Pro's Guide To Illinois Payroll: Calculate Now!

Navigating payroll regulations in Illinois can be a complex task, but with the right guidance, it becomes manageable. This comprehensive guide aims to equip you with the knowledge and tools to confidently tackle Illinois payroll, ensuring compliance and accuracy. From understanding the state's unique payroll laws to calculating wages and deductions, we've got you covered. Let's dive in and unlock the secrets to seamless Illinois payroll management.

Understanding Illinois Payroll Laws

Illinois has a comprehensive set of laws governing payroll practices, ensuring fair treatment of employees and compliance with state regulations. Here's an overview of the key laws you need to be familiar with:

Minimum Wage

Illinois has implemented a state minimum wage that exceeds the federal minimum wage. As of [insert latest update], the state minimum wage is set at $[amount] per hour. It's important to note that some cities within Illinois, such as Chicago, have their own minimum wage rates, which may be higher than the state minimum. Stay updated with the latest changes to ensure compliance.

Overtime Pay

Illinois follows the federal guidelines for overtime pay, requiring employers to pay time-and-a-half for hours worked beyond the standard 40-hour workweek. However, certain exemptions may apply, depending on the industry and the employee's role. Familiarize yourself with the Fair Labor Standards Act (FLSA) to understand the criteria for overtime eligibility.

Pay Frequency

Illinois does not mandate a specific pay frequency, allowing employers to choose between weekly, biweekly, semi-monthly, or monthly pay periods. However, it's crucial to maintain consistency and communicate the chosen pay frequency to employees.

Payroll Tax Requirements

Illinois imposes various payroll taxes on employers, including state income tax, unemployment insurance, and workers' compensation. Understanding these tax requirements and making timely payments is essential to avoid penalties. Stay informed about the tax rates and deadlines to ensure compliance.

New Hire Reporting

Illinois requires employers to report new hires within a specific timeframe. This includes providing information such as the employee's name, address, Social Security number, and start date. Failure to comply with new hire reporting requirements may result in penalties. Familiarize yourself with the process and ensure timely submission.

Calculating Wages and Deductions

Accurate wage calculation is crucial for maintaining a fair and transparent payroll system. Here's a step-by-step guide to help you calculate wages and deductions in Illinois:

Step 1: Determine Pay Rate

Start by establishing the employee's regular pay rate, taking into account the applicable minimum wage rate. Consider any additional pay rates, such as overtime rates, for employees who work beyond the standard workweek.

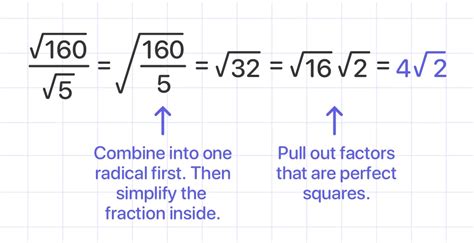

Step 2: Calculate Gross Pay

Gross pay is the total amount earned by an employee before any deductions. To calculate gross pay, multiply the employee's regular pay rate by the number of hours worked. If applicable, include overtime pay at the time-and-a-half rate for hours worked beyond the standard workweek.

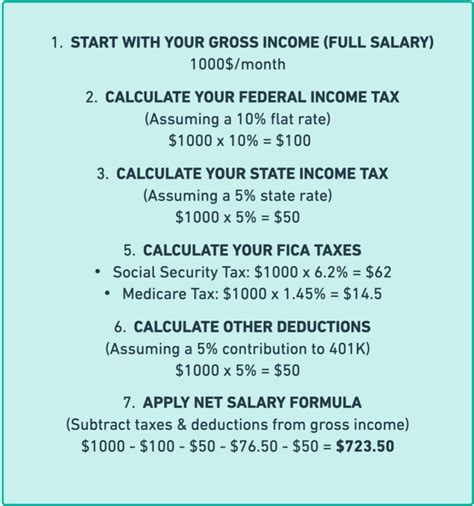

Step 3: Apply Deductions

Deductions are amounts withheld from an employee's gross pay for various purposes. In Illinois, the following deductions are typically made:

- Federal Income Tax: Based on the employee's filing status and allowances, use the IRS withholding tables to calculate the appropriate tax amount.

- State Income Tax: Illinois has a state income tax, and the deduction amount depends on the employee's tax bracket and filing status.

- Social Security and Medicare Taxes: These are federal taxes with a combined rate of [insert latest rate].

- Unemployment Insurance: Illinois employers are required to pay unemployment insurance taxes, which may be deducted from employee wages.

- Optional Deductions: Employees may choose to have additional deductions, such as health insurance premiums, retirement contributions, or voluntary benefits.

Step 4: Calculate Net Pay

Net pay is the amount an employee takes home after all deductions have been made. To calculate net pay, subtract the total deductions from the employee's gross pay.

Payroll Tax Management

Managing payroll taxes is a critical aspect of Illinois payroll. Here's a breakdown of the key payroll taxes you need to be aware of:

State Income Tax

Illinois imposes a state income tax, which is calculated based on the employee's taxable income and filing status. Employers are responsible for withholding the appropriate amount from employee wages and remitting it to the state on a regular basis.

Unemployment Insurance

Illinois employers are required to pay unemployment insurance taxes to provide benefits to unemployed workers. The tax rate is determined based on the employer's industry and experience rating. It's important to stay updated with the latest tax rates and make timely payments to avoid penalties.

Workers' Compensation

Workers' compensation insurance provides coverage for employees who suffer work-related injuries or illnesses. In Illinois, employers are required to carry workers' compensation insurance, and the cost is typically based on the employer's payroll and the nature of the business.

Recordkeeping and Reporting

Maintaining accurate records and timely reporting are essential for compliance with Illinois payroll regulations. Here's what you need to know:

Payroll Records

Illinois requires employers to maintain detailed payroll records, including employee names, addresses, Social Security numbers, hours worked, gross pay, deductions, and net pay. These records must be retained for at least [insert duration] and made available for inspection by authorized government agencies.

Payroll Reports

Illinois employers are required to submit various payroll reports, including quarterly wage reports and annual wage and tax statements (W-2 forms). These reports provide important information to government agencies and employees for tax purposes. Ensure you understand the reporting requirements and deadlines to avoid penalties.

Payroll Software and Automation

To streamline your payroll process and ensure accuracy, consider investing in reliable payroll software. Here are some benefits of using payroll software:

- Accuracy: Payroll software automates calculations, reducing the risk of errors in wage computation and tax deductions.

- Efficiency: Streamlined processes save time and effort, allowing you to focus on other aspects of your business.

- Compliance: Many payroll software solutions stay updated with the latest tax laws and regulations, ensuring your payroll practices remain compliant.

- Reporting: Payroll software generates accurate and timely reports, making it easier to meet reporting requirements.

Conclusion

Navigating Illinois payroll regulations can be complex, but with the right knowledge and tools, you can ensure compliance and accurate payroll management. From understanding the state's unique laws to calculating wages and managing payroll taxes, this guide has provided you with the essential information to tackle Illinois payroll with confidence. Remember to stay updated with any changes in regulations and utilize payroll software to streamline your processes. With a well-organized payroll system, you can focus on the growth and success of your business while keeping your employees happy and satisfied.

What are the penalties for non-compliance with Illinois payroll laws?

+Penalties for non-compliance with Illinois payroll laws can vary depending on the specific violation. Common penalties include fines, back wages owed to employees, and potential legal action. It’s crucial to stay informed about the latest regulations and seek professional advice if needed to avoid any non-compliance issues.

How often should I update my payroll software to ensure compliance with tax laws?

+It’s recommended to update your payroll software regularly to stay current with the latest tax laws and regulations. Many payroll software providers offer automatic updates, ensuring that you have access to the most up-to-date tax tables and calculation formulas. Check with your software provider for their update schedule and ensure you stay informed about any critical updates.

Can I use a payroll calculator instead of payroll software for small businesses?

+While payroll calculators can be a useful tool for quick calculations, they may not provide the comprehensive functionality and accuracy of payroll software. Payroll software offers features such as automated tax calculations, recordkeeping, and reporting, making it a more reliable and efficient solution for managing payroll. Consider the size and complexity of your business when deciding between a calculator and payroll software.

What should I do if an employee disputes their payroll records or calculations?

+If an employee disputes their payroll records or calculations, it’s important to address the issue promptly and professionally. Review the employee’s records, including time cards, hours worked, and wage calculations. Communicate with the employee to understand their concerns and provide a detailed explanation of the calculations. If necessary, seek advice from a payroll professional or HR expert to ensure accurate resolution.