Nfcu Life Insurance

Understanding NFCU Life Insurance: A Comprehensive Guide

Naval Federal Credit Union (NFCU) offers a range of financial services, including life insurance policies designed to provide financial protection and peace of mind to its members. In this comprehensive guide, we will delve into the world of NFCU life insurance, exploring its features, benefits, and how it can secure your family's future.

The Importance of Life Insurance

Life insurance is an essential financial tool that ensures your loved ones are taken care of in the event of your untimely demise. It provides a safety net, offering financial stability and support during a time of loss. With life insurance, you can protect your family's future, ensuring they have the means to maintain their lifestyle and achieve their goals.

NFCU Life Insurance: An Overview

NFCU offers a variety of life insurance products tailored to meet the diverse needs of its members. These policies are designed to provide comprehensive coverage, offering benefits such as:

- Death benefit payouts to your beneficiaries

- Flexible coverage options to suit your specific needs

- Affordable premiums to fit your budget

- Additional riders and benefits to enhance your coverage

- Simplified issue policies for instant coverage (no medical exam required)

Types of NFCU Life Insurance

NFCU provides several types of life insurance policies to cater to different life stages and financial situations. The main types include:

Term Life Insurance

Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. It provides a death benefit to your beneficiaries if you pass away during the term of the policy. Term life insurance is an affordable option, especially for young families or those with short-term financial obligations.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for your entire life. It offers a guaranteed death benefit and builds cash value over time, which can be borrowed against or withdrawn. Whole life insurance is a more comprehensive and long-term solution, often used for estate planning and wealth preservation.

Universal Life Insurance

Universal life insurance offers flexibility in terms of premium payments and death benefit amounts. It combines the features of term and whole life insurance, allowing you to adjust your coverage as your needs change. Universal life insurance is a popular choice for those seeking customizable and adaptable life insurance coverage.

Benefits of NFCU Life Insurance

NFCU life insurance policies offer a range of advantages, including:

- Affordable premiums: NFCU aims to provide competitive rates, making life insurance accessible to its members.

- Customizable coverage: You can choose the type and amount of coverage that best suits your needs and budget.

- Financial protection: Life insurance ensures your family's financial security and helps cover expenses such as funeral costs, outstanding debts, and daily living expenses.

- Peace of mind: Knowing your loved ones are taken care of can provide immense peace of mind, allowing you to focus on living your best life.

- Estate planning: Whole life insurance, in particular, can be a valuable tool for estate planning, helping to minimize taxes and ensure a smooth transition of assets to your beneficiaries.

How to Apply for NFCU Life Insurance

Applying for NFCU life insurance is a straightforward process. Here's a step-by-step guide:

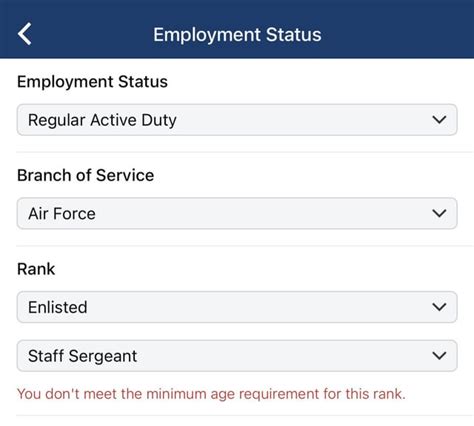

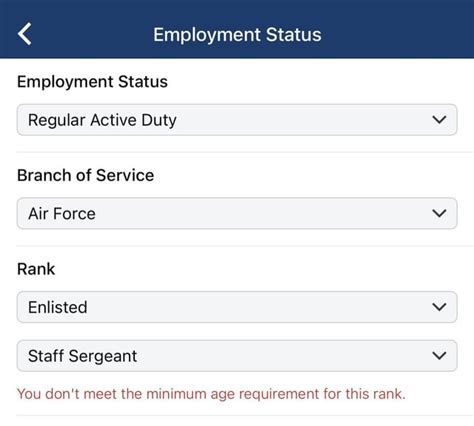

- Check Eligibility: Ensure you meet the eligibility criteria, which typically includes being a member of NFCU and meeting certain age requirements.

- Choose Your Policy: Decide on the type of life insurance (term, whole, or universal) and the coverage amount that aligns with your needs.

- Gather Information: Prepare the necessary documents, such as identification, financial records, and any relevant medical information.

- Complete the Application: Fill out the online application form or visit an NFCU branch to complete the application process.

- Medical Exam (if required): Depending on the policy and your health status, you may need to undergo a medical exam. This helps assess your risk and determine your premium.

- Review and Accept the Offer: Once your application is processed, NFCU will provide you with an offer. Review the terms and conditions, and if you're satisfied, accept the offer.

- Pay the Premium: Make the initial premium payment to activate your life insurance policy.

Notes

💡 Note: The application process and requirements may vary depending on the type of life insurance and your individual circumstances. It's essential to carefully review the policy documents and seek clarification from NFCU representatives if needed.

Conclusion

NFCU life insurance policies offer a range of benefits, providing financial protection and peace of mind to its members. By understanding the different types of life insurance and their features, you can make an informed decision and choose a policy that best suits your needs. Remember, life insurance is an essential tool for securing your family's future and ensuring they are taken care of, no matter what life brings.

FAQ

Can I apply for NFCU life insurance if I’m not a member?

+

No, you must be a member of NFCU to apply for their life insurance policies. However, becoming a member is straightforward, and you can easily join by meeting their eligibility criteria and opening an account.

What are the age limits for NFCU life insurance?

+

Age limits can vary depending on the type of life insurance and the policy. It’s best to check with NFCU representatives to understand the specific age requirements for each policy.

Can I add additional coverage to my NFCU life insurance policy?

+

Yes, NFCU offers various riders and additional coverage options to enhance your life insurance policy. These can include accidental death benefits, waiver of premium, and more. Consult with an NFCU representative to explore these options.

How long does it take to receive the death benefit payout from NFCU life insurance?

+

The time it takes to receive the death benefit payout can vary depending on several factors, including the completion of necessary paperwork and the complexity of the claim. NFCU aims to process claims promptly, typically within a few weeks after receiving all required documentation.

Can I transfer my NFCU life insurance policy to another provider?

+

Yes, you have the right to transfer your life insurance policy to another provider. However, it’s essential to carefully review the terms and conditions of the new policy and ensure a smooth transition. Consult with a financial advisor or insurance expert for guidance during the transfer process.