18 Essential Oregon Payroll Calculator Tips: Master Your Pay With These Expert Strategies

Navigating the intricacies of payroll can be a daunting task, especially when it comes to ensuring accurate calculations and compliance with regulations. For businesses in Oregon, mastering the payroll process is crucial to maintain smooth operations and keep employees satisfied. In this comprehensive guide, we delve into 18 essential tips to help you tackle payroll calculations like a pro, covering everything from understanding state-specific regulations to optimizing your payroll process.

Understanding Oregon's Payroll Regulations

Oregon's payroll landscape is unique, with its own set of rules and regulations. Here's a breakdown of the key aspects you need to be aware of:

Minimum Wage and Overtime

Oregon has a minimum wage rate that applies to all non-exempt employees. Currently, the minimum wage is $14.75 per hour for employers with 10 or more employees and $13.50 per hour for employers with 9 or fewer employees. Overtime pay is mandated for hours worked beyond 40 in a workweek, with a rate of 1.5 times the regular rate of pay.

Payroll Tax Obligations

Oregon employers are responsible for withholding and remitting various payroll taxes, including federal and state income taxes, Social Security, and Medicare taxes. Additionally, Oregon has its own state income tax, which must be withheld from employee wages.

Unemployment Insurance and Workers' Compensation

Oregon requires employers to contribute to the state's unemployment insurance fund and maintain workers' compensation insurance. These contributions are crucial for providing benefits to employees in the event of unemployment or work-related injuries.

Setting Up Your Payroll System

A well-organized payroll system is the foundation of accurate and efficient payroll processing. Here are some steps to help you get started:

Choose the Right Payroll Software

Select a payroll software solution that suits your business needs. Look for features such as easy integration with your accounting system, automated tax calculations, and the ability to handle complex payroll scenarios like multiple pay rates and bonus payments.

Collect Employee Information

Gather essential employee data, including names, addresses, Social Security numbers, and tax withholding information. Ensure that all information is accurate and up-to-date to avoid errors and ensure compliance.

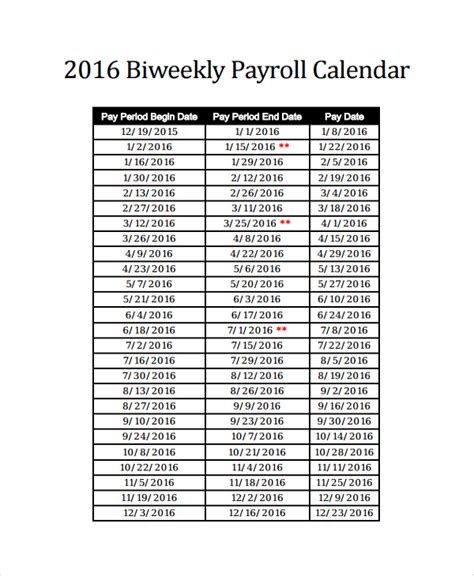

Set Up Pay Periods and Payment Methods

Define your pay periods, whether weekly, biweekly, or monthly, and establish the preferred payment method for your employees. Common options include direct deposit, paper checks, or payroll cards.

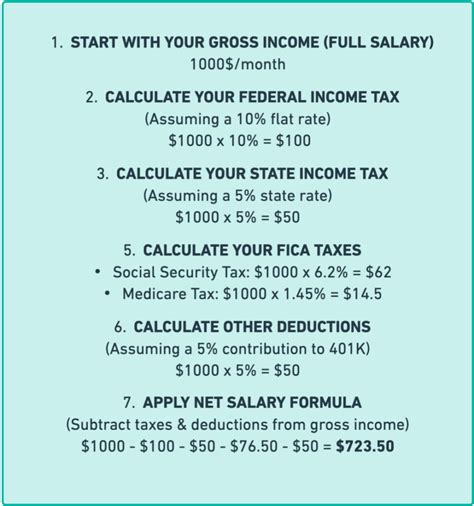

Calculating Gross Pay

Gross pay is the total amount earned by an employee before any deductions or taxes are applied. Here's how to calculate it accurately:

Regular Hours

Multiply the employee's regular hourly rate by the number of hours worked during the pay period. For example, if an employee works 40 hours at a rate of $15 per hour, their gross pay for regular hours would be $600.

Overtime Hours

Calculate overtime pay by multiplying the employee's overtime rate (1.5 times their regular rate) by the number of overtime hours worked. Add this amount to the gross pay for regular hours.

Bonus and Commission Payments

Include any bonus or commission payments in the gross pay calculation. Ensure that these payments are accurately recorded and documented to avoid discrepancies.

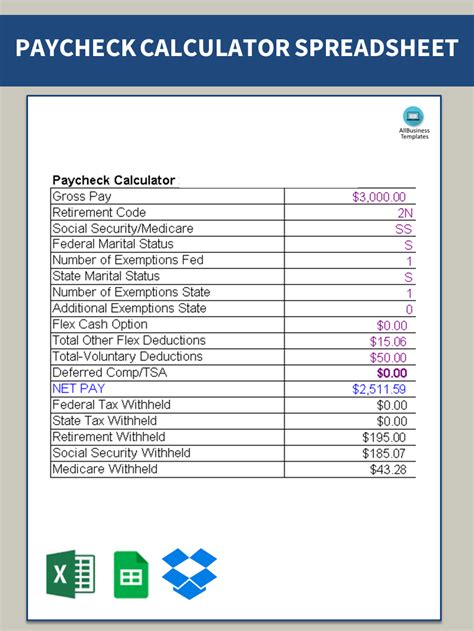

Applying Deductions and Withholdings

Deductions and withholdings reduce an employee's gross pay to arrive at their net pay. Here's a guide to navigating this process:

Federal and State Income Taxes

Withhold federal and state income taxes based on the employee's Form W-4 and the applicable tax tables. Ensure that you are using the most up-to-date tax rates and brackets to avoid over- or under-withholding.

Social Security and Medicare Taxes

Withhold Social Security and Medicare taxes at a flat rate of 7.65% from each employee's gross pay. The employer also contributes an equal amount, so the total tax rate is 15.3%.

Other Deductions

Apply any additional deductions authorized by the employee, such as health insurance premiums, retirement plan contributions, or voluntary deductions for charitable causes.

Handling Special Payroll Scenarios

Payroll processing can become more complex in certain situations. Here's how to tackle some common scenarios:

New Hires and Terminations

When onboarding new employees, ensure you have all the necessary paperwork, including a completed Form W-4 and I-9. For terminations, process final pay accurately, including any accrued vacation or sick time.

Garnishments and Child Support

If an employee has a garnishment or child support order, you must withhold the required amount from their pay and remit it to the appropriate agency. Follow the instructions provided to ensure compliance.

Sick Leave and Vacation Accruals

Track and calculate sick leave and vacation accruals for each employee. Ensure that you are following Oregon's regulations regarding paid time off and provide accurate records to employees upon request.

Staying Compliant with Reporting Requirements

Oregon has specific reporting requirements for employers. Here's what you need to know:

Quarterly and Annual Reports

File quarterly payroll tax reports with the appropriate agencies, including the IRS and the Oregon Department of Revenue. Ensure that you are using the correct forms and deadlines to avoid penalties.

Wage and Hour Reporting

Oregon requires employers to maintain accurate records of employee wages and hours worked. Keep detailed records, including time cards, pay stubs, and any other relevant documentation.

Unemployment Insurance and Workers' Compensation

Report any new hires to the Oregon Employment Department within 20 days of their start date. Additionally, maintain records of all workers' compensation claims and ensure timely reporting to the appropriate agencies.

Optimizing Your Payroll Process

Streamlining your payroll process can save time and reduce errors. Consider these tips for optimization:

Automate Where Possible

Utilize payroll software to automate calculations, tax withholdings, and reporting. This reduces the risk of manual errors and saves valuable time for your payroll team.

Implement Time Tracking Systems

Invest in accurate time tracking systems, especially if you have hourly employees. This ensures that you are paying employees accurately and helps with compliance.

Regularly Review and Update Payroll Policies

Stay updated with changes in payroll regulations and reflect these changes in your payroll policies. Conduct regular audits to ensure accuracy and identify any areas for improvement.

Managing Payroll Records and Documentation

Maintaining organized payroll records is essential for compliance and audit purposes. Here's how to stay on top of it:

Maintain Comprehensive Records

Keep detailed records of all payroll-related activities, including pay stubs, tax filings, and employee earnings records. Ensure that these records are easily accessible and secure.

Retain Records for the Required Period

Oregon requires employers to retain payroll records for at least three years. Follow this guideline to ensure you are compliant with record-keeping requirements.

Provide Employees with Access to Their Records

Make it easy for employees to access their payroll records, such as pay stubs and W-2 forms. This promotes transparency and helps employees understand their earnings and deductions.

Troubleshooting Common Payroll Issues

Despite your best efforts, payroll issues can arise. Here's how to tackle some common problems:

Missing or Inaccurate Time Cards

Implement a process to verify time cards and address any discrepancies promptly. Communicate with employees to ensure accurate time tracking and resolve any issues that may arise.

Employee Pay Disputes

When employees dispute their pay, review the payroll records and calculations carefully. Engage with the employee to understand their concerns and provide a detailed explanation of the pay calculation.

Late or Missed Payroll Tax Payments

If you miss a payroll tax payment deadline, take immediate action to resolve the issue. Contact the appropriate agencies and work out a payment plan to avoid penalties and interest charges.

Training and Educating Your Payroll Team

A well-trained payroll team is crucial for accurate and efficient payroll processing. Consider the following strategies:

Provide Comprehensive Training

Offer training sessions to familiarize your payroll team with the payroll software, calculations, and Oregon's payroll regulations. Ensure that they understand the importance of accuracy and compliance.

Stay Informed About Regulatory Changes

Encourage your payroll team to stay updated with any changes in payroll regulations. Provide regular updates and resources to ensure they have the latest information.

Conduct Regular Audits and Reviews

Implement a system of internal audits and reviews to identify any potential errors or areas for improvement. This proactive approach helps maintain accuracy and prevents future issues.

Seeking Professional Help

Payroll can be complex, and seeking professional assistance can be beneficial, especially for small businesses or those with limited resources. Consider the following options:

Outsource Your Payroll

Hire a professional payroll service provider to handle your payroll processing. This can free up your time and resources while ensuring accurate and compliant payroll management.

Consult with Payroll Experts

Engage the services of a payroll consultant or accountant who specializes in payroll. They can provide guidance on complex payroll scenarios and help you navigate any challenges you may encounter.

Utilize Online Resources

Take advantage of online resources, such as payroll calculators, tax tables, and compliance guides. These tools can assist you in making accurate calculations and staying up-to-date with the latest regulations.

Conclusion

Mastering payroll calculations is a crucial aspect of running a successful business in Oregon. By understanding the state's unique regulations, setting up an efficient payroll system, and staying compliant with reporting requirements, you can ensure accurate pay for your employees and avoid costly mistakes. Remember to keep your payroll team trained and informed, and don't hesitate to seek professional help when needed. With these expert strategies, you'll be well on your way to payroll success!

What is the minimum wage in Oregon?

+The minimum wage in Oregon varies based on the number of employees. For employers with 10 or more employees, the minimum wage is 14.75 per hour, while for employers with 9 or fewer employees, it is 13.50 per hour.

How often should I process payroll in Oregon?

+Oregon does not mandate a specific pay frequency. However, it is recommended to process payroll at least semi-monthly to ensure timely payments to employees.

What payroll taxes do I need to withhold in Oregon?

+In addition to federal income tax, Social Security, and Medicare taxes, Oregon employers must withhold state income tax from employee wages. Employers also contribute to the state’s unemployment insurance fund and workers’ compensation insurance.

How do I calculate overtime pay in Oregon?

+Overtime pay in Oregon is calculated at a rate of 1.5 times the employee’s regular hourly rate for hours worked beyond 40 in a workweek. For example, if an employee’s regular rate is 15 per hour, their overtime rate would be 22.50 per hour.

What records should I keep for payroll purposes in Oregon?

+Oregon requires employers to maintain accurate records of employee wages, hours worked, and any deductions or contributions made on their behalf. This includes pay stubs, time cards, and tax filings. Records should be retained for at least three years.