New Jersey Stimulus Checks 2024

In a move to provide financial relief to its residents, the state of New Jersey has announced stimulus checks for 2024. This initiative aims to support individuals and families who may be facing economic challenges, offering a much-needed boost to their finances. With the cost of living rising and various economic uncertainties, the stimulus checks are a welcome development for many New Jerseyans.

Eligibility and Qualifications

To ensure that the stimulus checks reach those who need them the most, the state has set specific eligibility criteria. Here's an overview of who qualifies for the New Jersey stimulus checks in 2024:

- Residency: You must be a resident of New Jersey to be eligible. This means that you should have a primary residence in the state and have lived there for a certain period, typically a year or more.

- Income: The stimulus checks are targeted at low- to moderate-income individuals and families. Your income level will be a key factor in determining your eligibility. The exact income thresholds may vary depending on the program's guidelines.

- Tax Filing: In most cases, you will need to have filed your state income tax returns for the previous year. This ensures that the state has your up-to-date financial information and can process your stimulus check accordingly.

- Social Security Number: To receive the stimulus check, you must have a valid Social Security number. This is a standard requirement to verify your identity and ensure accurate distribution of funds.

It's important to note that the eligibility criteria may vary depending on the specific program or initiative. The state of New Jersey often introduces different stimulus programs to address various economic situations, so staying informed about the latest updates is crucial.

How to Apply and Receive the Stimulus Check

If you meet the eligibility requirements, here's a step-by-step guide on how to apply for the New Jersey stimulus checks:

- Check the Official Website: Visit the official website of the New Jersey Department of Treasury or the specific agency in charge of the stimulus program. Here, you'll find detailed information about the program, including eligibility criteria, application forms, and deadlines.

- Gather Required Documents: Before starting your application, ensure you have all the necessary documents. This typically includes your identification documents, proof of residency, and tax returns for the previous year.

- Complete the Application Form: Download and fill out the application form provided on the official website. Make sure to provide accurate and complete information to avoid any delays in processing your application.

- Submit Your Application: Once you've filled out the form, submit it through the designated channel. This could be online, by mail, or in person, depending on the program's instructions.

- Wait for Approval: After submitting your application, allow some time for it to be processed. The processing time may vary, so be patient and keep an eye on your email or postal mail for updates.

- Receive Your Stimulus Check: If your application is approved, you will receive your stimulus check via the method specified by the program. This could be a direct deposit, a paper check sent to your address, or a prepaid debit card.

Remember, it's crucial to stay updated with the latest information and guidelines provided by the state. Keep an eye on official announcements and news sources to ensure you don't miss any important deadlines or changes to the program.

Types of Stimulus Programs in New Jersey

New Jersey has a history of implementing various stimulus programs to support its residents during economic downturns or to address specific financial challenges. Here are some common types of stimulus programs you may encounter:

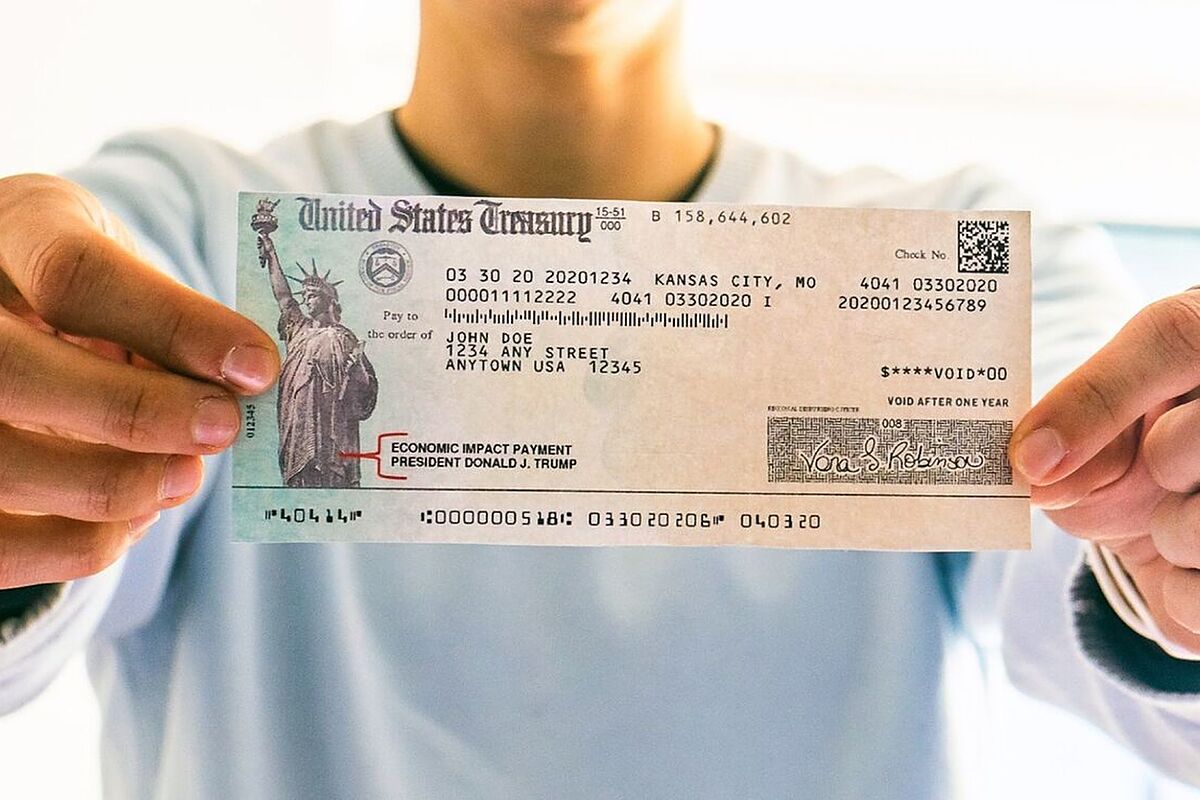

- Economic Stimulus Payments: These are one-time payments made to eligible residents to boost their purchasing power and stimulate the local economy. The amount and eligibility criteria may vary depending on the program.

- Tax Rebates: In some cases, the state may offer tax rebates to eligible taxpayers. This could be a refund of a portion of the taxes paid or a credit on future tax obligations.

- Housing Assistance: Stimulus programs may also focus on providing financial assistance to those struggling with housing costs. This could include rent relief, mortgage assistance, or down payment assistance for first-time homebuyers.

- Small Business Grants: To support local businesses, the state may offer grants or loans to eligible small businesses. These programs aim to help businesses recover from economic setbacks and create job opportunities.

- Childcare Support: Stimulus initiatives may include funding for childcare services, making it more affordable for working parents to access quality childcare options.

The state of New Jersey often collaborates with various agencies and organizations to administer these programs effectively. It's essential to explore all available resources and understand the specific requirements of each program to maximize your chances of receiving the benefits.

Impact and Benefits of Stimulus Checks

The introduction of stimulus checks in New Jersey brings several benefits to both individuals and the state's economy. Here's a closer look at the positive impact of these financial initiatives:

Financial Relief for Residents

Stimulus checks provide much-needed financial relief to low- and moderate-income individuals and families. With the cost of living rising, these payments can help cover essential expenses such as groceries, utilities, and healthcare. By easing the financial burden, residents can focus on their well-being and long-term financial stability.

Stimulating Local Economy

When residents receive stimulus checks, they are more likely to spend the money within their local communities. This increased spending boosts the local economy, supporting businesses, creating jobs, and generating tax revenue. The multiplier effect of stimulus checks can have a significant impact on economic growth and recovery.

Addressing Economic Disparities

Stimulus programs often target specific demographics or regions facing economic challenges. By providing financial support to these groups, the state can help reduce income inequality and promote social mobility. This targeted approach ensures that the benefits reach those who need them the most, fostering a more equitable society.

Encouraging Economic Participation

Stimulus checks can act as an incentive for individuals to engage in economic activities. For example, receiving a stimulus check may encourage people to start a small business, invest in education, or explore new career paths. By stimulating economic participation, the state can create a more dynamic and resilient economy.

Tips for Maximizing the Benefits of Stimulus Checks

To make the most of your stimulus check, consider the following tips:

- Budgeting: Create a budget to allocate your stimulus check wisely. Prioritize essential expenses and consider setting aside a portion for savings or investments.

- Debt Repayment: If you have outstanding debts, such as credit card balances or loans, use a portion of your stimulus check to reduce or eliminate these debts. This can help improve your financial stability and reduce interest charges.

- Emergency Fund: Consider adding your stimulus check to your emergency fund. Having a financial cushion can provide peace of mind and help you navigate unexpected expenses or income disruptions.

- Education and Skills Development: Invest in yourself by using the stimulus check to pursue further education or acquire new skills. This can enhance your employability and open up career opportunities.

- Supporting Local Businesses: When spending your stimulus check, consider supporting local businesses. Your purchases can have a direct impact on the local economy and help create a vibrant business environment.

Frequently Asked Questions

Here are some common questions and answers regarding the New Jersey stimulus checks:

When will the stimulus checks be distributed?

+

The distribution date may vary depending on the program and the state's budget. Keep an eye on official announcements for specific timelines.

How much will the stimulus check be worth?

+

The amount of the stimulus check can vary based on factors such as income level and the specific program. It's best to refer to the official guidelines for accurate information.

Can I receive the stimulus check if I didn't file taxes last year?

+

In some cases, you may still be eligible if you meet other criteria. Check the program's guidelines to understand the specific requirements.

Are there any income restrictions for the stimulus check program?

+

Yes, most stimulus check programs have income thresholds to ensure the benefits reach those who need them the most. Refer to the official eligibility criteria for details.

How can I stay updated on the latest information about the stimulus checks?

+

Visit the official website of the New Jersey Department of Treasury regularly. You can also subscribe to their email updates or follow their social media channels for timely notifications.

Conclusion

The New Jersey stimulus checks for 2024 offer a much-needed financial boost to residents facing economic challenges. By understanding the eligibility criteria, application process, and impact of these programs, individuals can take advantage of the benefits and make informed decisions to improve their financial well-being. Stay informed, apply promptly, and maximize the positive outcomes of these initiatives to build a stronger and more resilient New Jersey.