17 Tips For Using A Paycheck Calculator In Louisiana: Maximize Your Earnings Potential

Introduction

If you’re an employee in Louisiana, understanding your paycheck and maximizing your earnings is crucial. A paycheck calculator can be a valuable tool to help you achieve this. By using a paycheck calculator, you can gain insights into your take-home pay, deductions, and tax obligations. This comprehensive guide will provide you with 17 tips to make the most of a paycheck calculator in Louisiana, ensuring you can navigate your finances with confidence.

Understanding Your Paycheck

1. Gross Pay vs. Net Pay

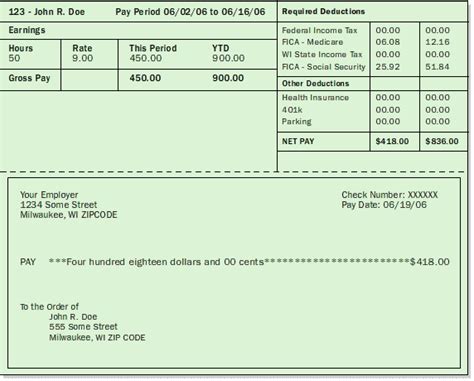

Before diving into the calculator, it’s essential to grasp the difference between gross pay and net pay. Gross pay refers to your total earnings before any deductions, while net pay is the amount you take home after all deductions and taxes. The paycheck calculator will help you calculate both.

2. Know Your Deductions

Louisiana has specific deductions that affect your paycheck. These include federal and state income taxes, Social Security, and Medicare. Additionally, you may have other deductions, such as health insurance premiums or retirement contributions. Understanding these deductions is vital for accurate paycheck calculations.

Maximizing Your Earnings

3. Tax Withholding

One of the key features of a paycheck calculator is its ability to help you optimize your tax withholding. By adjusting your withholding allowances, you can ensure you’re not overpaying or underpaying taxes. This can result in a larger refund or a reduced tax bill at the end of the year.

4. Claiming Dependents

If you have dependents, such as children or elderly parents, claiming them on your tax returns can reduce your taxable income. The paycheck calculator can assist you in determining the best strategy for claiming dependents and maximizing your tax benefits.

5. Utilize Tax Credits

Louisiana offers various tax credits that can lower your tax liability. These credits include the Earned Income Tax Credit (EITC) and the Child and Dependent Care Credit. The paycheck calculator can help you estimate the impact of these credits on your refund or tax bill.

6. Adjust Your W-4 Form

The W-4 form is a crucial document that determines your tax withholding. By using the paycheck calculator, you can review your current withholding status and make necessary adjustments to your W-4. This ensures that your tax payments align with your actual tax liability.

Calculating Your Paycheck

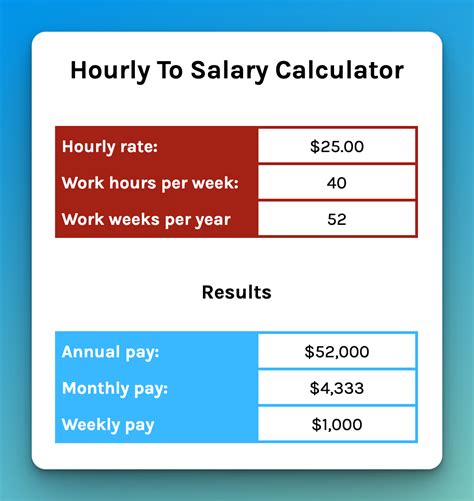

7. Enter Your Income

Start by inputting your gross income into the paycheck calculator. This should include your base salary, overtime pay, bonuses, and any other earnings. Accurate income entry is essential for precise calculations.

8. Choose Your Filing Status

Select your filing status, which can be single, married filing jointly, married filing separately, or head of household. This status impacts your tax rates and deductions.

9. Add Deductions and Credits

Input any applicable deductions and credits, such as student loan interest, education credits, or retirement savings contributions. These factors influence your taxable income and overall tax liability.

Advanced Features and Considerations

10. Multiple Jobs

If you have multiple jobs, the paycheck calculator can help you manage your earnings and deductions across all positions. This ensures you understand your total income and tax obligations.

11. Self-Employment

For those who are self-employed, the calculator can assist in estimating your quarterly tax payments and understanding your self-employment tax obligations.

12. Investment Income

If you have investment income, such as dividends or capital gains, the calculator can help you estimate the taxes you may owe on these earnings.

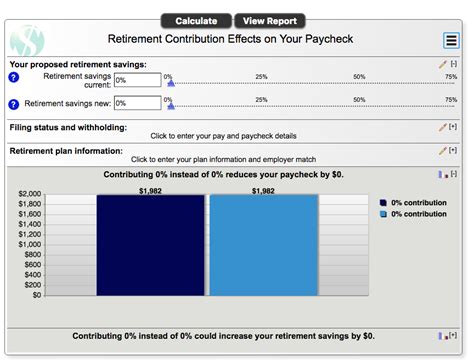

13. Retirement Planning

Many paycheck calculators offer retirement planning tools. These features can help you estimate the impact of retirement savings contributions on your taxable income and overall financial goals.

Staying Informed

14. Tax Law Changes

Tax laws can change annually, so it’s essential to stay updated. The paycheck calculator should provide information on any recent changes that may impact your taxes.

15. State-Specific Considerations

Louisiana has unique tax laws and deductions. Ensure that the calculator you choose takes into account these state-specific factors for accurate results.

Additional Tips

16. Regularly Review Your Paycheck

Use the calculator to review your paycheck regularly. This practice helps you identify any errors or changes in your deductions and ensures you’re on track with your financial goals.

17. Seek Professional Advice

While paycheck calculators are valuable tools, they may not cover all complex tax scenarios. If you have unique circumstances or high-value assets, consider consulting a tax professional for personalized advice.

Conclusion

By following these 17 tips, you can maximize your earnings potential and navigate your finances with confidence. A paycheck calculator is a powerful tool for understanding your paycheck, optimizing your tax situation, and making informed financial decisions. Stay informed, review your paychecks regularly, and seek professional advice when needed to ensure you’re making the most of your earnings in Louisiana.

FAQ

What is the best paycheck calculator for Louisiana residents?

+There are several reliable paycheck calculators available, such as PaycheckCity and SmartAsset. These calculators consider Louisiana’s specific tax laws and deductions to provide accurate results.

How often should I use a paycheck calculator?

+It’s recommended to use a paycheck calculator at least once a year, especially when filing your taxes. Additionally, review your paycheck regularly to ensure accuracy and make any necessary adjustments.

Can a paycheck calculator help with retirement planning?

+Yes, many advanced paycheck calculators offer retirement planning tools. These features can help you estimate the impact of retirement savings on your taxable income and overall financial well-being.