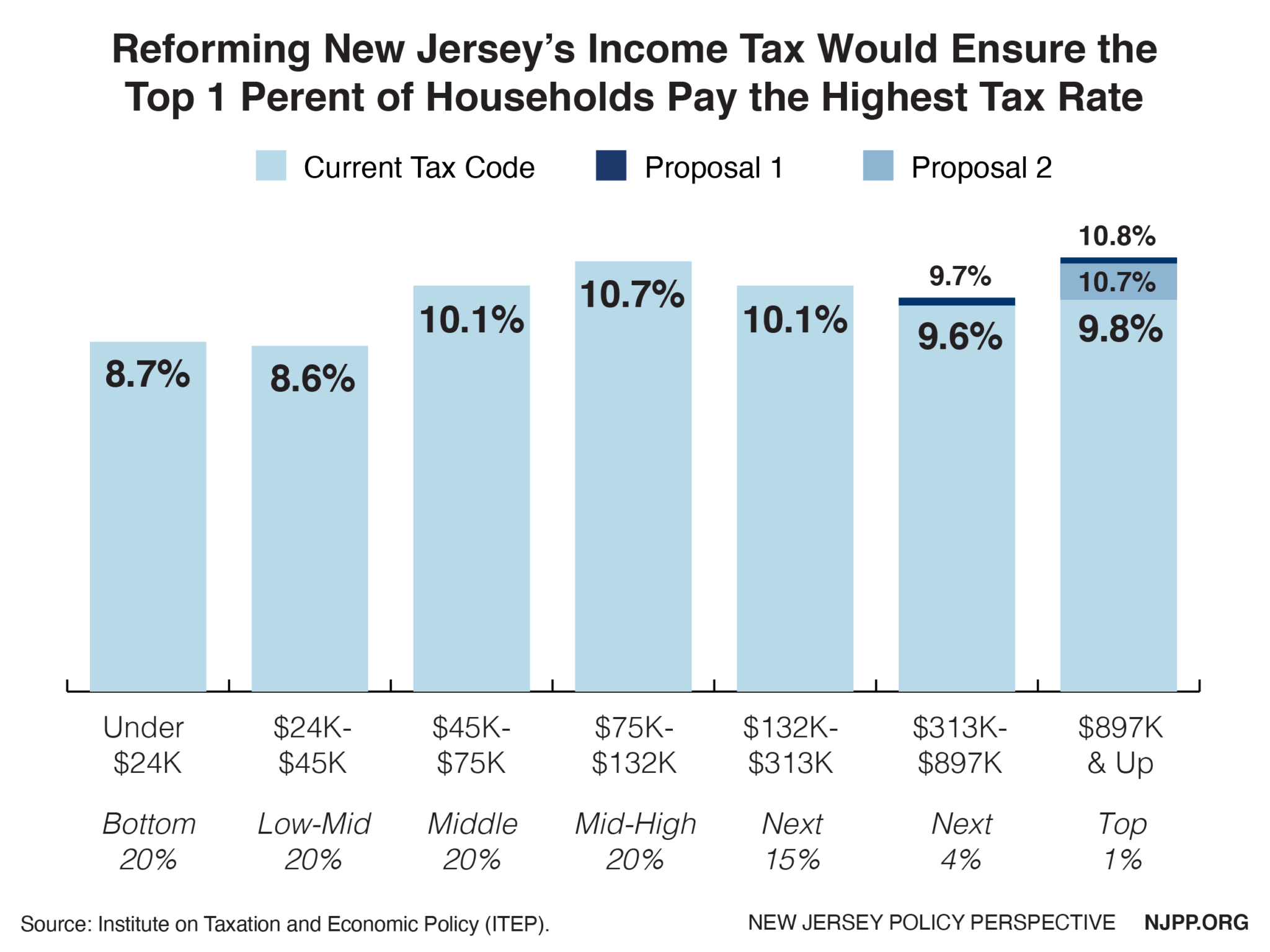

1. Introduction to New Jersey’s Tax System

New Jersey operates under a progressive tax system, which means that your tax rate increases as your income rises. This system ensures that individuals with higher incomes contribute a larger proportion of their earnings towards state revenue. It’s important to note that New Jersey has one of the highest state tax rates in the country, so being aware of your tax obligations is essential.

2. Salary Tax Calculation Process

The salary tax calculation in New Jersey involves several steps. First, your income is assessed to determine your tax bracket. Then, your taxable income is calculated by deducting any applicable exemptions and deductions. Finally, the appropriate tax rate is applied to your taxable income to determine the amount of tax you owe.

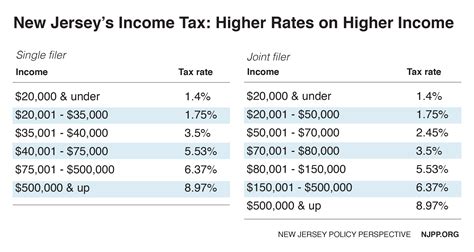

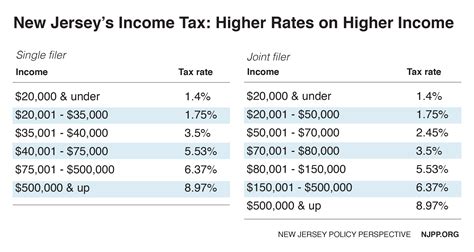

3. Tax Brackets and Rates

New Jersey has multiple tax brackets, each with its own tax rate. As of [insert current year], the tax brackets and rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - 20,000 | 1.4% |

| 20,001 - 35,000 | 3.5% |

| 35,001 - 40,000 | 5.525% |

| 40,001 - 75,000 | 6.625% |

| $75,001 and above | 8.975% |

These rates are subject to change, so it’s advisable to check the official New Jersey tax website for the most up-to-date information.

4. Exemptions and Deductions

New Jersey offers various exemptions and deductions that can reduce your taxable income. Some common exemptions include:

- Personal exemptions: You can claim an exemption for yourself and any dependents.

- Standard deductions: These are fixed amounts that reduce your taxable income.

- Itemized deductions: You may be able to deduct certain expenses, such as medical costs, charitable contributions, and mortgage interest.

It’s important to review your eligibility for these exemptions and deductions to minimize your tax liability.

5. Online Tax Calculators

To simplify the tax calculation process, New Jersey provides online tax calculators on its official website. These calculators allow you to input your income, exemptions, and deductions to estimate your tax liability. It’s a convenient tool to get a rough idea of your tax obligations before filing your return.

6. Filing Your Tax Return

Once you have calculated your tax liability, it’s time to file your tax return. New Jersey offers both electronic and paper filing options. The deadline for filing your return is typically April 15th, but it’s always a good idea to check the official website for any updates or extensions.

7. Payment Options

New Jersey provides various payment options for your tax liability. You can pay by credit card, debit card, electronic funds transfer, or by mailing a check. It’s important to choose a payment method that suits your needs and ensures timely payment to avoid penalties and interest.

8. Penalties and Interest

If you fail to file your tax return or pay your taxes on time, New Jersey may impose penalties and interest on your outstanding balance. These penalties can accumulate quickly, so it’s crucial to stay on top of your tax obligations.

9. Tax Refunds

In some cases, you may be entitled to a tax refund if you overpaid your taxes during the year. New Jersey typically issues refunds within a few weeks of receiving your return. It’s essential to keep track of your refund status and contact the tax authorities if you have any concerns.

10. Tax Credits

New Jersey offers various tax credits to eligible residents. These credits can reduce your tax liability and provide financial benefits. Some common tax credits include:

- Property tax credits: For homeowners, there are credits available to offset property taxes.

- Education credits: Residents pursuing higher education may be eligible for tax credits.

- Low-income credits: Individuals with low incomes may qualify for specific tax credits.

11. Tax Planning Strategies

To optimize your tax situation, it’s beneficial to engage in tax planning. This involves reviewing your financial situation, maximizing deductions and credits, and considering tax-efficient investment strategies. Consulting a tax professional can provide valuable insights and ensure you’re taking advantage of all available opportunities.

12. Tax Resident Status

Your tax resident status in New Jersey determines your tax obligations. If you are a full-year resident, you must report all your income, regardless of its source. Part-year residents, on the other hand, may only need to report income earned within the state. Understanding your resident status is crucial for accurate tax reporting.

13. Tax Forms and Documentation

When filing your tax return, you’ll need to gather various forms and documentation. This includes your W-2 forms, 1099 forms, and any other income statements. Additionally, you’ll need to provide proof of exemptions and deductions, such as receipts or documentation from charitable organizations.

14. Tax Software and Services

To simplify the tax filing process, many residents opt for tax software or professional tax preparation services. These tools can guide you through the process, ensure accuracy, and provide additional support. It’s worth considering these options, especially if you have a complex tax situation.

15. Staying Informed

Tax laws and regulations can change frequently, so it’s important to stay informed. Regularly check the official New Jersey tax website for updates, announcements, and any new tax initiatives. Staying up-to-date ensures you’re compliant with the latest requirements and can take advantage of any new benefits or deductions.

Final Thoughts

Understanding New Jersey’s salary tax calculator is essential for all residents. By familiarizing yourself with the tax system, brackets, and available exemptions, you can navigate the process with confidence. Remember to stay organized, meet deadlines, and seek professional advice when needed. With proper planning and awareness, you can ensure a smooth and stress-free tax experience.

🌟 Note: This guide provides a general overview. For specific tax advice, consult a qualified tax professional.

FAQ

What is the deadline for filing my tax return in New Jersey?

+The deadline for filing your tax return in New Jersey is typically April 15th. However, it’s important to check the official website for any updates or extensions.

Can I file my tax return electronically in New Jersey?

+Yes, New Jersey offers electronic filing as an option. It’s a convenient and efficient way to file your tax return.

Are there any tax credits available for residents of New Jersey?

+Yes, New Jersey offers various tax credits, including property tax credits, education credits, and low-income credits. Check the official website for eligibility criteria and requirements.