Michigan Tax Calculator

Understanding Michigan's Tax System: A Comprehensive Guide

When it comes to managing your finances in Michigan, one of the crucial aspects to consider is the state's tax system. Understanding how taxes work and how to calculate them accurately is essential for individuals and businesses alike. In this comprehensive guide, we will delve into the world of Michigan taxes, providing you with the knowledge and tools to navigate the tax landscape with ease.

The Basics of Michigan Taxation

Michigan, like many other states, imposes various taxes on its residents and businesses. These taxes contribute to the state's revenue and help fund essential services and infrastructure. Here's an overview of the key taxes you should be aware of:

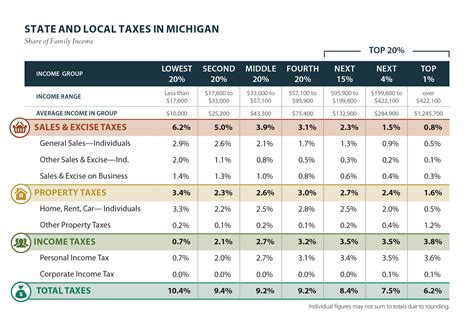

- Income Tax: Michigan levies an income tax on both individuals and businesses. The tax rate varies depending on your income bracket. For individuals, the tax rates range from 4.25% to 4.6% for tax year 2022.

- Sales and Use Tax: A sales tax is applied to most goods and services purchased within the state. The current sales tax rate in Michigan is 6%. Additionally, a use tax is imposed on goods and services purchased outside of Michigan but used or consumed within the state.

- Property Tax: Property taxes are assessed on real estate and personal property. The tax rate varies depending on the location and the assessed value of the property.

- Business Taxes: Businesses operating in Michigan are subject to various taxes, including corporate income tax, franchise fees, and specific industry-related taxes.

Calculating Your Michigan Taxes

Calculating your Michigan taxes accurately is crucial to ensure compliance with state regulations and avoid any penalties. Here's a step-by-step guide to help you through the process:

Step 1: Determine Your Taxable Income

Start by calculating your taxable income, which is the amount of income subject to Michigan income tax. This includes wages, salaries, bonuses, dividends, interest, and other forms of income. It's important to note that certain deductions and exemptions may apply, reducing your taxable income.

For example, Michigan offers a standard deduction of $4,400 for single filers and $8,800 for joint filers. Additionally, you may be eligible for deductions based on your medical expenses, charitable contributions, or other specific circumstances.

Step 2: Apply the Appropriate Tax Rate

Once you have determined your taxable income, the next step is to apply the corresponding tax rate. As mentioned earlier, Michigan's income tax rates vary based on your income bracket. The state uses a progressive tax system, meaning the higher your income, the higher the tax rate.

Here's a simplified breakdown of the income tax rates for 2022:

| Income Bracket | Tax Rate |

|---|---|

| Up to $20,000 | 4.25% |

| $20,001 - $50,000 | 4.275% |

| $50,001 - $100,000 | 4.325% |

| $100,001 - $300,000 | 4.4% |

| Over $300,000 | 4.6% |

Remember, these rates are subject to change, so it's always a good idea to refer to the official Michigan Department of Treasury website for the most up-to-date information.

Step 3: Calculate Your Tax Liability

Now that you have your taxable income and the applicable tax rate, you can calculate your tax liability. Multiply your taxable income by the appropriate tax rate to determine the amount of income tax you owe.

For instance, if your taxable income falls within the $50,001 - $100,000 bracket, your tax rate would be 4.325%. To calculate your tax liability, simply multiply your taxable income by 0.04325.

Step 4: Consider Tax Credits and Deductions

Michigan offers various tax credits and deductions that can reduce your tax liability. These include credits for low-income earners, homeowners, and individuals with disabilities. Make sure to explore these options and claim any credits or deductions you may be eligible for.

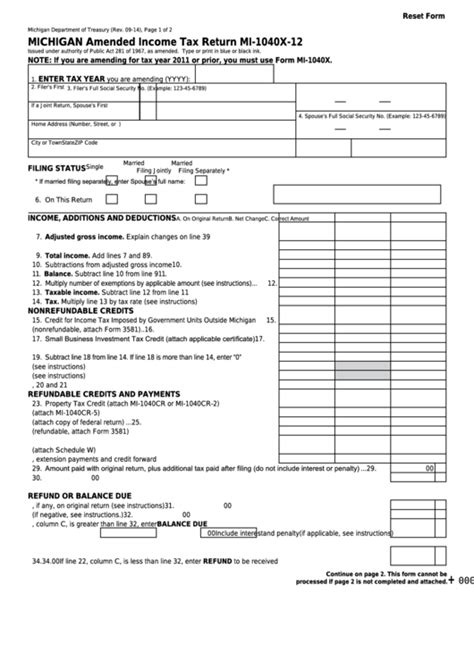

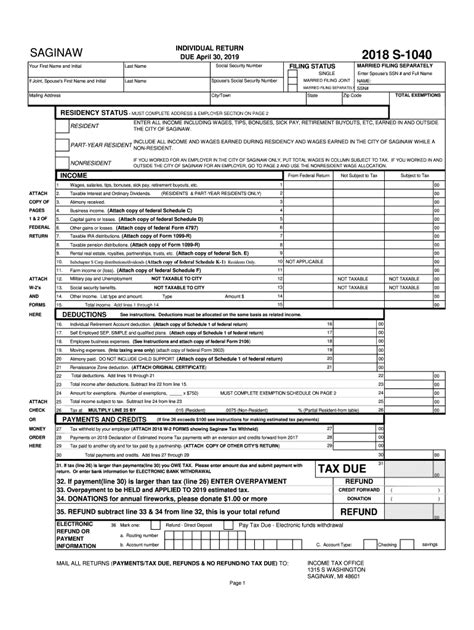

Step 5: File Your Tax Return

Once you have calculated your tax liability and considered any applicable credits or deductions, it's time to file your tax return. Michigan provides both online and paper filing options. The due date for filing your tax return is typically April 15th of each year, but it's important to check for any extensions or changes.

Tax Resources and Support

Navigating the world of taxes can be complex, but Michigan offers several resources to assist you. The Michigan Department of Treasury provides a wealth of information and tools to help individuals and businesses understand their tax obligations. Here are some valuable resources to keep in mind:

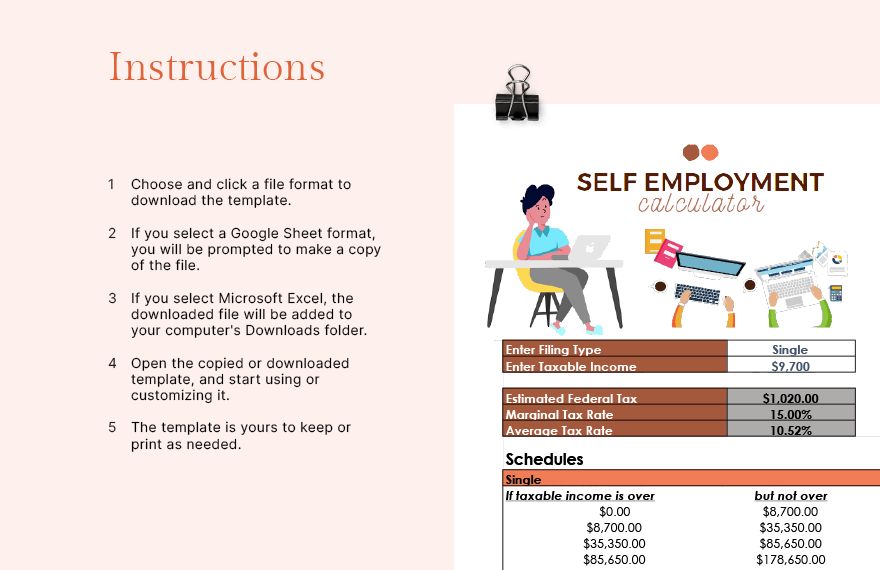

- Online Tax Calculator: The Department of Treasury offers an online tax calculator that allows you to estimate your tax liability based on your income and other factors. This tool can be a helpful guide during the tax preparation process.

- Tax Publications: Michigan publishes a range of tax publications, including guides, forms, and instructions. These resources provide detailed information on specific tax topics and can help you navigate complex tax scenarios.

- Tax Assistance Programs: For those who require additional support, Michigan offers tax assistance programs. These programs provide free tax preparation services for eligible individuals, ensuring they receive accurate and timely assistance.

Notes

🧑💻 Note: It's important to stay updated with any changes or amendments to Michigan's tax laws. Regularly check the official Michigan Department of Treasury website for the latest information and guidance.

💰 Note: When calculating your tax liability, be sure to consider any applicable tax credits and deductions. These can significantly reduce your tax burden and save you money.

📅 Note: Keep track of important tax dates and deadlines. Late filing or payment may result in penalties and interest charges.

Conclusion

Understanding Michigan's tax system is an essential step towards financial literacy and compliance. By familiarizing yourself with the various taxes, calculating your tax liability accurately, and utilizing the available resources, you can navigate the tax landscape with confidence. Remember, staying informed and seeking professional advice when needed can make a significant difference in your tax planning and management.

Frequently Asked Questions

What is the current sales tax rate in Michigan?

+

The current sales tax rate in Michigan is 6%.

Are there any income tax brackets for 2023 yet?

+

As of my last update in January 2023, the income tax brackets for 2023 have not been released yet. It’s recommended to check the official Michigan Department of Treasury website for the most current information.

Can I claim a tax credit for energy-efficient home improvements?

+

Yes, Michigan offers a tax credit for certain energy-efficient home improvements. This credit is known as the Michigan Home Energy Savings Program (HESP). To claim this credit, you must meet specific eligibility criteria and follow the guidelines provided by the Michigan Department of Treasury.

Are there any online tools to help me calculate my Michigan taxes?

+

Yes, the Michigan Department of Treasury provides an online tax calculator that can assist you in estimating your tax liability. This tool takes into account your income, deductions, and other relevant factors to provide a rough estimate of your tax obligation.

What is the due date for filing my Michigan tax return?

+

The due date for filing your Michigan tax return is typically April 15th of each year. However, it’s essential to stay informed about any changes or extensions that may occur. It’s recommended to check the official Michigan Department of Treasury website for the most accurate and up-to-date information.