Alabama Paycheck Calculator

Calculating your paycheck in Alabama is an essential step to understanding your earnings and managing your finances effectively. Whether you're a resident of Alabama or planning to work there, having a clear idea of your take-home pay is crucial. In this comprehensive guide, we will walk you through the process of using the Alabama Paycheck Calculator, covering everything from understanding the state's tax system to calculating your net income. By the end of this article, you'll have the tools and knowledge to estimate your earnings accurately and make informed financial decisions.

Understanding Alabama's Tax System

Before diving into the paycheck calculator, it's important to familiarize yourself with Alabama's tax landscape. The state operates under a progressive tax system, which means that your tax rate increases as your income rises. Alabama has four income tax brackets, ranging from 2% to 5% for the 2023 tax year. Additionally, the state imposes a 4% sales tax on most goods and services.

When calculating your paycheck, you'll need to consider the following taxes:

- Income Tax: Based on your income level, you'll fall into one of the four tax brackets. The calculator will help you determine the appropriate rate.

- Federal Income Tax: Alabama follows the federal tax system, so you'll also pay federal income tax. The calculator will account for this as well.

- Social Security and Medicare Taxes: These are payroll taxes that fund social programs. The current rates are 6.2% for Social Security and 1.45% for Medicare.

- State Unemployment Tax (SUTA): Alabama employers contribute to this tax, which provides unemployment benefits to eligible workers. The calculator will factor in this deduction.

Using the Alabama Paycheck Calculator

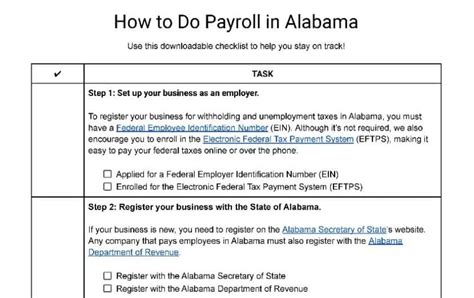

The Alabama Paycheck Calculator is a user-friendly tool designed to estimate your take-home pay accurately. Here's a step-by-step guide on how to use it:

- Access the Calculator: Visit the official Alabama Department of Revenue website or use a reputable online paycheck calculator. Ensure you're using a secure and reliable source.

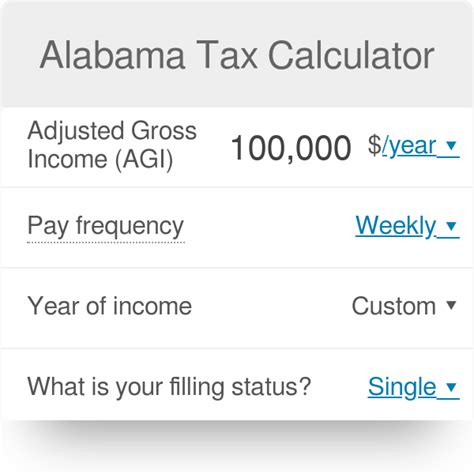

- Input Your Information:

- Income Details: Enter your annual salary, hourly rate, or weekly earnings. The calculator will automatically convert this to a yearly income.

- Tax Information: Provide your filing status (single, married, head of household, etc.) and the number of allowances you claim on your W-4 form.

- Deductions: Specify any additional deductions, such as 401(k) contributions or health insurance premiums, if applicable.

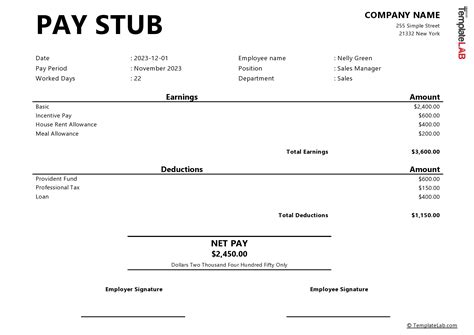

- Calculate Your Paycheck: Click the "Calculate" or "Submit" button to generate your estimated paycheck. The calculator will provide a breakdown of your earnings, deductions, and net pay.

- Review the Results: The calculator will display your gross income, federal and state tax deductions, Social Security and Medicare contributions, and your final take-home pay. Ensure you understand each component.

Factors Affecting Your Paycheck

Several factors can influence the amount of money you take home from your paycheck. Here are some key considerations:

- Income Level: Your earnings directly impact your tax bracket and, consequently, your take-home pay. Higher incomes generally result in higher tax rates.

- Filing Status: Your marital status and whether you have dependents can affect your tax liability. Married individuals may benefit from filing jointly, while single filers may have higher tax obligations.

- Allowances and Deductions: The number of allowances you claim on your W-4 form can impact the amount of tax withheld from your paycheck. Additionally, voluntary deductions for retirement plans or insurance can reduce your taxable income.

- Tax Credits: Alabama offers various tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, which can reduce your tax liability. Check if you're eligible for any credits to maximize your refund.

Tips for Maximizing Your Take-Home Pay

While the Alabama Paycheck Calculator provides an accurate estimate, there are strategies you can employ to potentially increase your take-home pay:

- Review Your W-4 Form: Ensure that the information on your W-4 form is up-to-date and accurate. This form determines the amount of tax withheld from your paycheck. Consider adjusting your allowances if your personal or financial situation changes.

- Explore Tax-Advantaged Accounts: Consider contributing to retirement accounts like a 401(k) or an Individual Retirement Account (IRA). These accounts offer tax benefits and can reduce your taxable income.

- Maximize Tax Credits: Research and claim any tax credits for which you may be eligible. The EITC and Child Tax Credit can provide significant savings on your tax liability.

- Negotiate Benefits: Discuss benefit options with your employer. Some companies offer flexible spending accounts (FSAs) or health savings accounts (HSAs) that can reduce your taxable income while providing additional financial benefits.

Frequently Asked Questions

Here are some common questions related to the Alabama Paycheck Calculator and tax system:

How often should I update my W-4 form?

+

It's recommended to review and update your W-4 form annually or whenever there are significant changes in your personal or financial situation. This ensures that the correct amount of tax is withheld from your paycheck.

Are there any tax breaks for Alabama residents?

+

Yes, Alabama offers several tax credits and deductions, including the Earned Income Tax Credit, Child Tax Credit, and various deductions for certain expenses. It's advisable to consult a tax professional or refer to the official Alabama tax guidelines for a comprehensive list.

Can I use the paycheck calculator for hourly wage calculations?

+

Absolutely! The Alabama Paycheck Calculator is versatile and can handle both salaried and hourly wage calculations. Simply input your hourly rate or weekly earnings, and the calculator will do the rest.

What if I have multiple jobs? How does that affect my taxes?

+

If you have multiple jobs, each employer will withhold taxes based on the information provided on your W-4 form. It's important to ensure that your total tax liability is not exceeded. Consider adjusting your allowances or consulting a tax professional for guidance.

Conclusion

The Alabama Paycheck Calculator is a valuable tool for anyone looking to estimate their take-home pay accurately. By understanding Alabama’s tax system and using the calculator effectively, you can make informed decisions about your finances. Remember to review your W-4 form regularly, explore tax-advantaged accounts, and maximize any applicable tax credits. With a clear understanding of your earnings and deductions, you can better plan for your financial future.