Minnesota Tax Calculator

Introduction to Minnesota Tax Calculator

The Minnesota Tax Calculator is a valuable tool for residents and businesses operating within the state. It simplifies the process of calculating various taxes, providing an accurate and efficient way to determine tax liabilities. Whether you're an individual filing your income tax or a business calculating sales tax, this calculator is designed to make tax computations straightforward and accessible.

Key Features of Minnesota Tax Calculator

- Income Tax Calculation: Easily estimate your state income tax based on your earnings and deductions.

- Sales Tax Computation: Determine the sales tax for your purchases or the tax you need to collect as a business.

- Property Tax Estimation: Get an idea of the property taxes you may owe based on your property's value.

- Fuel Tax Calculation: Calculate fuel taxes for different types of vehicles and fuel.

- Convenient and User-Friendly Interface: The calculator is designed with simplicity in mind, ensuring a smooth user experience.

How to Use the Minnesota Tax Calculator

- Access the Calculator: Visit the official Minnesota Department of Revenue website or use a trusted third-party tax calculator platform.

- Select Tax Type: Choose the type of tax you want to calculate, such as income tax, sales tax, or property tax.

- Enter Relevant Information: Provide the necessary details, such as income, sales amount, or property value.

- Apply Deductions and Credits: Input any applicable deductions or tax credits to get an accurate calculation.

- Calculate and Review: Click the calculate button, and the tool will provide you with the estimated tax amount. Review the result and ensure all information is correct.

Benefits of Using a Tax Calculator

- Accuracy: Tax calculators ensure precise calculations, reducing the risk of errors in your tax filings.

- Time-Saving: These tools streamline the tax computation process, saving you valuable time.

- Convenience: Accessible online, tax calculators provide an easy way to manage your tax obligations anytime, anywhere.

- Understanding Tax Liabilities: By using a calculator, you gain a clear understanding of your tax responsibilities, helping you plan your finances effectively.

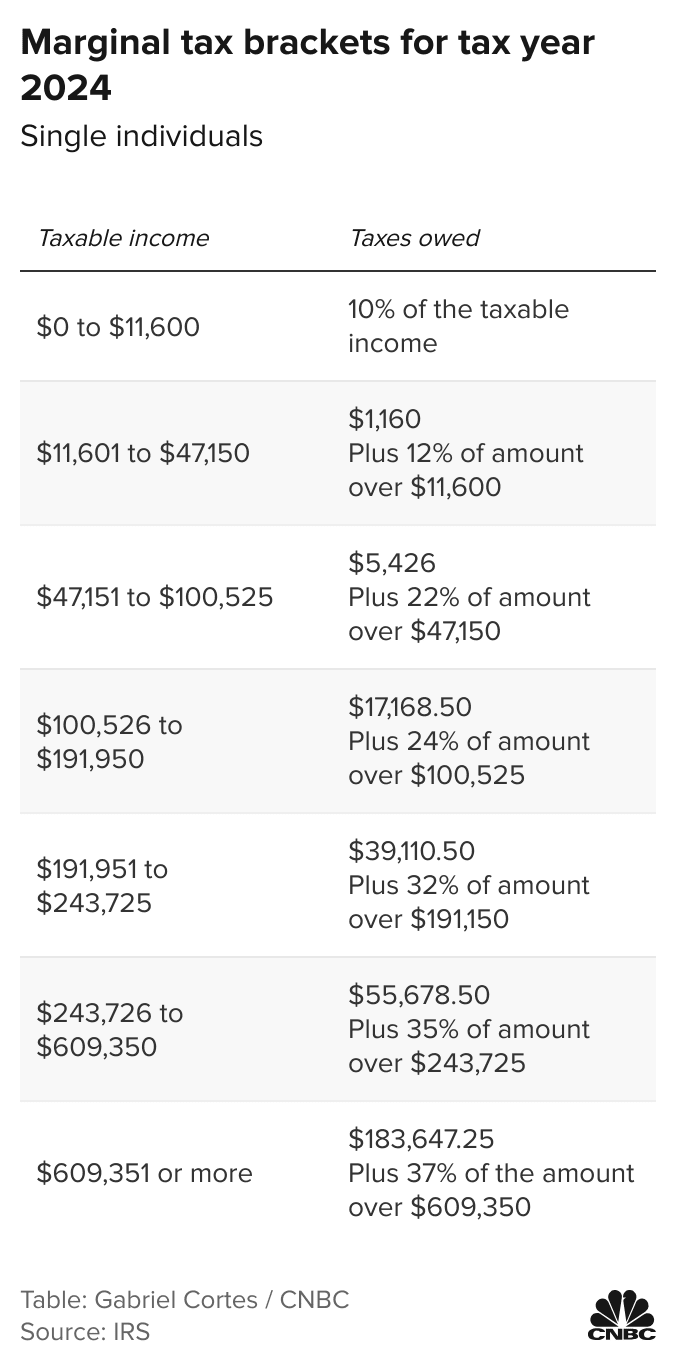

Tax Rates and Structures in Minnesota

Minnesota has a progressive income tax structure, with tax rates ranging from 5.35% to 9.85%, depending on income brackets. Sales tax rates vary across the state, with a base rate of 6.875% and additional local taxes in some areas. Property taxes are assessed at the local level, with rates varying by county and municipality.

| Tax Type | Rate |

|---|---|

| Income Tax | 5.35% - 9.85% |

| Sales Tax | 6.875% (base) + Local Taxes |

| Property Tax | Varies by County and Municipality |

Tips for Maximizing Tax Benefits

- Stay Informed: Keep up-to-date with the latest tax laws and regulations in Minnesota to ensure you're taking advantage of all available benefits.

- Explore Deductions and Credits: Research and understand the various deductions and tax credits you may be eligible for to reduce your tax liability.

- Seek Professional Advice: For complex tax situations, consider consulting a tax professional who can provide personalized guidance.

Common Misconceptions about Minnesota Taxes

There are several misconceptions about Minnesota's tax system. One common myth is that the state has a flat tax rate for income tax, which is not true. Minnesota's tax system is progressive, meaning higher earners pay a higher percentage of their income in taxes.

Tax Planning Strategies for Minnesotans

- Maximize Retirement Contributions: Contribute to tax-advantaged retirement accounts like 401(k)s or IRAs to reduce your taxable income.

- Utilize Pre-Tax Benefits: Take advantage of pre-tax benefits like health savings accounts (HSAs) or flexible spending accounts (FSAs) to lower your taxable income.

- Explore Tax-Efficient Investments: Consider investing in tax-efficient options like municipal bonds or real estate investment trusts (REITs) to minimize tax implications.

Staying Compliant with Minnesota Tax Laws

To ensure compliance with Minnesota tax laws, it's essential to understand your tax obligations and stay informed about any changes. The Minnesota Department of Revenue provides comprehensive resources and guidelines to help individuals and businesses navigate the tax system.

Conclusion

The Minnesota Tax Calculator is a powerful tool that simplifies the tax computation process, making it easier for residents and businesses to manage their tax obligations. By utilizing this calculator and staying informed about tax laws, individuals can ensure accurate filings and take advantage of available tax benefits. Remember, staying compliant and understanding your tax responsibilities is crucial for a smooth financial journey in Minnesota.

What is the Minnesota Tax Calculator?

+

The Minnesota Tax Calculator is an online tool that helps residents and businesses calculate various taxes, including income tax, sales tax, and property tax.

How accurate is the Minnesota Tax Calculator?

+

The calculator provides accurate estimates based on the information you input. However, for precise calculations, it’s recommended to consult official tax guidelines or seek professional advice.

Can I use the Minnesota Tax Calculator for business taxes?

+

Yes, the calculator can be used for both personal and business tax calculations. It offers features specific to business taxes, such as sales tax computation and fuel tax calculation.

Are there any limitations to the Minnesota Tax Calculator?

+

While the calculator is a valuable tool, it may not cover all complex tax scenarios. For specialized tax situations, it’s advisable to consult a tax professional.

Where can I find more information about Minnesota tax laws?

+

The Minnesota Department of Revenue website provides comprehensive resources and guidelines regarding tax laws, rates, and regulations in the state.