Private Equity Vs Venture Capital: Ultimate Guide To Investment Strategies

Introduction to Private Equity and Venture Capital

The world of finance and investment is vast and diverse, offering numerous opportunities for growth and profit. Two prominent players in this arena are private equity and venture capital, often used interchangeably but representing distinct investment strategies. Understanding the nuances between these two investment approaches is crucial for anyone looking to navigate the complex world of finance. In this comprehensive guide, we will delve into the strategies, benefits, and differences between private equity and venture capital, providing you with a deeper understanding of these investment vehicles.

Private Equity: Unlocking Value in Established Businesses

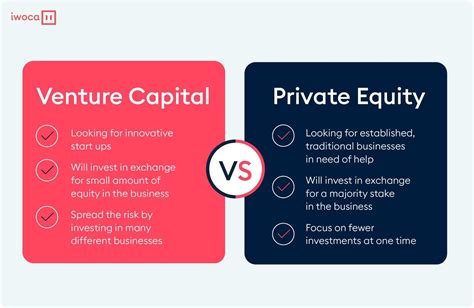

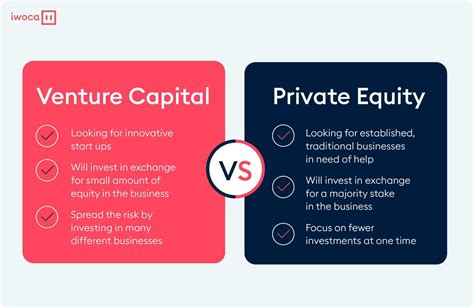

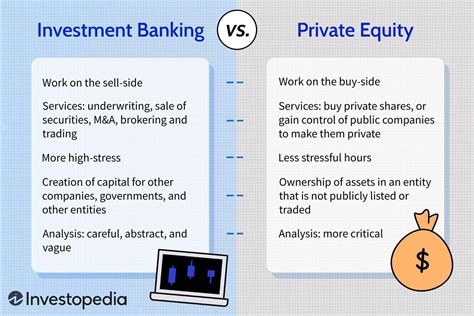

Private equity is an investment strategy focused on acquiring equity stakes in privately held companies, often with the aim of improving their operational and financial performance. Unlike public companies, which trade their shares on stock exchanges, private companies are not publicly listed, making them attractive targets for private equity investors. These investors bring not only capital but also their expertise and resources to help businesses reach new heights.

Key Characteristics of Private Equity:

Control and Influence: Private equity investors typically acquire a significant ownership stake in the target company, giving them substantial control over its strategic decisions. This level of involvement allows them to implement changes and drive growth.

Long-Term Focus: Private equity investments are often long-term commitments, with investors aiming to hold onto their stakes for several years. This long-term perspective allows for a more comprehensive approach to value creation.

Value Creation Strategies: Private equity firms employ various strategies to enhance the value of their investments. These may include operational improvements, cost-cutting measures, mergers and acquisitions, and access to new markets.

Targeted Industries: Private equity investors often specialize in specific industries or sectors where they have expertise and can add the most value. This industry-specific knowledge is a key advantage.

How Private Equity Works:

Private equity investments typically follow a structured process:

Fundraising: Private equity firms raise capital from institutional investors, high-net-worth individuals, or pension funds to create a private equity fund.

Investment: The firm identifies and acquires a stake in a privately held company, often through a leveraged buyout (LBO) or a growth equity investment.

Value Creation: Once invested, the private equity firm works closely with the company’s management to implement strategic changes, improve operational efficiency, and enhance financial performance.

Exit Strategy: After a period of value creation, the private equity firm aims to exit its investment through various means, such as an initial public offering (IPO), a sale to another private company, or a merger with a strategic buyer.

Venture Capital: Fueling Innovation and High-Growth Startups

Venture capital, on the other hand, is an investment strategy focused on providing capital to early-stage, high-potential startups with innovative ideas and technologies. These startups often operate in sectors with high growth potential but also carry a higher level of risk. Venture capitalists (VCs) play a crucial role in supporting these young companies, offering not only financial resources but also mentorship and industry connections.

Key Characteristics of Venture Capital:

High-Risk, High-Reward: Venture capital investments carry a higher level of risk compared to private equity. VCs invest in early-stage companies with unproven business models, but the potential for significant returns is also higher.

Focus on Innovation: Venture capital is often attracted to industries and sectors that are disrupting traditional markets with innovative technologies or business models.

Active Involvement: Venture capitalists typically take an active role in the companies they invest in, providing strategic guidance, mentorship, and industry connections to help the startup succeed.

Exit Strategies: VCs aim to exit their investments through various means, including IPOs, acquisitions by larger companies, or secondary sales to other investors.

How Venture Capital Works:

The venture capital process involves the following steps:

Fundraising: Venture capital firms raise capital from limited partners, which can include institutional investors, family offices, or high-net-worth individuals.

Investment: VCs identify and invest in early-stage startups with high-growth potential. They may invest in multiple rounds, providing funding at different stages of the company’s development.

Value Addition: Venture capitalists work closely with the startup’s founders to provide strategic guidance, industry connections, and mentorship. They help the startup navigate challenges and scale its operations.

Exit Strategy: VCs aim to exit their investments within a defined timeframe, typically within 3-7 years. They do so through various means, including IPOs, acquisitions, or secondary sales.

Differences Between Private Equity and Venture Capital

While private equity and venture capital share some similarities, there are distinct differences between the two investment strategies:

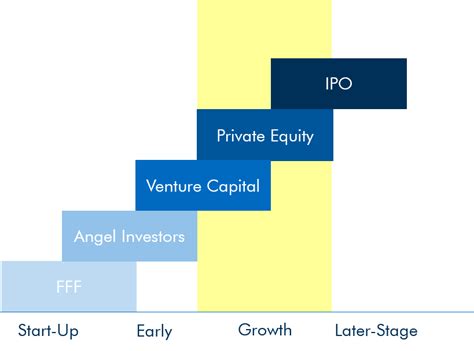

Investment Stage: Private equity typically invests in established, privately held companies, often with a focus on mature industries. Venture capital, on the other hand, invests in early-stage startups with high-growth potential, often in innovative sectors.

Risk and Return Profile: Private equity investments are generally considered less risky compared to venture capital. While private equity targets mature companies with proven business models, venture capital invests in high-risk, high-reward startups.

Involvement Level: Private equity investors aim to acquire a significant ownership stake and exert control over the company’s strategic decisions. Venture capitalists, on the other hand, take a more hands-on approach, providing guidance and mentorship to startup founders.

Exit Strategies: Private equity firms often aim for long-term holdings and exit through IPOs or sales to strategic buyers. Venture capitalists, due to the nature of early-stage investments, have a shorter investment horizon and exit through IPOs, acquisitions, or secondary sales.

Benefits of Private Equity and Venture Capital

Both private equity and venture capital offer unique advantages to investors and the companies they invest in:

Access to Capital: Both investment strategies provide companies with access to significant capital, allowing them to expand operations, enter new markets, or fund research and development.

Value Creation: Private equity firms bring expertise and resources to enhance the value of their investments, while venture capitalists provide strategic guidance and industry connections to help startups succeed.

Long-Term Growth: Private equity investments can drive long-term growth and stability for established companies, while venture capital investments can fuel innovation and create disruptive technologies.

Diversification: Investors can diversify their portfolios by allocating capital to both private equity and venture capital, reducing risk and maximizing returns.

Investment Strategies and Considerations

When considering an investment in private equity or venture capital, it’s essential to understand the specific strategies and considerations associated with each:

Private Equity Investment Strategies:

Leveraged Buyouts (LBOs): Private equity firms often use debt to finance their acquisitions, leveraging the target company’s assets and cash flows to repay the debt.

Growth Equity: This strategy involves investing in privately held companies with strong growth potential, often providing capital for expansion or market penetration.

Distressed Investments: Private equity firms may invest in companies facing financial distress, aiming to turn around their operations and unlock value.

Mergers and Acquisitions (M&A): Private equity firms may use their resources to facilitate mergers or acquisitions, creating synergies and driving growth.

Venture Capital Investment Strategies:

Seed Stage: Venture capitalists invest in startups at the idea or prototype stage, providing initial funding for product development and market testing.

Early Stage: This stage involves investing in startups with a proven product and initial traction, often providing funding for market expansion and scaling operations.

Later Stage: Venture capitalists invest in more mature startups with established revenue streams, often providing funding for further growth and market penetration.

Series A, B, C, and Beyond: Venture capital investments often occur in rounds, with each round providing funding for specific milestones and growth stages.

Case Studies: Success Stories in Private Equity and Venture Capital

Private Equity:

- The Blackstone Group’s Investment in Hilton Worldwide: Blackstone, a leading private equity firm, acquired Hilton Worldwide in 2007 and implemented a series of strategic initiatives to enhance its value. The firm improved Hilton’s operational efficiency, expanded its global presence, and ultimately sold the company for a significant profit.

Venture Capital:

- Accel Partners’ Investment in Facebook: Accel Partners, a prominent venture capital firm, invested in Facebook during its early stages. The firm provided not only capital but also mentorship and industry connections, helping Facebook become a global social media giant. Accel’s investment paid off handsomely as Facebook went public and became one of the most valuable companies in the world.

Conclusion

Private equity and venture capital are powerful investment strategies, each with its own unique approach and set of benefits. Private equity focuses on established businesses, aiming to enhance their value through strategic interventions, while venture capital fuels innovation by investing in high-growth startups. Understanding the differences and similarities between these strategies is crucial for investors looking to diversify their portfolios and support businesses at various stages of development. Whether it’s the stability of private equity or the potential for disruptive innovation in venture capital, both investment approaches have their place in the dynamic world of finance.