Retirement Age For Air Force

The retirement age for Air Force personnel is a topic of great interest to those serving in the military and those considering a career in the armed forces. It's essential to understand the regulations and benefits associated with retirement to plan for the future effectively. In this blog post, we will delve into the details of the Air Force's retirement age, the eligibility criteria, and the various retirement programs available to service members.

Understanding the Retirement Age in the Air Force

The Air Force, like other branches of the U.S. military, has specific retirement age guidelines that determine when service members can retire with full benefits. The retirement age can vary depending on factors such as the member's rank, years of service, and specific retirement program they are enrolled in.

Retirement Age Based on Rank

The retirement age for Air Force personnel can be influenced by their rank. Generally, higher-ranking officers have a longer service commitment and, consequently, a higher retirement age. Here's a breakdown of the retirement age based on rank:

- Enlisted Members: Enlisted personnel typically have a retirement age of 20 years of service. This means they can retire with full benefits after serving for two decades.

- Officers: Officers in the Air Force usually have a retirement age of 20 to 30 years of service, depending on their specific rank and position. For instance, a Lieutenant Colonel may have a retirement age of 26 years, while a General may have a retirement age of 30 years.

Years of Service

The number of years served is a crucial factor in determining eligibility for retirement. Air Force personnel must meet the minimum service requirement to qualify for retirement benefits. Here's a general overview:

- 20 years of service: This is the standard retirement age for most enlisted members and some officers.

- 26-30 years of service: Higher-ranking officers may have a retirement age ranging from 26 to 30 years of service.

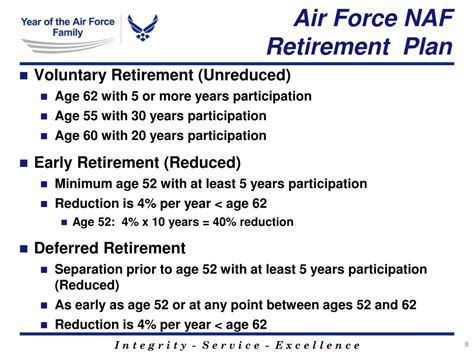

Retirement Programs in the Air Force

The Air Force offers several retirement programs to its service members, each with its own set of benefits and eligibility criteria. Understanding these programs is essential for planning your retirement journey.

High-Year Tenure (HYT)

High-Year Tenure is a term used to describe the maximum number of years an Air Force member can serve in their current rank before being required to either retire or move to a different position. It is designed to ensure a balanced and diverse workforce within the Air Force. Here are some key points about HYT:

- Enlisted Members: Enlisted personnel typically have a HYT of 20 years, which aligns with their standard retirement age.

- Officers: HYT for officers can vary based on their rank and position. For example, a Major may have a HYT of 24 years, while a Lieutenant Colonel may have a HYT of 26 years.

- When an Air Force member reaches their HYT, they have the option to either retire or seek promotion to a higher rank. If they choose to retire, they can do so with full retirement benefits, provided they meet the service requirements.

Career Status Bonus (CSB)

The Career Status Bonus is a program designed to incentivize Air Force personnel to extend their service beyond their initial commitment. It provides a monetary bonus to those who agree to serve for an additional period of time. Here's how it works:

- Eligibility: Air Force members who have completed their initial service commitment and are within a certain time frame of their retirement age are eligible for the CSB program.

- Bonus Amount: The bonus amount varies depending on the member's rank and years of service. It is typically a fixed amount, and the longer the service extension, the higher the bonus.

- Service Extension: By participating in the CSB program, Air Force members agree to extend their service for a specified period, usually ranging from 1 to 6 years.

- Benefits: In addition to the monetary bonus, members who participate in the CSB program may also be eligible for other benefits, such as increased retirement pay or enhanced healthcare coverage.

Voluntary Separation Incentive (VSI)

The Voluntary Separation Incentive is a program that allows Air Force members to voluntarily separate from service before reaching their retirement age. It provides a financial incentive to those who choose to leave early. Here's an overview of the VSI program:

- Eligibility: Air Force members who have served for a minimum of 6 years and are within a certain time frame of their retirement age can apply for the VSI program.

- Incentive Amount: The incentive amount varies based on the member's rank and years of service. It is typically a fixed percentage of their base pay, with a maximum limit set by the Department of Defense.

- Separation Requirements: Members who choose to participate in the VSI program must meet certain separation requirements, such as maintaining a satisfactory performance record and not being subject to any administrative or disciplinary actions.

- Benefits: In addition to the financial incentive, members who separate through the VSI program may also be eligible for other benefits, such as healthcare coverage for a limited period or access to transition assistance programs.

Benefits of Air Force Retirement

Retiring from the Air Force comes with a range of benefits that can provide financial security and a comfortable lifestyle for service members and their families. Here are some key advantages:

Retirement Pay

One of the most significant benefits of Air Force retirement is the monthly retirement pay. This pay is calculated based on the member's years of service, rank, and base pay. It provides a steady income stream for life, ensuring financial stability during retirement.

Healthcare Benefits

Air Force retirees are eligible for healthcare coverage through the Department of Defense's Military Health System. This includes access to military treatment facilities, TRICARE health plans, and a network of civilian healthcare providers. Retirees can choose the plan that best suits their needs and maintain quality healthcare coverage.

Post-9/11 GI Bill

Air Force retirees who have served for at least 3 years and were honorably discharged are eligible for educational benefits under the Post-9/11 GI Bill. This bill provides financial support for higher education, covering tuition, fees, and a housing allowance. It opens doors to further education and career opportunities post-retirement.

Transition Assistance

The Air Force offers comprehensive transition assistance programs to help retiring service members prepare for civilian life. These programs provide career counseling, resume building, job search assistance, and access to resources to facilitate a smooth transition into civilian careers.

Eligibility Criteria for Air Force Retirement

To be eligible for Air Force retirement benefits, service members must meet certain criteria. Here are the key requirements:

- Minimum Years of Service: As mentioned earlier, the standard retirement age for most enlisted members is 20 years of service. Officers may have different retirement ages based on their rank.

- Honorable Discharge: To qualify for retirement benefits, Air Force members must have an honorable discharge from the service. This means they must have served with integrity and met all the required standards of conduct.

- Medical Fitness: Retiring service members must be medically fit to perform their duties. A medical evaluation is conducted to ensure they are physically capable of continuing their service or transitioning to retirement.

- Good Conduct: Air Force members must maintain a record of good conduct throughout their service. Any disciplinary actions or misconduct could impact their eligibility for retirement benefits.

Steps to Retire from the Air Force

Retiring from the Air Force is a significant decision, and it's essential to follow the proper steps to ensure a smooth transition. Here's a general guide on how to retire from the Air Force:

- Determine Eligibility: Assess your years of service, rank, and other factors to determine if you meet the eligibility criteria for retirement.

- Consult with a Retirement Counselor: Reach out to a retirement counselor or a financial advisor who specializes in military retirement. They can provide personalized guidance and help you understand your retirement options.

- Complete Required Paperwork: Fill out and submit the necessary retirement paperwork, including the Retirement Application and any other required forms. Ensure all information is accurate and up-to-date.

- Medical Evaluation: Undergo a medical evaluation to assess your fitness for retirement. This evaluation will determine if you are physically capable of continuing your service or transitioning to retirement.

- Transition Assistance: Utilize the Air Force's transition assistance programs to prepare for civilian life. Attend workshops, seek career counseling, and take advantage of the resources provided to make a successful transition.

- Financial Planning: Develop a financial plan for your retirement. Calculate your expected retirement pay, estimate your living expenses, and consider additional sources of income to ensure a comfortable retirement.

- Healthcare Coverage: Research and choose the appropriate healthcare plan through the Military Health System to ensure you have access to quality healthcare post-retirement.

- Educational Benefits: If eligible, apply for educational benefits under the Post-9/11 GI Bill. This can help you pursue further education or training to enhance your career prospects after retirement.

🌟 Note: The information provided in this blog post is based on general guidelines and may not reflect the most current regulations. It is important to consult official Air Force resources and seek professional advice for accurate and up-to-date information regarding retirement.

Conclusion

Understanding the retirement age and the various retirement programs offered by the Air Force is crucial for service members planning their future. By meeting the eligibility criteria and taking advantage of the available benefits, Air Force retirees can enjoy a secure and fulfilling retirement. Remember to stay informed about the latest regulations and seek professional guidance to make the most of your retirement journey.

Can I retire from the Air Force early, and what are the implications?

+

Yes, you can retire from the Air Force early through programs like the Voluntary Separation Incentive (VSI). However, early retirement may result in reduced retirement pay and limited access to certain benefits. It’s important to carefully consider the financial implications and seek professional advice before making a decision.

What happens if I don’t meet the minimum years of service for retirement?

+If you don’t meet the minimum years of service for retirement, you may still be eligible for certain benefits, such as the Career Status Bonus (CSB) or the Voluntary Separation Incentive (VSI). These programs can provide financial incentives to extend your service or separate early. It’s recommended to consult with a retirement counselor to explore your options.

Are there any age limits for retirement in the Air Force?

+While there are no strict age limits for retirement in the Air Force, the retirement age is primarily based on years of service and rank. However, it’s important to note that certain retirement programs, such as the Career Status Bonus (CSB), may have age restrictions. It’s best to refer to the official Air Force guidelines for specific age-related requirements.

Can I continue working after retiring from the Air Force?

+Yes, you can continue working after retiring from the Air Force. Retirement does not necessarily mean the end of your career. Many retirees choose to pursue civilian jobs, start their own businesses, or engage in consulting work. It’s important to consider your financial goals and explore options that align with your interests and skills.

What are the tax implications of Air Force retirement pay?

+Air Force retirement pay is generally taxable, similar to regular income. However, the tax treatment may vary depending on your specific circumstances and the state you reside in. It’s recommended to consult with a tax professional to understand the tax implications and explore potential deductions or credits that may be applicable to your retirement income.