7 Ways To Create A Military Pay Advance Loan Today

Introduction to Military Pay Advance Loans

For service members and their families, accessing financial resources can sometimes be a challenge, especially when unexpected expenses arise. Fortunately, military pay advance loans offer a solution to bridge the gap between paydays and cover urgent financial needs. These loans are designed to provide quick and convenient access to funds, ensuring that military personnel and their loved ones can navigate through financial emergencies with ease. In this blog post, we will explore seven effective ways to create a military pay advance loan today, empowering you to take control of your financial situation and navigate life’s unexpected twists and turns.

Understanding Military Pay Advance Loans

Before diving into the strategies for obtaining a military pay advance loan, let’s clarify what these loans entail and how they can benefit service members. Military pay advance loans, also known as military payday loans or military emergency loans, are short-term financial solutions specifically tailored for active-duty military personnel, veterans, and their families. These loans are designed to provide quick access to funds, typically ranging from a few hundred to a few thousand dollars, to cover unexpected expenses or urgent financial needs.

One of the key advantages of military pay advance loans is their flexibility and speed. Unlike traditional loans, which often require extensive paperwork and a lengthy approval process, military pay advance loans can be obtained within a matter of hours or days. This rapid turnaround time ensures that service members can address their financial concerns promptly, without having to wait for weeks or months.

7 Ways to Create a Military Pay Advance Loan

Now, let’s explore the seven effective strategies to create a military pay advance loan today:

1. Online Lenders

The internet has revolutionized the lending industry, making it easier than ever to access financial resources. Online lenders specialize in providing military pay advance loans, offering a convenient and efficient application process. By visiting reputable online lending platforms, you can compare loan options, interest rates, and terms to find the best fit for your needs. Many online lenders offer pre-approval checks, allowing you to assess your eligibility and understand the loan terms before officially applying.

2. Military-Specific Lenders

Several lenders cater specifically to the military community, understanding the unique financial challenges faced by service members. These military-specific lenders often have a deeper understanding of military pay cycles and can offer tailored loan products. By working with a military-focused lender, you may benefit from more flexible repayment terms, lower interest rates, and a smoother application process. Research reputable military lenders and compare their offerings to find the most suitable option for your financial situation.

3. Credit Unions

Credit unions are not-for-profit financial institutions that provide various financial services to their members. Many credit unions offer military pay advance loans with competitive interest rates and flexible repayment options. Joining a credit union that caters to the military community can provide access to exclusive loan products and benefits. Consider researching credit unions that have a strong military presence and explore their loan offerings to find a suitable military pay advance loan.

4. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual lenders, creating a unique borrowing experience. These platforms often have a wide range of loan options, including military pay advance loans. By utilizing peer-to-peer lending, you can access funds from individual investors who are willing to lend to military personnel. The application process is typically straightforward, and you can often receive funds within a short timeframe. Research reputable peer-to-peer lending platforms and compare their loan terms to find the best fit for your needs.

5. Military Assistance Programs

Various military assistance programs and organizations provide financial support to service members and their families. These programs often offer emergency loans or grants to cover unexpected expenses. Research and reach out to organizations such as the Army Emergency Relief, Air Force Aid Society, Navy-Marine Corps Relief Society, and Coast Guard Mutual Assistance. These organizations may provide financial assistance, including military pay advance loans, to eligible individuals facing financial hardships.

6. Government Benefits and Entitlements

Service members and their families are entitled to certain government benefits and entitlements that can provide financial support during times of need. Explore the benefits offered by the Department of Veterans Affairs (VA), such as the VA Pension program or the VA Home Loan program. Additionally, consider researching state-specific benefits and programs that may offer financial assistance to military personnel. By maximizing your government benefits, you can reduce your financial burden and potentially access funds for urgent expenses.

7. Emergency Savings Fund

Building an emergency savings fund is a proactive approach to financial preparedness. By setting aside a portion of your income regularly, you can create a financial cushion to cover unexpected expenses. Aim to save at least three to six months’ worth of living expenses in a dedicated emergency fund. This fund can serve as a reliable source of funds during financial emergencies, eliminating the need for high-interest loans. Consider automating your savings by setting up regular transfers from your paycheck or bank account to your emergency fund.

Tips for a Successful Military Pay Advance Loan Application

When applying for a military pay advance loan, keep the following tips in mind to increase your chances of a successful application:

Research and Compare: Take the time to research and compare different loan options, interest rates, and terms. Understand the repayment requirements and ensure that the loan fits within your financial capabilities.

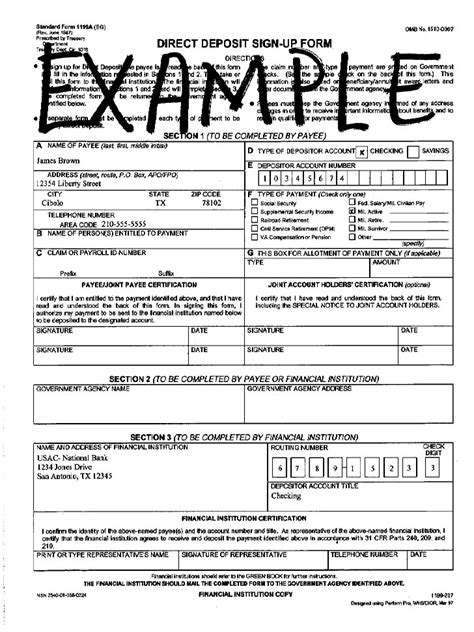

Gather Necessary Documentation: Prepare all the required documentation, such as proof of income, military identification, and bank statements. Having these documents readily available can streamline the application process.

Understand the Repayment Terms: Carefully review the repayment terms of the loan, including the interest rate, repayment schedule, and any associated fees. Ensure that you can meet the repayment obligations without straining your finances.

Consider Your Credit Score: While a good credit score is not always a requirement for military pay advance loans, it can impact the interest rate and loan terms. Maintain a healthy credit score by making timely payments and managing your credit responsibly.

Explore Loan Pre-Approval: Some lenders offer loan pre-approval, allowing you to assess your eligibility and understand the loan terms before officially applying. This can help you make an informed decision and avoid unnecessary application fees.

Conclusion

Military pay advance loans provide a valuable financial safety net for service members and their families, offering quick access to funds during times of need. By exploring the seven strategies outlined in this blog post, you can create a military pay advance loan today and navigate financial emergencies with confidence. Remember to research and compare loan options, choose reputable lenders, and understand the terms and conditions of the loan. With the right approach, you can secure the financial support you need to overcome unexpected challenges and maintain financial stability. Stay informed, stay prepared, and take control of your financial future!

FAQ

Can I get a military pay advance loan if I have bad credit?

+

Yes, many military pay advance loans do not require a perfect credit score. Lenders understand the unique financial circumstances of service members and often offer loans based on factors such as income and military status. However, it’s important to note that having a bad credit score may result in higher interest rates or additional fees.

How quickly can I receive funds from a military pay advance loan?

+

The speed of receiving funds from a military pay advance loan can vary depending on the lender and the application process. Some lenders offer same-day funding, while others may take a few days to process and approve the loan. It’s advisable to research and choose a lender that offers a quick turnaround time to meet your urgent financial needs.

Are there any hidden fees associated with military pay advance loans?

+

It’s important to thoroughly review the loan terms and conditions to understand any potential hidden fees. While some lenders may charge application fees or processing fees, others may not. Transparency is key, so ensure you understand all the associated costs before proceeding with the loan.

Can I use a military pay advance loan for any purpose?

+Military pay advance loans are typically intended for urgent and unexpected expenses. Lenders may have specific guidelines or restrictions on how the funds can be used. It’s recommended to discuss the intended use of the loan with the lender to ensure it aligns with their policies.

What happens if I cannot repay the military pay advance loan on time?

+If you encounter difficulties in repaying the loan, it’s crucial to communicate with your lender as soon as possible. Lenders may offer flexible repayment options or extensions to help you manage your financial situation. Failing to repay the loan could result in negative consequences, such as additional fees or damage to your credit score.