The Ultimate 10Step Guide To Ohio's Paycheck Calculator: Master Your Finances

Calculating your paycheck accurately is crucial for financial planning and ensuring you receive the correct compensation for your hard work. Ohio's paycheck calculator is a valuable tool to help employees and employers alike navigate the complexities of payroll. In this comprehensive guide, we will walk you through the 10 essential steps to master the Ohio paycheck calculator and take control of your finances.

Step 1: Understand Your Pay Rate

The foundation of calculating your paycheck starts with knowing your pay rate. Whether you are an hourly employee or receive a salary, understanding your pay rate is vital. Here's how to determine your pay rate:

-

Hourly Employees: Calculate your hourly rate by dividing your annual salary by the number of hours you work in a year. This includes regular working hours, overtime, and any other additional hours.

-

Salaried Employees: Determine your salary by multiplying your hourly rate by the number of hours you work in a week, then by the number of weeks you work in a year. This accounts for any overtime or additional hours.

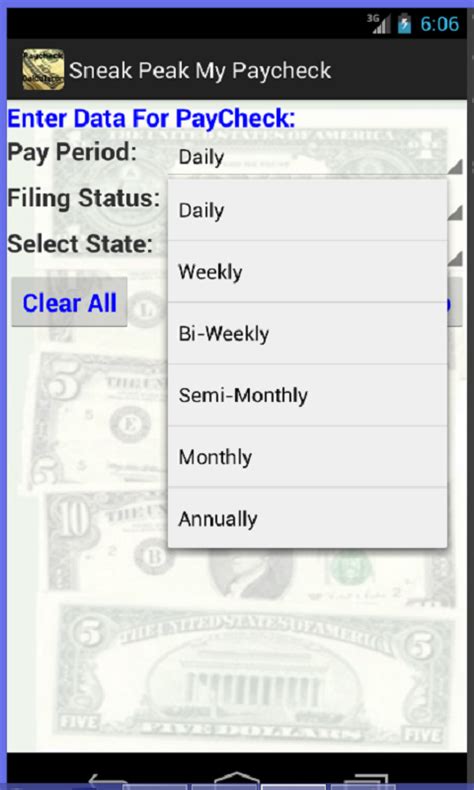

Step 2: Calculate Your Gross Pay

Gross pay refers to the total amount earned before any deductions. To calculate your gross pay, follow these steps:

-

Multiply your hourly rate by the number of hours worked in a pay period. A pay period can be weekly, biweekly, or monthly, depending on your employment agreement.

-

If you work overtime, calculate the overtime pay separately. In Ohio, overtime is paid at 1.5 times the regular rate for hours worked beyond 40 in a workweek.

-

Add the regular pay and overtime pay to determine your gross pay for the pay period.

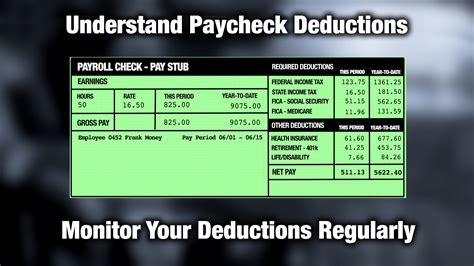

Step 3: Identify Deductions

Deductions are amounts withheld from your gross pay for various reasons. It's important to understand the different types of deductions to ensure accuracy in your paycheck calculation. Here are some common deductions:

-

Federal Income Tax: The amount deducted for federal income tax depends on your filing status, income level, and allowances claimed. Refer to the IRS tax tables or use online calculators to estimate your federal tax deduction.

-

State Income Tax: Ohio has a state income tax, and the deduction amount varies based on your income and filing status. Check the Ohio Department of Taxation's website for the latest tax rates and brackets.

-

FICA Taxes (Social Security and Medicare): These are mandatory deductions for Social Security and Medicare. The current rates are 6.2% for Social Security and 1.45% for Medicare. Both the employee and employer contribute to these taxes.

-

Other Deductions: These may include contributions to retirement plans, health insurance premiums, union dues, or any voluntary deductions you have opted for.

Step 4: Calculate Net Pay

Net pay, also known as take-home pay, is the amount you receive after all deductions are made. To calculate your net pay, subtract the total deductions from your gross pay. This is the amount you will see deposited into your bank account or receive as a paycheck.

Step 5: Factor in Overtime

Overtime pay is an important consideration when calculating your paycheck, especially if you work in industries where overtime is common. Here's how to factor in overtime:

-

Determine your regular hourly rate and the overtime rate (1.5 times the regular rate) for the pay period.

-

Calculate the number of overtime hours worked during the pay period.

-

Multiply the overtime rate by the number of overtime hours to find the overtime pay.

-

Add the overtime pay to your regular pay to determine your total gross pay for the pay period.

Step 6: Consider Additional Earnings

Apart from your regular earnings, you may have additional sources of income or earnings. It's essential to include these in your paycheck calculation to ensure accuracy. Some examples of additional earnings include:

-

Bonuses or incentives received for exceptional performance.

-

Commissions earned from sales or other performance-based incentives.

-

Tips or gratuities received by employees in certain industries, such as hospitality or food service.

-

Reimbursements for business-related expenses, such as travel or mileage.

Step 7: Review Deduction Details

Understanding the specifics of your deductions is crucial for accurate paycheck calculation. Review the following aspects of your deductions:

-

Tax Deductions: Ensure that your federal and state income tax deductions are correct by referring to the appropriate tax tables or using online calculators. Consider factors such as marital status, number of dependents, and any tax credits or deductions you may be eligible for.

-

Retirement Contributions: Check the amount deducted for retirement plans, such as a 401(k) or pension. Verify that the contribution amount matches your chosen contribution rate and any employer match.

-

Health Insurance Premiums: Review the deductions for health insurance coverage. Ensure that the premium amounts align with your chosen plan and any dependent coverage.

-

Other Voluntary Deductions: Go through any other voluntary deductions, such as life insurance premiums, flexible spending account contributions, or charity donations. Make sure these deductions are as per your instructions.

Step 8: Check for Accuracy

Before relying on your paycheck calculation, it's crucial to double-check for accuracy. Here are some tips to ensure your calculations are correct:

-

Compare your calculated gross pay with your pay stubs or previous paychecks to ensure consistency.

-

Verify that the deduction amounts for taxes, retirement contributions, and other items match your chosen options and instructions.

-

Cross-check the calculation of overtime pay, especially if you work irregular hours or have varying overtime rates.

-

If you have any doubts or questions, consult with your employer's payroll department or a trusted financial advisor.

Step 9: Stay Informed About Tax Changes

Tax laws and regulations can change from year to year, which may impact your paycheck calculations. Stay informed about any updates or changes in tax laws that could affect your deductions or tax liability. Here's how to stay up-to-date:

-

Follow reputable news sources and financial websites that provide information on tax law changes.

-

Subscribe to email updates or notifications from the IRS and Ohio Department of Taxation to receive important updates directly.

-

Attend workshops or webinars organized by tax professionals or financial institutions to learn about the latest tax developments.

-

Consult with a tax professional or accountant to ensure you are aware of any changes that may impact your paycheck calculations.

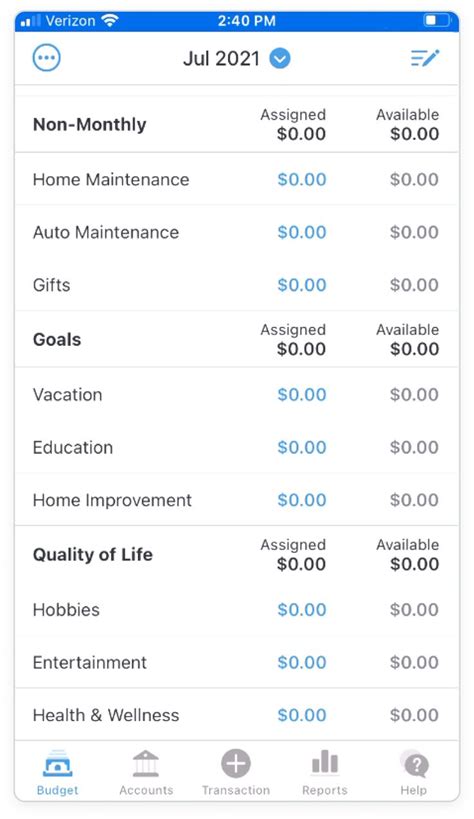

Step 10: Track Your Paycheck History

Maintaining a record of your paycheck history is beneficial for financial planning and future reference. Here's why it's important to track your paycheck history:

-

Financial Planning: Tracking your paycheck history allows you to analyze your income trends, identify any discrepancies, and make informed financial decisions.

-

Tax Preparation: Having a record of your pay stubs and paycheck details simplifies the process of filing your tax returns and ensures accurate reporting of your income.

-

Dispute Resolution: In case of any payroll errors or discrepancies, having a record of your paycheck history can help resolve issues with your employer or payroll provider.

Conclusion

Mastering the Ohio paycheck calculator is an essential skill for employees and employers alike. By following these 10 steps, you can accurately calculate your paycheck, understand the deductions, and make informed financial decisions. Remember to stay informed about tax changes, review your deductions regularly, and maintain a record of your paycheck history. With a solid understanding of your paycheck calculations, you can take control of your finances and plan for a secure financial future.

What are the key differences between hourly and salaried employees when calculating paychecks in Ohio?

+

The main difference lies in how pay is calculated. Hourly employees are paid based on the number of hours worked, while salaried employees receive a fixed amount regardless of hours worked. Hourly employees may be eligible for overtime pay, while salaried employees typically do not receive overtime pay unless specifically outlined in their employment contract.

How often do Ohio employers issue paychecks to their employees?

+

In Ohio, employers are required to pay employees at least once every 16 days. However, many employers choose to issue paychecks on a weekly, biweekly, or monthly basis, depending on the company’s payroll schedule.

Are there any specific tax laws or deductions that are unique to Ohio when calculating paychecks?

+

Yes, Ohio has its own state income tax, which is separate from federal income tax. Employers are required to withhold state income tax from employees’ paychecks based on the applicable tax rates and brackets. Additionally, Ohio has a Local Governmental Retirement System (LPRS) deduction for certain public employees.