Florida's Salary Tax Calculator: The Complete Guide To Maximizing Your Earnings

Understanding Florida's tax system is crucial for anyone looking to maximize their earnings, especially when it comes to salary calculations. This comprehensive guide will walk you through the ins and outs of Florida's salary tax, providing you with the knowledge to make informed financial decisions.

Florida's Tax Landscape

Florida is known for its unique tax structure, which differs significantly from many other states. One of the most notable aspects is the absence of a state income tax. This means that your salary, whether earned through employment or self-employment, is not subject to state-level income taxation.

However, it's important to note that Florida does impose other types of taxes, such as sales tax and property tax. Additionally, federal income tax still applies to your earnings, and understanding how these taxes work together is key to optimizing your financial situation.

Federal Income Tax in Florida

Federal income tax is a mandatory tax levied by the United States government on individuals' earnings. The Internal Revenue Service (IRS) is responsible for collecting and administering these taxes. Here's a breakdown of how federal income tax works in Florida:

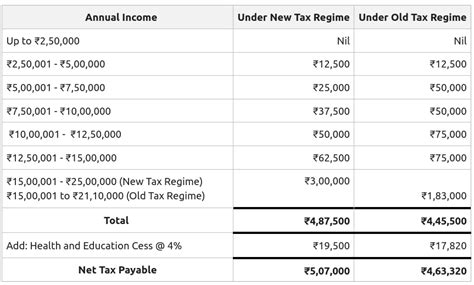

Tax Brackets and Rates

Federal income tax is progressive, meaning that as your income increases, so does the tax rate. The IRS divides taxable income into brackets, and each bracket has a corresponding tax rate. As of [insert current year], the tax brackets and rates for individuals are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 10% | Up to $9,950 |

| 12% | $9,951 to $40,525 |

| 22% | $40,526 to $86,375 |

| 24% | $86,376 to $187,850 |

| 32% | $187,851 to $231,450 |

| 35% | $231,451 to $523,600 |

| 37% | Over $523,600 |

It's important to note that these brackets and rates are for single filers. For married filing jointly or head of household, the brackets and rates may differ slightly.

Taxable Income and Deductions

When calculating your federal income tax, you start with your total income and subtract any eligible deductions and adjustments. This includes deductions for contributions to retirement accounts, medical expenses, and certain other expenses. The resulting amount is your taxable income, which is then subject to the tax brackets and rates mentioned above.

Tax Credits

In addition to deductions, you may also be eligible for tax credits, which directly reduce the amount of tax you owe. Common tax credits include the Child Tax Credit, Earned Income Tax Credit, and the Saver's Credit. These credits can significantly impact your tax liability, so it's worth exploring whether you qualify for any of them.

Sales Tax in Florida

Sales tax is a consumption tax levied on the sale of goods and services in Florida. The state sales tax rate is 6%, and it applies to most purchases, including groceries, clothing, and entertainment. However, there are certain exceptions and exemptions, such as the sales tax exemption for non-prepared food items.

In addition to the state sales tax, local governments in Florida may also impose their own sales taxes. These local sales taxes can vary depending on the county or municipality, so it's important to be aware of the specific rates in your area.

Property Tax in Florida

Property tax is an ad valorem tax, meaning it is based on the assessed value of your property. In Florida, property tax is primarily used to fund local governments and school districts. The tax rate varies depending on the location of your property and the assessed value.

Property tax is typically calculated by multiplying the assessed value of your property by the tax rate. The assessed value is determined by the county property appraiser and is based on factors such as the property's size, location, and improvements.

Maximizing Your Earnings: Strategies and Tips

Now that we have a better understanding of Florida's tax landscape, let's explore some strategies to maximize your earnings and minimize your tax liability:

1. Optimize Your Tax Bracket

Understanding your tax bracket is crucial for optimizing your earnings. If you're close to the threshold of a higher tax bracket, consider strategies to keep your income within the lower bracket. This could involve timing the sale of assets or adjusting your retirement contributions.

2. Take Advantage of Deductions and Credits

- Explore all eligible deductions and credits to reduce your taxable income and overall tax liability. This includes deductions for mortgage interest, state and local taxes, and charitable contributions.

- Consider contributing to a traditional IRA or 401(k) plan, as these retirement accounts offer tax advantages and can lower your taxable income.

- If you have children, research the Child Tax Credit and other family-related tax benefits to see if you qualify.

3. Plan for Sales and Property Taxes

- When making significant purchases, be mindful of the sales tax rate in your area. Plan your purchases strategically to take advantage of sales tax holidays or exemptions.

- If you own property in Florida, stay informed about property tax rates and assessment values. Ensure that your property is accurately assessed to avoid overpaying.

- Consider engaging a tax professional or using tax planning software to optimize your property tax payments.

4. Consult a Tax Professional

Navigating the complexities of tax laws can be challenging. Consider seeking advice from a certified public accountant (CPA) or tax attorney who specializes in Florida's tax system. They can provide personalized guidance and help you make the most of the available tax benefits.

Conclusion

Maximizing your earnings in Florida requires a comprehensive understanding of the state's unique tax landscape. By familiarizing yourself with federal income tax brackets and rates, taking advantage of deductions and credits, and planning for sales and property taxes, you can optimize your financial situation. Remember, seeking professional advice can further enhance your tax strategy and ensure compliance with the latest regulations.

What is the main difference between Florida’s tax system and that of other states?

+

Florida’s tax system is unique because it does not impose a state income tax. This means that residents of Florida do not pay state-level income tax on their earnings.

Are there any tax benefits for retirees in Florida?

+

Yes, Florida offers several tax benefits for retirees. These include exemptions for homestead properties, a tax exemption for pension and retirement income, and a reduced tax rate for certain retirement accounts.

How often do tax rates change in Florida?

+

Tax rates in Florida can change periodically, typically as a result of legislative actions or budgetary decisions. It’s important to stay updated with any changes to ensure you’re aware of the current tax landscape.