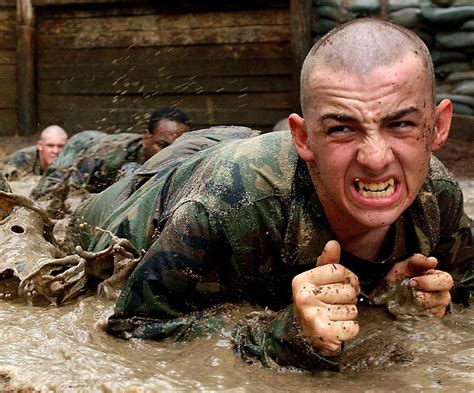

Pay For Army Basic Training

If you're considering a career in the military or simply want to experience the rigors of army basic training, you might be wondering how to pay for it. Army basic training, also known as initial entry training (IET), is a crucial step towards becoming a soldier and serves as the foundation for your military journey. In this blog post, we will explore the various options available to cover the costs associated with army basic training, ensuring that financial considerations don't stand in the way of your aspirations.

Understanding the Costs of Army Basic Training

Before delving into the payment options, it's essential to have a clear understanding of the costs involved in army basic training. While the specific expenses may vary depending on factors such as location, duration, and personal choices, here are some common expenses to consider:

- Enlistment Bonus: Many recruits are eligible for an enlistment bonus, which can be used to cover training-related expenses.

- Travel and Transportation: You may need to travel to your designated training location, and transportation costs can add up quickly.

- Uniforms and Gear: The army provides standard-issue uniforms and equipment, but you might choose to purchase additional items or upgrade your gear.

- Personal Expenses: During training, you'll have some personal expenses, such as communication with family, snacks, and other small purchases.

- Medical and Dental Exams: Prior to basic training, you'll need to undergo medical and dental exams, which may have associated costs.

By understanding these potential costs, you can better plan and budget for your army basic training journey. Now, let's explore the various ways to pay for this transformative experience.

Scholarships and Grants

Scholarships and grants are excellent options to cover the costs of army basic training, as they provide financial aid that typically does not need to be repaid. Here are some key scholarship and grant opportunities to consider:

- GI Bill: The GI Bill is a well-known benefit for military personnel and veterans. It provides financial assistance for education and training, including army basic training. The Post-9/11 GI Bill, in particular, can cover a significant portion of your training expenses.

- Military Tuition Assistance (TA): The army offers tuition assistance to eligible soldiers, which can be used for basic training costs. TA typically covers a percentage of the total training expenses, making it a valuable resource.

- State-Sponsored Programs: Some states offer scholarships or grants specifically for military training. Researching state-level programs in your area can uncover additional financial support.

- Private Scholarships: Private organizations and foundations often provide scholarships for military personnel. These scholarships can be competitive, but they offer a great opportunity to secure funding for your basic training.

When applying for scholarships and grants, be sure to carefully review the eligibility criteria and application requirements. Many of these opportunities have specific deadlines, so plan your application process accordingly.

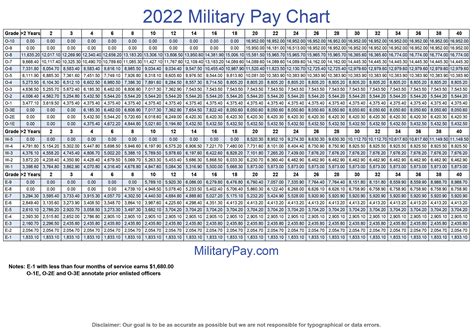

Enlistment Bonuses

Enlistment bonuses are a common incentive offered by the army to attract qualified recruits. These bonuses can be a significant source of funding for your basic training expenses. Here's what you need to know about enlistment bonuses:

- Eligibility: Enlistment bonuses are typically offered to individuals with specific skills or those enlisting in certain military occupations. The amount of the bonus can vary based on factors like MOS (Military Occupational Specialty) and length of service commitment.

- Timing: Enlistment bonuses are usually paid out at specific intervals during your service, such as upon completion of basic training or at regular intervals throughout your enlistment period.

- Usage: While enlistment bonuses can be used for various purposes, they are an excellent way to cover basic training costs. You can allocate a portion of your bonus towards travel, uniforms, and other training-related expenses.

Discuss enlistment bonus opportunities with your recruiter to understand the specific details and eligibility requirements. Keep in mind that enlistment bonuses are subject to change, so staying informed about the latest offerings is crucial.

Personal Savings and Financing

If you have the means, using your personal savings to cover basic training expenses can be a straightforward and flexible option. Here's how you can leverage your savings:

- Assess Your Savings: Evaluate your current financial situation and determine how much you can allocate towards basic training. Create a budget to ensure you have sufficient funds for the entire training period.

- Set Up a Dedicated Savings Account: Consider opening a separate savings account specifically for basic training expenses. This can help you track your progress and ensure you have the necessary funds when the time comes.

- Explore Financing Options: If your savings fall short, you can explore financing options such as personal loans or credit cards. However, be cautious of high-interest rates and ensure you can manage the repayments effectively.

Remember, while personal savings and financing can provide flexibility, it's important to approach these options with caution and consider the long-term financial implications.

Military Loans and Financial Assistance

The military offers various loan and financial assistance programs to support soldiers and their families. These programs can be valuable resources to cover basic training expenses. Here are some key options to consider:

- Military Star Card: The Military Star Card is a credit card specifically designed for military personnel and their families. It offers competitive interest rates and can be used to cover various expenses, including basic training costs.

- Military Loans: Military loans are offered by various financial institutions and are tailored to the unique needs of military personnel. These loans often have favorable terms and can be used for a range of purposes, including basic training.

- Military Assistance Programs: The army and other branches of the military provide assistance programs to help soldiers and their families with financial challenges. These programs may offer grants, low-interest loans, or other forms of support to cover essential expenses.

Research and explore the specific loan and assistance programs available within your branch of the military. Working with a financial advisor who specializes in military finances can also provide valuable guidance.

Work-Study Programs and Part-Time Jobs

If you're looking for a more hands-on approach to funding your basic training, consider work-study programs or part-time jobs. These options allow you to earn income while gaining valuable work experience. Here's how you can make it work:

- Work-Study Programs: Many military installations offer work-study programs that provide part-time employment opportunities for soldiers. These programs can help you earn income to cover basic training expenses while gaining valuable work experience within the military.

- Part-Time Jobs: If you're not eligible for work-study programs or prefer external employment, consider taking on a part-time job. Whether it's working at a local business or pursuing freelance opportunities, part-time work can provide a steady income stream to support your basic training journey.

When exploring work-study programs or part-time jobs, be sure to consider the time commitment and ensure it aligns with your training schedule. Balancing work and training can be challenging, so careful planning is essential.

Tax Benefits and Reimbursements

Tax benefits and reimbursements can provide a financial boost towards covering basic training expenses. Here are some key tax-related opportunities to explore:

- Military Tax Credits: The military offers various tax credits that can reduce your tax liability. These credits can be applied to your basic training expenses, providing a direct financial benefit.

- Reimbursement for Qualified Expenses: Depending on your specific circumstances, you may be eligible for reimbursement for certain qualified expenses related to basic training. This could include travel costs, uniform purchases, or other approved expenses.

- Tax Preparation Services: Utilize tax preparation services that specialize in military taxes. These professionals can help you maximize your tax benefits and ensure you receive all the deductions and credits you're entitled to.

Stay informed about the latest tax benefits and reimbursements available to military personnel. Working with a tax professional who understands military finances can ensure you take full advantage of these opportunities.

Conclusion

Paying for army basic training is an important consideration for anyone aspiring to join the military. By exploring the various options outlined in this blog post, you can find the right financial solution to support your journey. From scholarships and grants to enlistment bonuses and personal savings, there are multiple paths to cover the costs of basic training. Remember to carefully research and plan your financial strategy, ensuring you make the most of the available resources. With the right approach, you can embark on your military career with confidence and financial stability.

Can I use a combination of funding sources to pay for basic training?

+

Absolutely! You can combine multiple funding sources to cover your basic training expenses. For example, you can use a combination of scholarships, enlistment bonuses, and personal savings to ensure you have sufficient funds.

Are there any low-interest loan options specifically for basic training expenses?

+

Yes, the military offers low-interest loan programs tailored to the needs of soldiers. These loans often have favorable terms and can be used to cover basic training costs. Consult with a financial advisor to explore these options.

Can I receive financial assistance for basic training if I’m a veteran?

+

While financial assistance programs are primarily aimed at active-duty soldiers, veterans may still be eligible for certain benefits. The GI Bill, for example, can provide financial support for veterans pursuing further education or training, including basic training.

Are there any tax benefits specifically for military personnel undergoing basic training?

+

Yes, the military offers a range of tax credits and benefits specifically for military personnel. These can include deductions for qualified expenses related to basic training. Consult with a tax professional to maximize your tax benefits.

Can I work part-time while undergoing basic training to earn extra income?

+

Working part-time while undergoing basic training is challenging due to the intensive nature of the training schedule. However, you can explore work-study programs offered by military installations, which provide part-time employment opportunities specifically for soldiers.