Paycheck Calculator Washington

The state of Washington offers a unique and comprehensive approach to calculating paychecks, ensuring that employees receive accurate and fair compensation for their hard work. In this blog post, we will delve into the world of paycheck calculations in Washington, exploring the various factors that come into play and providing a step-by-step guide to help you understand your earnings.

Understanding Washington's Paycheck Calculation Process

Washington state follows specific regulations and guidelines when it comes to calculating employee pay. Here's an overview of the key elements involved:

- Minimum Wage: Washington boasts one of the highest minimum wages in the nation, currently set at $15.74 per hour for most workers. This rate ensures that employees receive a fair compensation for their labor.

- Overtime Pay: Employees who work more than 40 hours in a workweek are entitled to overtime pay. In Washington, the overtime rate is typically 1.5 times the regular hourly rate.

- Tipped Employees: Workers who receive tips, such as servers and bartenders, have a different minimum wage rate. Their regular rate is $7.63 per hour, and they must earn at least $15.74 per hour, including tips, to meet the state's minimum wage requirement.

- Meal and Rest Breaks: Washington employers are required to provide meal and rest breaks to their employees. These breaks impact the calculation of regular work hours and overtime.

- Pay Frequency: Employers in Washington must pay their employees at least once a month. However, many choose to pay biweekly or even weekly to ensure timely compensation.

Step-by-Step Guide to Calculating Your Paycheck

Let's break down the process of calculating your paycheck in Washington into simple steps:

-

Determine Your Regular Hours:

Start by calculating the number of regular hours you've worked during the pay period. This includes any hours worked up to 40 hours per week. Let's say you worked 35 regular hours this week.

-

Calculate Your Regular Pay:

Multiply your regular hourly rate by the number of regular hours worked. For example, if your regular hourly rate is $20, your regular pay for 35 hours would be $700.

-

Check for Overtime Eligibility:

If you've worked more than 40 hours in a workweek, you are eligible for overtime pay. Calculate the number of overtime hours by subtracting 40 from your total hours worked. In this case, you worked 5 overtime hours (45 total hours - 40 regular hours = 5 overtime hours)

-

Compute Overtime Pay:

Multiply your regular hourly rate by 1.5 to determine your overtime rate. Then, multiply this rate by the number of overtime hours. For instance, if your regular rate is $20, your overtime rate would be $30. For 5 overtime hours, your overtime pay would be $150.

-

Add Regular and Overtime Pay:

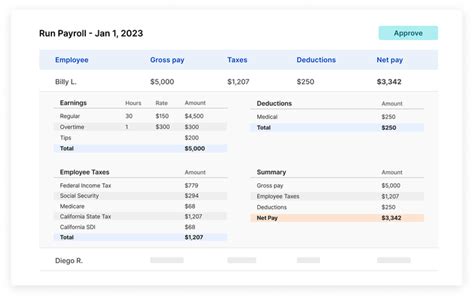

Sum up your regular pay and overtime pay to get your gross earnings for the pay period. In this example, your gross earnings would be $700 (regular pay) + $150 (overtime pay) = $850.

-

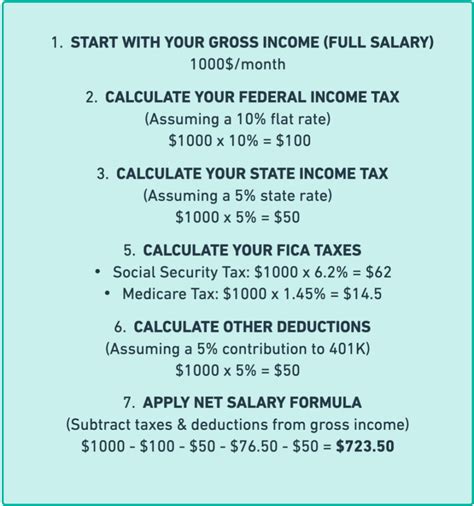

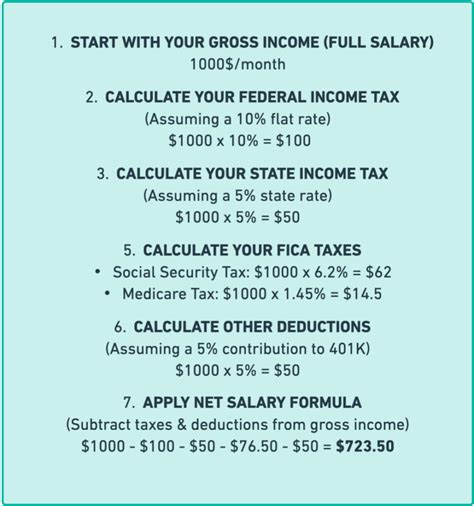

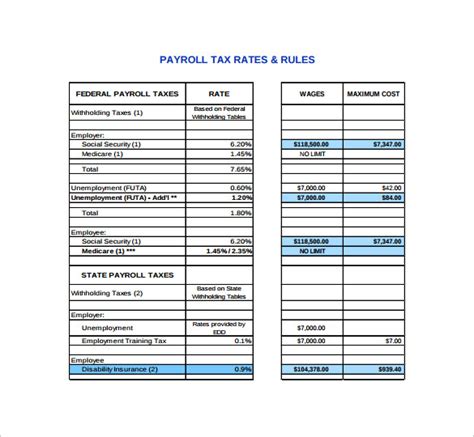

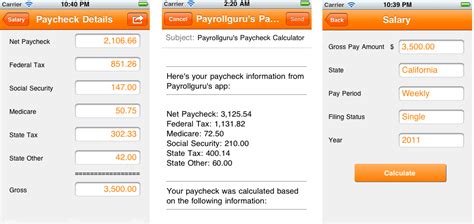

Subtract Deductions:

Now, it's time to deduct any applicable deductions from your gross earnings. These may include federal and state taxes, social security, Medicare, and any voluntary deductions like retirement contributions or insurance premiums. Let's assume your total deductions amount to $150.

-

Calculate Net Pay:

Subtract the total deductions from your gross earnings to determine your net pay. In this case, your net pay would be $850 (gross earnings) - $150 (deductions) = $700.

Tips for Accurate Paycheck Calculation

- Keep track of your hours worked, especially if you work in an industry where overtime is common, such as hospitality or healthcare.

- Understand your employment contract and the terms of your pay, including any bonuses, commissions, or benefits.

- Regularly review your pay stubs to ensure accuracy and promptly address any discrepancies.

- Stay informed about any changes in Washington's labor laws and regulations that may impact your paycheck calculation.

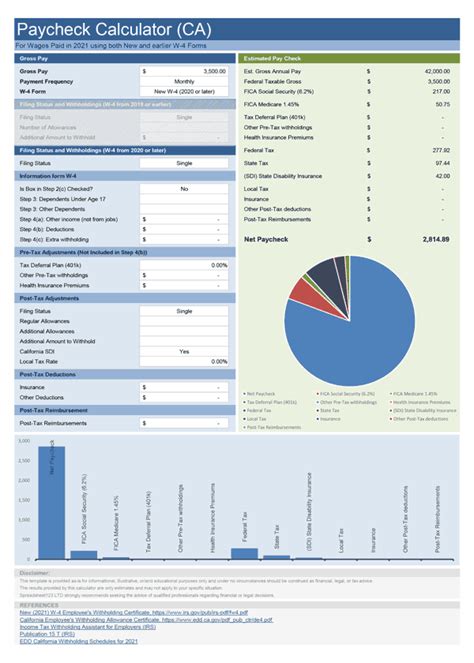

Paycheck Calculation Tools

To simplify the process, you can utilize online paycheck calculators specifically designed for Washington state. These tools consider the state's unique regulations and provide a quick and accurate estimate of your earnings. Some popular options include:

- Paycheck City's Washington Calculator

- SmartAsset's Washington Paycheck Calculator

- Paycor's Washington Paycheck Calculator

Common Questions and Scenarios

Here are some frequently asked questions and scenarios related to paycheck calculations in Washington:

What if I work for multiple employers?

If you have multiple jobs, each employer is responsible for calculating and paying your wages separately. Ensure that you accurately report your hours worked to each employer to avoid any discrepancies.

How are tips included in my paycheck calculation?

In Washington, employers are required to include tips in your wages as long as they meet the minimum wage requirement. If your tips, combined with your regular wages, fall short of the minimum wage, your employer must make up the difference.

Can I request a different pay frequency?

While Washington mandates a minimum pay frequency of once a month, you can negotiate with your employer for more frequent payments. Many employers are open to biweekly or weekly pay periods to accommodate their employees’ needs.

Conclusion

Calculating your paycheck in Washington involves understanding the state's unique regulations and guidelines. By following the step-by-step guide provided and utilizing the available resources, you can ensure accurate and fair compensation for your hard work. Remember to stay informed about any changes in labor laws and keep track of your hours worked to maintain a clear picture of your earnings.

How often do employers in Washington pay their employees?

+

Employers in Washington must pay their employees at least once a month. However, many choose to pay biweekly or weekly.

What is the current minimum wage in Washington?

+

The current minimum wage in Washington is 15.74 per hour for most workers.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any special considerations for tipped employees in Washington?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, tipped employees in Washington have a different minimum wage rate. Their regular rate is 7.63 per hour, and they must earn at least $15.74 per hour, including tips, to meet the state’s minimum wage requirement.