Mtd Explained: The Ultimate Guide To Decoding Its Meaning And Impact

Introduction to MTD

MTD, or Making Tax Digital, is a groundbreaking initiative by HM Revenue and Customs (HMRC) in the United Kingdom. It aims to revolutionize the way taxpayers interact with the tax system, making it more efficient, accurate, and user-friendly. With the introduction of MTD, the traditional paper-based tax returns are being phased out, and digital methods are taking center stage.

This comprehensive guide will delve into the intricacies of MTD, exploring its purpose, key features, and its impact on taxpayers and businesses. By the end of this article, you will have a clear understanding of MTD and its role in shaping the future of taxation.

Understanding the Purpose of MTD

Streamlining the Tax Process

One of the primary objectives of MTD is to streamline the tax process for both individuals and businesses. By digitizing tax records and introducing real-time information sharing, MTD aims to reduce the administrative burden on taxpayers. With digital tools and software, taxpayers can now manage their tax obligations more efficiently, saving time and effort.

Enhancing Accuracy and Compliance

MTD also plays a crucial role in enhancing accuracy and compliance within the tax system. By encouraging the use of digital record-keeping and reporting, MTD minimizes the chances of errors and ensures that taxpayers meet their tax obligations accurately. This initiative promotes transparency and reduces the risk of non-compliance, leading to a more efficient and fair tax system.

Improving Taxpayer Experience

The implementation of MTD has significantly improved the overall taxpayer experience. With user-friendly digital platforms and software, taxpayers can access their tax information and manage their finances with ease. The online filing system, coupled with clear guidelines and support, makes the tax process less daunting and more accessible for individuals and businesses.

Key Features of MTD

Digital Record-Keeping

A fundamental aspect of MTD is the requirement for digital record-keeping. Taxpayers are encouraged to maintain their financial records in a digital format, such as through accounting software or cloud-based platforms. This digital approach simplifies the process of gathering and organizing financial data, making it easier to generate accurate tax returns.

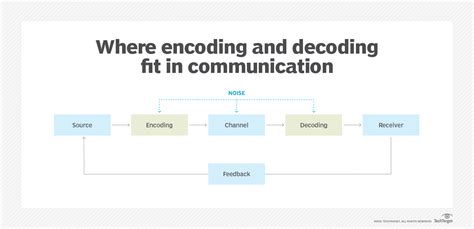

Real-Time Information Sharing

MTD introduces the concept of real-time information sharing between taxpayers and HMRC. This means that tax information is submitted to HMRC on a more frequent basis, often on a quarterly basis, rather than the traditional annual tax return. Real-time information sharing provides HMRC with up-to-date and accurate data, allowing for better monitoring and analysis of tax obligations.

Digital Filing and Software

To comply with MTD, taxpayers must utilize digital filing methods and approved software. HMRC has approved a range of software providers that offer user-friendly platforms for tax filing. These software solutions often integrate with accounting software, making it convenient for taxpayers to generate and submit their tax returns digitally.

MTD for VAT

MTD for VAT is a specific component of MTD that targets Value Added Tax (VAT) registered businesses. VAT-registered businesses with a turnover above the VAT threshold are required to keep digital records and submit their VAT returns through MTD-compatible software. This ensures a more efficient and accurate VAT reporting process.

Impact of MTD on Taxpayers and Businesses

Benefits for Taxpayers

MTD brings several advantages for individual taxpayers:

- Simplified Tax Process: MTD streamlines the tax filing process, making it less complex and time-consuming.

- Real-Time Awareness: Taxpayers can stay updated on their tax obligations and financial positions with real-time information sharing.

- Reduced Errors: Digital record-keeping minimizes the chances of errors, leading to more accurate tax returns.

- Improved Support: HMRC provides comprehensive guidance and support materials to assist taxpayers throughout the MTD process.

Advantages for Businesses

For businesses, MTD offers a range of benefits:

- Efficient Record-Keeping: Digital record-keeping simplifies financial management and reduces the administrative burden.

- Enhanced Compliance: MTD ensures businesses meet their tax obligations accurately, reducing the risk of penalties and non-compliance.

- Improved Cash Flow: Real-time information sharing allows businesses to better manage their cash flow and make informed financial decisions.

- Cost Savings: By utilizing digital tools and software, businesses can save on administrative costs associated with traditional paper-based record-keeping.

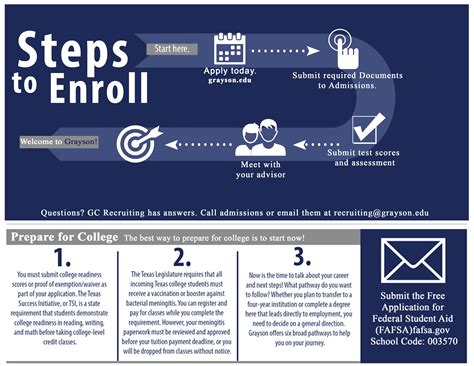

Getting Started with MTD

Step 1: Understand Your Obligations

The first step in getting started with MTD is to understand your specific tax obligations. Determine whether you are required to participate in MTD based on your tax status and turnover. For VAT-registered businesses, it is crucial to understand the VAT threshold and the requirement to use MTD-compatible software for VAT returns.

Step 2: Choose Suitable Software

Select MTD-compatible software that aligns with your business needs and tax obligations. HMRC provides a list of approved software providers, making it easier to find a solution that suits your requirements. Consider factors such as ease of use, integration capabilities, and additional features offered by the software.

Step 3: Set Up Digital Record-Keeping

Implement a digital record-keeping system to meet the requirements of MTD. This involves organizing your financial data, such as income, expenses, and VAT records, in a digital format. Accounting software or cloud-based platforms can assist in this process, providing a centralized location for your financial information.

Step 4: File Your Taxes Digitally

Once you have your digital records in place, it’s time to file your taxes digitally. Utilize the chosen MTD-compatible software to generate and submit your tax returns. Follow the step-by-step instructions provided by the software and ensure that all the necessary information is accurately entered.

Notes

- VAT Threshold: The VAT threshold is an important consideration for VAT-registered businesses. If your business’s taxable turnover exceeds the threshold, you are required to use MTD-compatible software for VAT returns.

- HMRC Support: HMRC offers a wealth of resources and support materials to assist taxpayers with MTD. Visit the HMRC website or contact their helpline for guidance and assistance throughout the MTD process.

- Software Providers: When choosing MTD-compatible software, consider seeking recommendations from other businesses or tax professionals. This can help ensure you select a reliable and user-friendly solution.

Conclusion

Making Tax Digital (MTD) is a transformative initiative that brings numerous benefits to taxpayers and businesses. By embracing digital record-keeping, real-time information sharing, and user-friendly software, MTD simplifies the tax process, enhances accuracy, and improves the overall taxpayer experience. As MTD continues to evolve, it is essential for taxpayers and businesses to stay informed and adapt to the changing tax landscape. With the right tools and knowledge, navigating MTD can be a seamless and efficient process, leading to a more compliant and efficient tax system.

FAQ

What is the VAT threshold for MTD-VAT?

+The VAT threshold for MTD-VAT is £85,000. If your business’s taxable turnover exceeds this amount, you are required to use MTD-compatible software for VAT returns.

Can I use my existing accounting software for MTD?

+Yes, you can use your existing accounting software as long as it is MTD-compatible. HMRC provides a list of approved software providers, so check if your software is on the list or if it can be updated to meet the MTD requirements.

Are there any penalties for non-compliance with MTD?

+Yes, there are penalties for non-compliance with MTD. HMRC may impose fines or penalties if you fail to meet your MTD obligations. It is important to understand your responsibilities and ensure you comply with the MTD requirements to avoid any penalties.

Can I get support from HMRC for MTD?

+Absolutely! HMRC offers extensive support and guidance for taxpayers navigating MTD. You can find helpful resources, step-by-step guides, and contact information on their website. Additionally, their helpline is available to answer any questions or provide assistance.