Pennsylvania Paycheck Calculator

Calculating your paycheck in Pennsylvania is an essential task, especially when you want to understand your earnings and deductions. With a clear breakdown of your income, you can plan your finances effectively. In this guide, we will walk you through the process of calculating your paycheck, considering various factors that affect your take-home pay. Let's dive in!

Understanding Your Paycheck Components

Before we begin, it's crucial to familiarize yourself with the different components that make up your paycheck. These include:

- Gross Pay: This is your total earnings before any deductions.

- Deductions: These are amounts withheld from your gross pay for various reasons, such as taxes, insurance, and retirement contributions.

- Net Pay: Your take-home pay, which is the amount you receive after all deductions have been made.

By understanding these components, you can gain insight into how your paycheck is calculated and make informed decisions about your finances.

Step-by-Step Paycheck Calculation

Now, let's break down the process of calculating your paycheck in Pennsylvania:

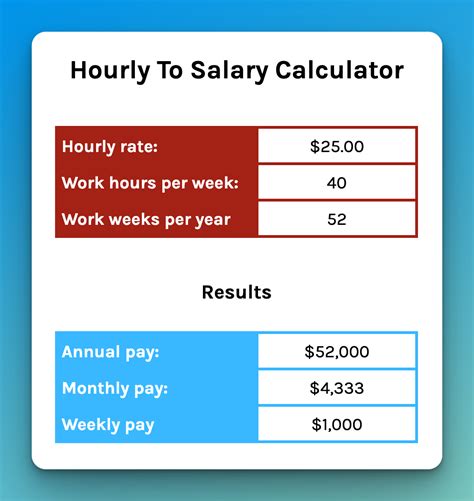

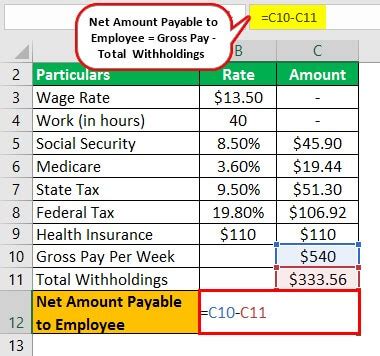

Step 1: Determine Your Gross Pay

Start by calculating your gross pay, which is the total amount you earn before any deductions. This can be based on your hourly rate or your salary.

- If you are paid hourly, multiply your hourly rate by the number of hours worked.

- For salaried employees, your gross pay remains the same each pay period.

Let's assume you are paid an hourly rate of $20 per hour and worked 40 hours this week. Your gross pay for this pay period would be:

$20/hour x 40 hours = $800

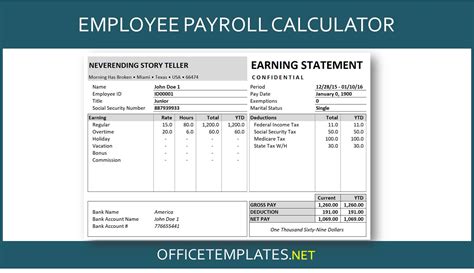

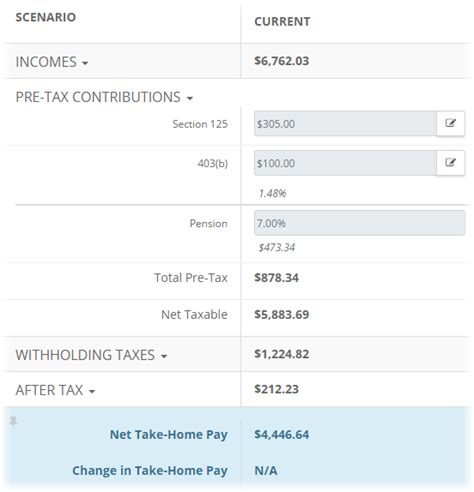

Step 2: Calculate Deductions

Next, we need to consider the deductions that will be taken out of your gross pay. These deductions can include:

- Federal Income Tax: This is based on your filing status and income level. You can use the IRS tax withholding calculator to estimate your federal income tax.

- State Income Tax: Pennsylvania has a progressive state income tax, which means the tax rate increases as your income increases. You can refer to the Pennsylvania Department of Revenue's website for tax rates and brackets.

- Local Taxes: Some municipalities in Pennsylvania have local income taxes. Check with your local government to determine if you are subject to any additional taxes.

- Social Security and Medicare Taxes: These are payroll taxes that fund social programs. The current rates are 6.2% for Social Security and 1.45% for Medicare.

- Optional Deductions: You may have chosen to contribute to retirement plans, insurance premiums, or other benefits. These amounts will be deducted from your gross pay as well.

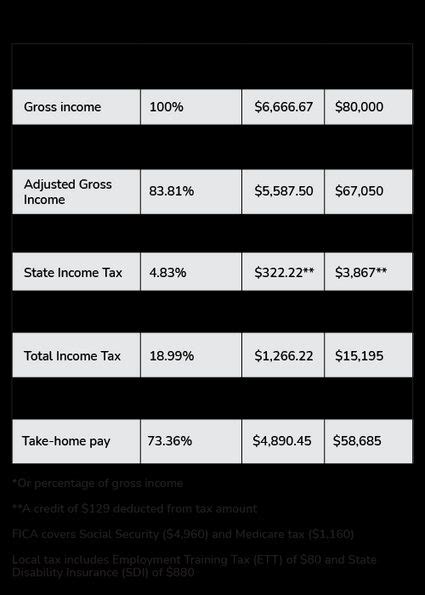

Let's estimate some deductions for our example. Assuming you are single and your income falls within the 3.06% state income tax bracket, your deductions could look like this:

| Deduction | Amount |

|---|---|

| Federal Income Tax | $120 |

| State Income Tax | $24.48 |

| Social Security | $49.60 |

| Medicare | $11.60 |

| Retirement Contribution | $40 |

| Health Insurance | $20 |

| Total Deductions | $265.68 |

Step 3: Calculate Your Net Pay

Finally, subtract the total deductions from your gross pay to calculate your net pay, or take-home pay.

Net Pay = Gross Pay - Total Deductions

In our example, your net pay would be:

$800 - $265.68 = $534.32

So, your take-home pay for this pay period would be $534.32.

Notes

🌟 Note: This is a simplified example, and actual deductions may vary based on your specific circumstances and the policies of your employer. It's important to consult with your employer or a tax professional for accurate and personalized guidance.

Frequently Asked Questions

What if I have multiple jobs in Pennsylvania? How do I calculate my paycheck in that case?

+

If you have multiple jobs, you will need to calculate your paycheck for each job separately. You can use the same steps outlined above for each employment. However, it's important to note that having multiple jobs may impact your tax obligations and deductions. Consult with a tax professional to ensure you are complying with all relevant tax laws.

Are there any tax credits or deductions I should be aware of when calculating my paycheck in Pennsylvania?

+

Yes, Pennsylvania offers various tax credits and deductions that can reduce your tax liability. Some common ones include the Earned Income Tax Credit (EITC), Child and Dependent Care Credit, and the Property Tax/Rent Rebate program. It's advisable to research and understand these credits to maximize your potential savings.

How often will I receive my paycheck in Pennsylvania?

+

In Pennsylvania, the frequency of pay periods is typically determined by your employer. Common pay periods include weekly, biweekly (every two weeks), semi-monthly (twice a month), and monthly. Your paycheck schedule will depend on the pay period chosen by your employer.

Can I choose how my paycheck is delivered?

+

Many employers in Pennsylvania offer the option of receiving your paycheck through direct deposit, which is a convenient and secure method. However, some employers may still issue paper checks. You can discuss your preferred method of payment with your employer to ensure your paycheck is delivered in a way that suits your needs.

Final Thoughts

Calculating your paycheck in Pennsylvania is a crucial step towards understanding your financial situation. By following the step-by-step process outlined above, you can estimate your gross pay, deductions, and net pay. Remember to consult with your employer or a tax professional for personalized guidance and to stay up-to-date with any changes in tax laws or deductions. Stay informed, and you’ll be well on your way to managing your finances effectively!