18 Paycheck Calculation Tips: The Ultimate Md Guide To Financial Freedom

Introduction

Welcome to this comprehensive guide on paycheck calculation, a crucial aspect of financial management that can greatly impact your overall financial well-being. In this blog post, we will explore 18 essential tips to help you navigate the complexities of paycheck calculations and take control of your financial freedom. By understanding the ins and outs of your paychecks, you can make informed decisions, optimize your earnings, and achieve your financial goals. So, let’s dive in and unlock the secrets to mastering paycheck calculations!

Understanding Your Paycheck Components

Before we delve into the tips, it’s important to familiarize ourselves with the key components of a paycheck. A paycheck typically consists of the following elements:

- Gross Pay: This is the total amount earned before any deductions or taxes are applied. It represents your total earnings for a specific pay period.

- Deductions: Deductions are amounts withheld from your gross pay for various reasons. These can include federal, state, and local taxes, Social Security and Medicare contributions, health insurance premiums, retirement plan contributions, and any other mandatory or voluntary deductions.

- Net Pay: Net pay, also known as take-home pay, is the amount you receive after all deductions have been made. It represents the actual money you have available to spend or save.

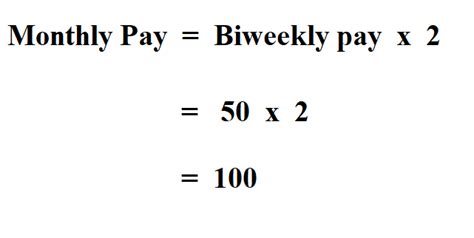

Tip 1: Know Your Pay Frequency

The first step in understanding your paycheck is to know your pay frequency. Most employers follow a regular pay schedule, which can be weekly, biweekly (every two weeks), semi-monthly (twice a month), or monthly. Knowing your pay frequency helps you anticipate when to expect your paychecks and plan your finances accordingly.

Tip 2: Review Your Pay Stub

Your pay stub, or paycheck stub, is a detailed record of your earnings and deductions for a specific pay period. It contains valuable information about your gross pay, deductions, and net pay. Take the time to review your pay stub carefully to ensure accuracy and understand the breakdown of your paycheck. Look for any errors or discrepancies and address them with your employer if needed.

Tip 3: Understand Tax Withholdings

Tax withholdings are an important aspect of paycheck calculations. Federal, state, and local taxes are deducted from your gross pay to ensure you meet your tax obligations. Understanding how tax withholdings work and adjusting them accordingly can help you avoid surprises come tax time. Familiarize yourself with the tax brackets, tax rates, and any applicable tax credits or deductions to optimize your tax withholdings.

Tip 4: Calculate Your Take-Home Pay

Calculating your take-home pay, or net pay, is essential for budgeting and financial planning. To calculate your take-home pay, you need to subtract all the deductions from your gross pay. This includes taxes, Social Security, Medicare, and any other mandatory or voluntary deductions. By knowing your take-home pay, you can accurately assess your disposable income and make informed financial decisions.

Tip 5: Track Your Earnings

Keeping track of your earnings is crucial for accurate paycheck calculations. Make sure to record your gross pay for each pay period, whether it’s weekly, biweekly, or monthly. This will help you monitor your income trends, identify any discrepancies, and ensure you receive the correct amount of pay. Consider using a spreadsheet or a dedicated financial tracking app to maintain a record of your earnings.

Tip 6: Understand Overtime Pay

If you work overtime hours, it’s important to understand how overtime pay is calculated. Overtime pay typically applies when you work beyond a certain number of hours in a workweek, often 40 hours. Your overtime rate is usually calculated at 1.5 times your regular hourly rate. Make sure to review your overtime pay calculations to ensure they are accurate and in line with labor laws.

Tip 7: Know Your Deduction Categories

Your paycheck may include various deduction categories, such as federal and state taxes, Social Security, Medicare, and other optional deductions like retirement plan contributions or health insurance premiums. Familiarize yourself with these deduction categories and understand how they impact your net pay. This knowledge will help you make informed decisions about your deductions and optimize your financial planning.

Tip 8: Review Your Benefits and Deductions

In addition to taxes and mandatory deductions, your paycheck may include deductions for employee benefits. These can include health insurance premiums, life insurance, disability insurance, and retirement plan contributions. Review these deductions carefully to ensure they align with your chosen benefit options and understand their impact on your net pay.

Tip 9: Calculate Your Net Worth

Calculating your net worth is an important step in assessing your overall financial health. Your net worth is the difference between your total assets (such as savings, investments, and property) and your total liabilities (debts and loans). By regularly calculating your net worth, you can track your financial progress, set goals, and make informed decisions about your financial future.

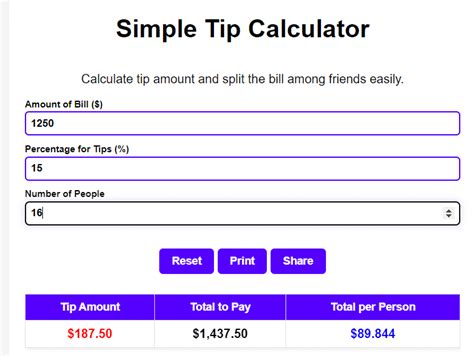

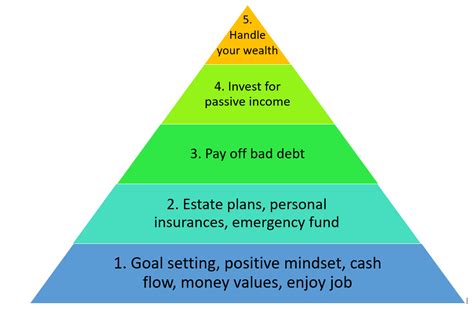

Tip 10: Create a Budget

A budget is a powerful tool for managing your finances and achieving your financial goals. Create a comprehensive budget that takes into account your income, expenses, savings, and debt payments. Allocate your income wisely, prioritize your expenses, and set aside a portion for savings and investments. Regularly review and adjust your budget to ensure it aligns with your financial goals and changing circumstances.

Tip 11: Automate Your Savings

Automating your savings is an effective way to build your financial security and reach your savings goals. Set up automatic transfers from your paycheck to your savings or investment accounts. This ensures that a portion of your income is consistently allocated towards savings, even if you don’t have the discipline to manually transfer funds. Start with a small amount and gradually increase it as your financial situation improves.

Tip 12: Maximize Your Retirement Contributions

Contributing to a retirement plan, such as a 401(k) or IRA, is an excellent way to secure your financial future. Take advantage of your employer’s retirement plan, if available, and contribute enough to receive any matching contributions offered. Maximize your retirement contributions within the allowable limits to benefit from tax advantages and ensure a comfortable retirement.

Tip 13: Explore Tax-Advantaged Accounts

In addition to retirement accounts, consider exploring other tax-advantaged accounts, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). These accounts allow you to set aside pre-tax dollars for specific purposes, such as healthcare expenses or dependent care. By contributing to these accounts, you can reduce your taxable income and potentially save on taxes.

Tip 14: Utilize Payroll Deductions for Debt Repayment

If you have outstanding debts, consider utilizing payroll deductions to streamline your debt repayment process. Many employers offer the option to have a portion of your paycheck automatically deducted and applied towards your debts, such as student loans or credit card balances. This can help you stay on top of your payments and reduce the burden of managing multiple debt payments.

Tip 15: Understand Paycheck Adjustments

Throughout your employment, you may encounter various paycheck adjustments, such as bonuses, commissions, or salary increases. Understand how these adjustments impact your gross pay and net pay. Calculate the additional income and deductions accurately to ensure you receive the correct amount. Stay informed about any changes to your pay structure and communicate with your employer if needed.

Tip 16: Keep Track of Paycheck Errors

Mistakes can happen, and it’s important to keep track of any paycheck errors you encounter. If you notice discrepancies in your pay stub, such as incorrect deductions or miscalculated earnings, bring them to the attention of your employer’s payroll department. Keep records of any communications regarding paycheck errors and follow up until the issues are resolved.

Tip 17: Stay Informed About Tax Laws and Changes

Tax laws and regulations can change over time, impacting your paycheck calculations and tax obligations. Stay informed about any updates or changes to tax laws that may affect your financial situation. Consult with a tax professional or use reliable online resources to stay up-to-date and ensure you are compliant with the latest tax requirements.

Tip 18: Seek Professional Financial Advice

While this guide provides valuable insights into paycheck calculations, seeking professional financial advice can further enhance your financial journey. Consider consulting a certified financial planner or a tax advisor who can provide personalized guidance based on your unique circumstances. They can help you optimize your tax strategies, create a comprehensive financial plan, and make informed decisions about your investments and savings.

Conclusion

Mastering paycheck calculations is an essential step towards achieving financial freedom and security. By following the 18 tips outlined in this guide, you can gain a deeper understanding of your paychecks, optimize your earnings, and make informed financial decisions. Remember to review your pay stubs, track your earnings, and stay informed about tax laws and changes. With a solid foundation in paycheck calculations, you can take control of your finances and work towards a brighter financial future.

FAQ

What is the difference between gross pay and net pay?

+

Gross pay refers to the total amount earned before any deductions, while net pay, or take-home pay, is the amount you receive after all deductions have been made.

How often should I review my pay stubs?

+

It is recommended to review your pay stubs regularly, ideally with each paycheck, to ensure accuracy and identify any discrepancies.

Can I adjust my tax withholdings?

+

Yes, you can adjust your tax withholdings by completing a new W-4 form or by consulting with a tax professional. Adjusting your withholdings can help you optimize your tax situation and potentially increase your take-home pay.

How can I track my earnings effectively?

+

You can use a spreadsheet or a dedicated financial tracking app to record your earnings for each pay period. This will help you monitor your income trends and identify any discrepancies.

What should I do if I find a mistake on my pay stub?

+

If you find a mistake on your pay stub, contact your employer’s payroll department immediately. Provide them with the details of the error and work with them to resolve the issue promptly.