Military Total Compensation Calculator

Calculating military total compensation is crucial for understanding the overall benefits and earnings of military personnel. This comprehensive guide will walk you through the process, ensuring you have a clear grasp of the various components that make up military compensation.

Understanding Military Total Compensation

Military total compensation refers to the combined value of all monetary and non-monetary benefits received by service members. It goes beyond basic pay and includes various allowances, special pays, and benefits. Understanding this concept is essential for military personnel, as it provides an accurate representation of their overall compensation package.

Components of Military Total Compensation

Basic Pay

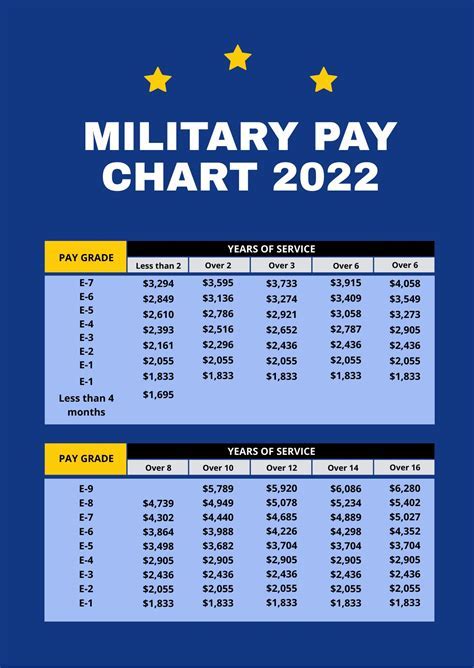

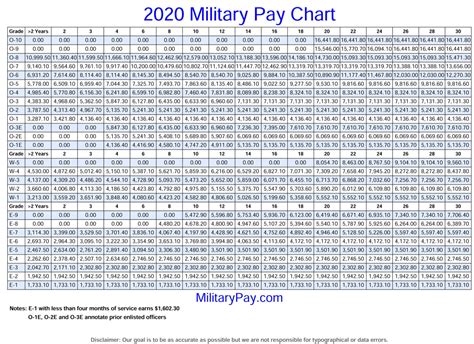

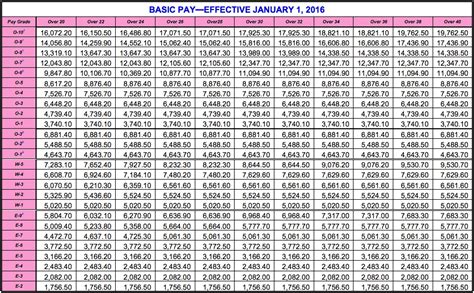

Basic pay is the primary component of military compensation. It is determined by the service member's rank, years of service, and any applicable special pays. Basic pay rates are set by the Department of Defense and are subject to annual adjustments.

Allowances

Allowances are additional monetary benefits provided to service members to cover specific expenses. Some common allowances include:

- Basic Allowance for Housing (BAH): This allowance helps cover the cost of off-base housing and is based on the service member's duty station, pay grade, and dependency status.

- Basic Allowance for Subsistence (BAS): BAS is provided to assist with the cost of meals when not on a military installation.

- Clothing Allowance: Certain service members, such as those in the Marine Corps, may receive a clothing allowance to cover the cost of uniforms and other specialized clothing.

- Family Separation Allowance: This allowance is given to service members experiencing long-term separation from their families due to deployment or temporary duty assignments.

Special Pays

Special pays are additional monetary incentives provided to service members for specific skills, assignments, or hazardous duty. Some examples include:

- Hostile Fire/Imminent Danger Pay: This pay is given to service members serving in designated combat zones or areas of imminent danger.

- Flight Pay: Service members who are pilots, navigators, or flight engineers may receive flight pay.

- Dive Pay: Dive pay is awarded to service members who perform underwater duties as divers.

- Incentive Pays: These pays are offered to encourage service members to acquire specific skills or serve in certain locations.

Benefits

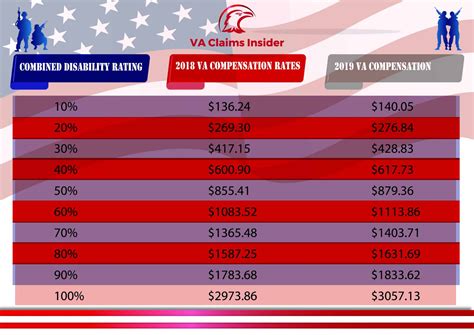

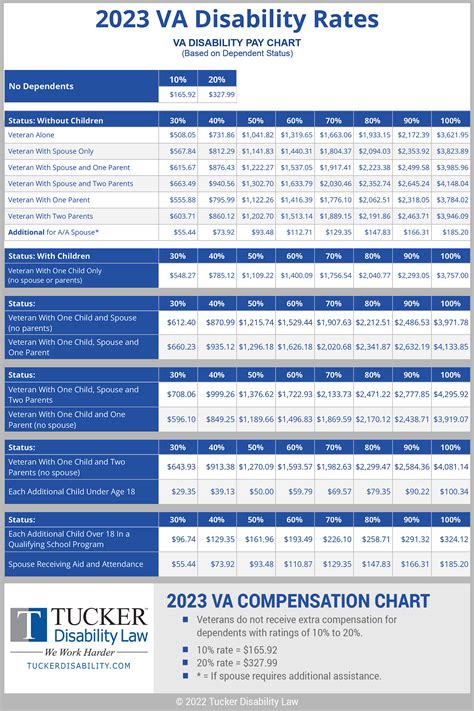

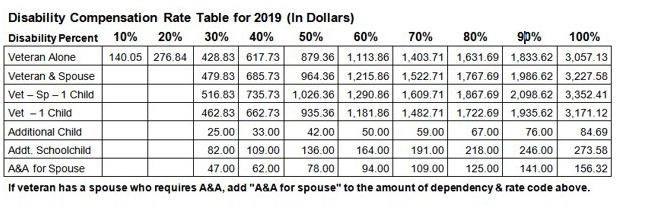

In addition to monetary compensation, service members are entitled to a wide range of benefits. These benefits contribute significantly to the overall value of military total compensation. Some key benefits include:

- Healthcare: Military personnel and their families have access to comprehensive healthcare services through the Military Health System.

- Education Benefits: The Post-9/11 GI Bill provides financial support for service members to pursue higher education or vocational training.

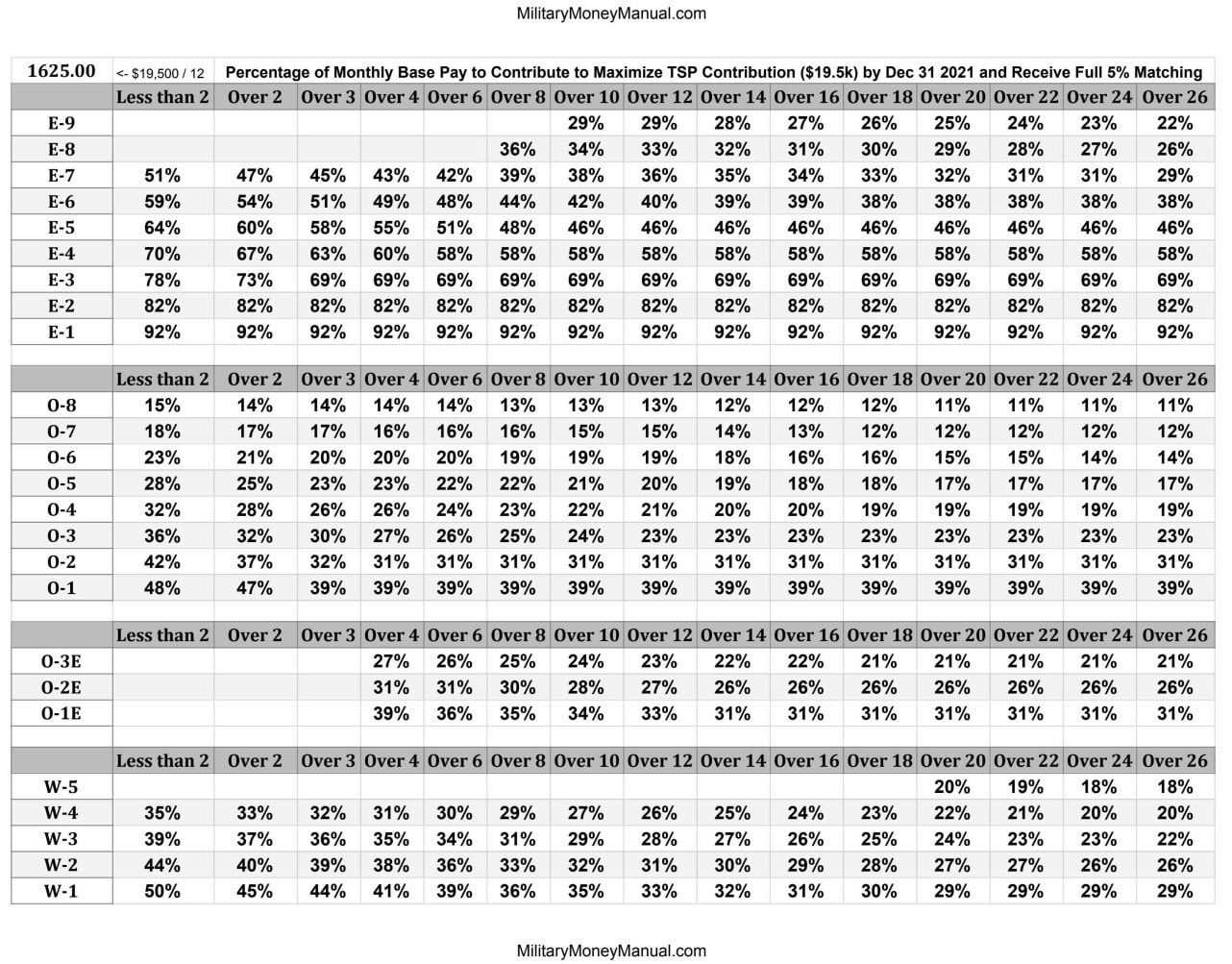

- Retirement Benefits: Service members who meet certain criteria are eligible for retirement benefits, including a pension and access to the Thrift Savings Plan (TSP) for retirement savings.

- Life Insurance: The Servicemembers' Group Life Insurance (SGLI) program offers low-cost life insurance coverage to service members and their families.

- Vacation and Leave: Service members accrue vacation and leave days, providing them with opportunities for rest and relaxation.

Calculating Military Total Compensation

To calculate military total compensation, you need to consider all the components mentioned above. Here's a step-by-step guide to help you through the process:

-

Determine Basic Pay

Start by calculating your basic pay based on your rank, years of service, and any applicable special pays. You can use official military pay charts or online calculators to determine your basic pay accurately.

-

Add Allowances

Next, add the various allowances you are entitled to. These include BAH, BAS, clothing allowance, and any other applicable allowances. You can find information about your specific allowances on military pay websites or by consulting with your unit's finance office.

-

Consider Special Pays

If you are eligible for any special pays, such as Hostile Fire/Imminent Danger Pay or Flight Pay, include these in your calculation. Special pays are often added to your basic pay and may be subject to tax.

-

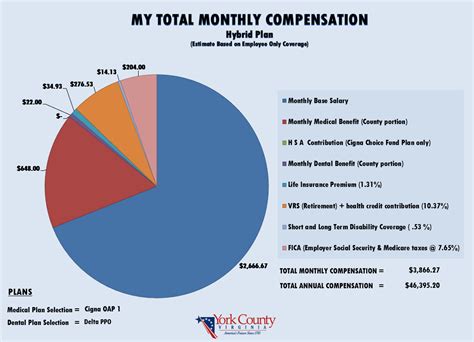

Estimate Benefits

While it's challenging to assign a precise dollar value to benefits, it's essential to consider their contribution to your overall compensation. Benefits like healthcare, education assistance, and retirement plans have significant value and should be factored into your total compensation calculation.

-

Combine and Compare

Finally, add up all the components of your military total compensation, including basic pay, allowances, special pays, and an estimated value for benefits. Compare this total to your civilian counterparts' compensation to gain a comprehensive understanding of your earnings.

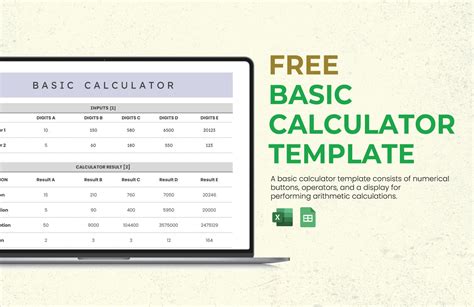

Using the Military Total Compensation Calculator

To simplify the calculation process, you can utilize online tools and calculators specifically designed for military total compensation. These calculators take into account various factors, such as your rank, years of service, duty station, and dependency status, to provide an accurate estimate of your total compensation.

When using a military total compensation calculator, ensure that you provide accurate and up-to-date information. Regularly update your inputs to reflect any changes in your rank, duty station, or other relevant factors that may impact your compensation.

Key Considerations

When calculating military total compensation, keep the following points in mind:

-

Taxes: Military compensation, including basic pay and certain allowances, is subject to federal and state taxes. Ensure you understand the tax implications and deductions that apply to your specific situation.

-

Cost of Living: Consider the cost of living in your duty station when comparing your military compensation to civilian earnings. Some locations may have a higher cost of living, impacting the value of your compensation.

-

Variable Components: Some components of military compensation, such as allowances and special pays, may vary depending on your duty station, deployment status, or other factors. Be aware of these variables and their potential impact on your total compensation.

💡 Note: Regularly review and update your military total compensation calculation to account for any changes in pay rates, allowances, or benefits. Stay informed about military pay adjustments and consult official sources for the most accurate information.

Conclusion

Understanding and calculating military total compensation is essential for service members to make informed financial decisions. By considering all the components, from basic pay to benefits, you can gain a comprehensive view of your overall compensation package. Remember to regularly update your calculations and stay informed about any changes in military pay and benefits to ensure an accurate representation of your earnings.

FAQ

How often are military pay rates adjusted?

+

Military pay rates are typically adjusted annually, based on the recommendations of the Department of Defense. These adjustments aim to keep military compensation competitive with civilian earnings.

Are there any tax advantages for military personnel?

+Yes, military personnel may be eligible for certain tax benefits, such as the exclusion of certain allowances from taxable income. It’s important to consult a tax professional to understand your specific tax obligations and advantages.

Can military total compensation be affected by deployment or temporary duty assignments?

+Yes, deployment or temporary duty assignments can impact military total compensation. Service members may be eligible for additional special pays, such as Hostile Fire/Imminent Danger Pay, while on deployment or in designated combat zones.