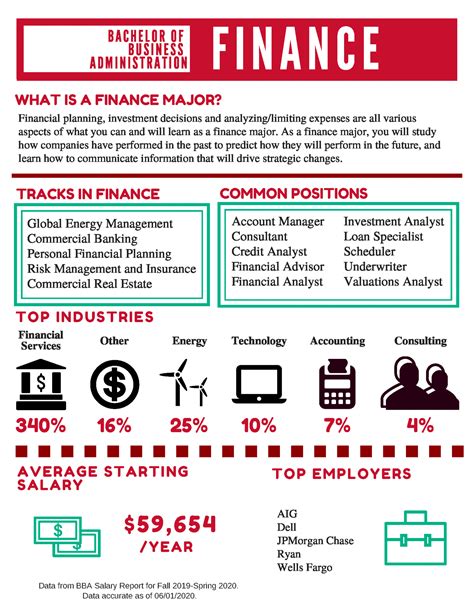

Opportunities For Finance Majors

Introduction

The field of finance offers a plethora of exciting career paths and opportunities for individuals with a passion for numbers, analysis, and strategic decision-making. Whether you’re a recent graduate or an experienced professional looking to transition into the world of finance, there are numerous avenues to explore and excel in. In this blog post, we will delve into the diverse range of opportunities available to finance majors, highlighting the skills, knowledge, and potential career trajectories that await you.

Understanding the Finance Industry

Before we dive into the specific opportunities, let’s gain a comprehensive understanding of the finance industry and its significance in the global economy. The finance industry plays a crucial role in facilitating economic activities, providing individuals and businesses with access to capital, and managing financial risks. It encompasses a wide range of sectors, including investment banking, commercial banking, asset management, insurance, and more.

Skills and Knowledge for Finance Majors

As a finance major, you possess a unique skill set that is highly valued in the industry. Here are some key skills and areas of knowledge that will serve as your foundation for a successful career:

- Financial Analysis: The ability to analyze financial statements, interpret data, and make informed decisions is at the core of finance. You will learn to assess the financial health of companies, evaluate investment opportunities, and forecast financial trends.

- Accounting Principles: A solid understanding of accounting principles is essential. Finance majors often delve into topics like financial accounting, managerial accounting, and cost analysis, equipping them with the skills to interpret financial data accurately.

- Investment Management: Gaining knowledge of investment strategies, portfolio management, and asset allocation is crucial. Finance majors learn about different investment vehicles, risk management techniques, and the factors that influence investment decisions.

- Risk Assessment and Mitigation: Finance professionals are adept at identifying and assessing risks. You will develop skills in risk analysis, developing risk management strategies, and implementing measures to mitigate potential financial losses.

- Financial Modeling: Building financial models and conducting scenario analyses is a valuable skill. Finance majors learn to create models that simulate financial scenarios, helping businesses make strategic decisions and evaluate potential outcomes.

- Communication and Presentation: Effective communication is vital in the finance industry. You will learn to present complex financial information in a clear and concise manner, both verbally and through written reports.

- Critical Thinking and Problem-Solving: Finance majors are trained to think critically and solve complex problems. The ability to analyze data, identify patterns, and propose innovative solutions is highly sought after by employers.

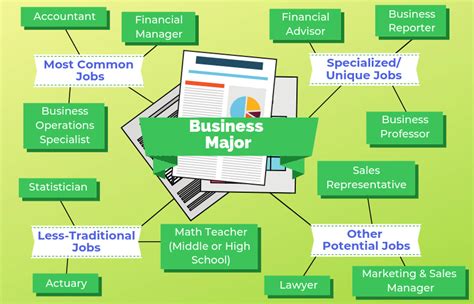

Career Opportunities for Finance Majors

Now, let’s explore some of the exciting career paths that await finance majors:

Investment Banking

Investment banking is often seen as the pinnacle of the finance industry. As an investment banker, you will work closely with corporations, governments, and high-net-worth individuals to raise capital, structure deals, and provide strategic advice. Some key roles in investment banking include:

- Investment Banking Analyst: Analysts play a crucial role in deal-making and client engagement. They conduct financial analysis, prepare pitch books, and assist in the execution of transactions.

- Corporate Finance: Corporate finance professionals focus on a company’s financial strategy, including capital structure, dividend policy, and merger and acquisition activities. They work closely with the finance team to optimize financial performance.

- Mergers and Acquisitions (M&A): M&A specialists are involved in the acquisition, merger, or divestiture of companies. They analyze potential targets, conduct due diligence, and negotiate deals on behalf of their clients.

Commercial Banking

Commercial banking offers a more stable and customer-centric environment. As a commercial banker, you will work directly with individuals and businesses, providing a range of financial services and products. Here are some popular roles:

- Personal Banker: Personal bankers build relationships with individual clients, offering advice on savings, investments, and loan products. They assist customers in achieving their financial goals and provide excellent customer service.

- Business Banker: Business bankers focus on serving small to medium-sized businesses. They offer financial solutions tailored to the needs of businesses, including loans, cash management, and investment opportunities.

- Credit Analyst: Credit analysts assess the creditworthiness of individuals and businesses. They analyze financial statements, evaluate risk, and make recommendations on loan approvals and interest rates.

Asset Management

Asset management involves managing investment portfolios on behalf of clients, such as pension funds, endowments, and high-net-worth individuals. Here are some key roles in asset management:

- Portfolio Manager: Portfolio managers are responsible for constructing and managing investment portfolios. They make investment decisions, select securities, and monitor portfolio performance to meet client objectives.

- Fund Manager: Fund managers oversee mutual funds, hedge funds, or other investment vehicles. They conduct research, analyze market trends, and make investment choices to maximize returns for fund investors.

- Investment Research Analyst: Research analysts provide in-depth analysis and insights on specific industries, companies, or sectors. Their research guides investment decisions and helps portfolio managers make informed choices.

Insurance and Risk Management

The insurance industry plays a vital role in managing risks and providing financial protection to individuals and businesses. Finance majors can find opportunities in:

- Actuarial Science: Actuaries use mathematical and statistical models to assess and manage risk. They work in various sectors, including insurance, finance, and pensions, to determine premiums, calculate reserves, and analyze investment risks.

- Risk Management: Risk management professionals identify, assess, and mitigate risks across different industries. They develop risk management strategies, implement controls, and ensure compliance with regulations.

- Insurance Underwriting: Underwriters evaluate the risk associated with insurance policies and determine the terms and premiums. They analyze applications, assess potential risks, and make recommendations on policy approvals.

Corporate Finance and Treasury

Corporate finance and treasury roles are integral to the financial health of organizations. Here are some key positions:

- Financial Analyst: Financial analysts provide valuable insights and recommendations to support decision-making within a company. They analyze financial data, prepare reports, and assist in budgeting, forecasting, and strategic planning.

- Treasury Manager: Treasury managers oversee an organization’s cash flow, investments, and financial risk management. They ensure optimal cash management, negotiate financing terms, and implement effective treasury strategies.

- Controller: Controllers are responsible for the overall financial management and reporting of a company. They oversee accounting operations, ensure compliance with regulations, and provide financial analysis to support strategic decision-making.

Entrepreneurship and Consulting

Finance majors can also explore entrepreneurial ventures or consultancies, leveraging their expertise to provide financial advice and solutions to businesses. Some avenues to consider include:

- Financial Planning and Consulting: Financial planners and consultants work with individuals and businesses to develop financial strategies, offering advice on investments, tax planning, and wealth management.

- Start-up Entrepreneurship: Finance majors can bring valuable skills to start-up ventures, helping entrepreneurs navigate financial challenges, secure funding, and manage cash flow.

- Business Consulting: Business consultants assist organizations in improving their financial performance, providing strategic advice, and implementing financial solutions to drive growth and profitability.

Education and Qualifications

To pursue a career in finance, a strong educational background is essential. Here are some key considerations:

- Bachelor’s Degree: A bachelor’s degree in finance, accounting, economics, or a related field is often the minimum requirement for entry-level positions. Pursuing a specialized finance program can provide a solid foundation and enhance your employability.

- Master’s Degree: Obtaining a master’s degree, such as an MBA (Master of Business Administration) or a specialized finance degree, can open up advanced career opportunities and increase your earning potential.

- Professional Certifications: Consider obtaining professional certifications such as the Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA) designation. These certifications demonstrate your expertise and commitment to the field, making you a more attractive candidate to employers.

Networking and Professional Development

Building a strong professional network and investing in continuous learning are crucial for long-term success in the finance industry. Here are some tips:

- Join Finance Clubs and Organizations: Engage with finance-focused clubs and organizations on campus or in your community. These groups provide networking opportunities, industry insights, and mentorship.

- Attend Industry Events: Participate in industry conferences, seminars, and workshops to stay updated on market trends and connect with professionals in your field.

- Mentorship Programs: Seek out mentorship opportunities with experienced finance professionals. Mentors can provide valuable guidance, share their industry knowledge, and offer career advice.

- Continuous Learning: Stay abreast of industry developments and best practices by reading financial publications, following industry leaders on social media, and enrolling in online courses or webinars.

Conclusion

The opportunities for finance majors are vast and diverse, offering a rewarding and dynamic career path. Whether you aspire to work in investment banking, commercial banking, asset management, or other finance-related fields, your skills and knowledge will be in high demand. By honing your financial analysis abilities, developing a strong foundation in accounting principles, and staying updated with industry trends, you can unlock a world of possibilities. Remember, the finance industry is ever-evolving, and by embracing continuous learning and networking, you can position yourself for success and make a meaningful impact in the world of finance.

FAQ

What are the key skills employers look for in finance majors?

+Employers seek finance majors with strong analytical skills, proficiency in financial analysis, and a solid understanding of accounting principles. Effective communication, problem-solving abilities, and a keen eye for detail are also highly valued.

Can finance majors explore careers outside the traditional finance industry?

+Absolutely! Finance majors possess transferable skills that are valuable in various industries. They can pursue careers in consulting, entrepreneurship, data analysis, or even transition into roles in technology or healthcare.

What are the benefits of obtaining professional certifications in finance?

+Professional certifications, such as the CFA or CPA, enhance your credibility and expertise in the finance industry. They demonstrate your commitment to continuous learning, increase your earning potential, and open doors to advanced career opportunities.

How can finance majors stay updated with industry trends and developments?

+Staying informed is crucial in the dynamic finance industry. Finance majors can achieve this by reading industry publications, following financial news, attending conferences, and actively participating in professional networks and organizations.

Are there opportunities for finance majors to work internationally?

+Absolutely! The finance industry is global in nature, and finance majors can explore international opportunities in investment banking, asset management, or consulting. Gaining experience in a different market can be an exciting and valuable career move.