Ultimate Guide: 5 Pro Strategies For Debt Snowball

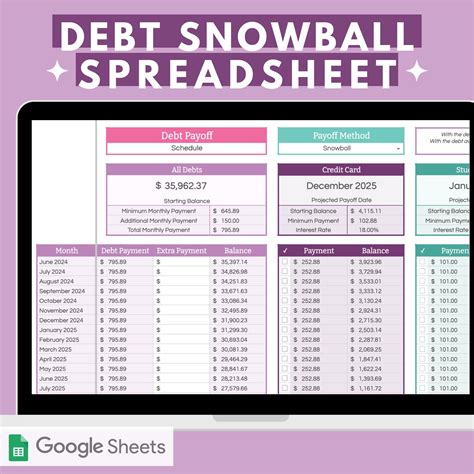

The debt snowball method is a popular and effective strategy to tackle debt repayment. It involves focusing on one debt at a time while making minimum payments on others. This approach, made famous by financial expert Dave Ramsey, aims to provide a sense of progress and motivation by quickly eliminating smaller debts first. In this comprehensive guide, we'll explore five powerful strategies to maximize the debt snowball method and accelerate your journey to financial freedom.

1. Prioritize Your Debts

The first step in the debt snowball method is to prioritize your debts. Start by listing all your debts, including credit cards, loans, and any other outstanding balances. Arrange them in order of their balance amounts, from smallest to largest. While it might be tempting to focus on the debt with the highest interest rate, the debt snowball method prioritizes eliminating the smallest debts first to provide a quick win and boost your motivation.

2. Increase Your Payments

To make the debt snowball method work effectively, you need to increase your payments beyond the minimum due. Here's how you can do it:

- Create a Budget: Begin by creating a realistic budget that outlines your income and expenses. Identify areas where you can cut back on non-essential spending and redirect those funds towards debt repayment.

- Extra Income: Consider ways to boost your income. This could include taking on a side hustle, selling unwanted items, or negotiating for a raise at work. Use any extra income to accelerate your debt repayment journey.

- Cut Unnecessary Expenses: Review your monthly expenses and identify areas where you can cut back. This might include reducing dining out, canceling subscription services you no longer need, or negotiating lower rates on insurance or utility bills.

- Snowball Effect: As you pay off each debt, take the amount you were paying towards it and add it to the payment for the next debt on your list. This "snowball effect" will help you pay off your debts faster and gain momentum.

3. Negotiate with Creditors

Negotiating with creditors can be a powerful strategy to reduce your overall debt burden. Here's how you can approach it:

- Contact Creditors: Reach out to your creditors and explain your situation. Be honest and open about your financial struggles and express your willingness to repay the debt. Many creditors are open to negotiating payment plans or reducing interest rates to help you get back on track.

- Offer a Settlement: If you have the means, propose a settlement amount that you can pay in full. This might involve paying a lump sum that is less than the total balance, but it can help you eliminate the debt quickly and save on interest charges.

- Consolidate Debt: Consider consolidating your debts into a single loan with a lower interest rate. This can simplify your repayment process and potentially save you money on interest. Shop around for the best consolidation options and choose a reputable lender.

4. Maintain Motivation

Staying motivated throughout your debt repayment journey is crucial. Here are some tips to keep you on track:

- Visualize Progress: Create a visual representation of your debt repayment progress. This could be a physical chart or a digital tracker. Update it regularly to see how far you've come and celebrate your achievements.

- Set Short-Term Goals: Break down your debt repayment into smaller, achievable goals. For example, aim to pay off a specific debt within a certain timeframe. This will help you stay focused and motivated.

- Celebrate Milestones: Celebrate your successes along the way. Whether it's paying off a small debt or reaching a significant milestone, acknowledge your progress and reward yourself (within reason) to stay motivated.

- Seek Support: Surround yourself with a supportive network. Share your journey with friends or family who can provide encouragement and hold you accountable. Consider joining online communities or support groups where you can connect with others facing similar challenges.

5. Automate Your Payments

Automating your debt payments can help you stay consistent and on track. Here's how you can do it:

- Set Up Automatic Payments: Contact your creditors and set up automatic payments for the minimum due on each debt. This ensures that your payments are made on time and avoids any late fees or penalties.

- Make Additional Payments: In addition to your automatic minimum payments, make additional payments manually whenever possible. Use direct deposit or online banking to transfer funds directly to your creditors.

- Use Budgeting Apps: Take advantage of budgeting apps or personal finance tools that offer automatic payment features. These apps can help you stay organized, track your progress, and ensure that your payments are made consistently.

Conclusion

The debt snowball method is a powerful strategy to conquer your debts and achieve financial freedom. By prioritizing your debts, increasing your payments, negotiating with creditors, maintaining motivation, and automating your payments, you can accelerate your journey and reach your goals faster. Remember, consistency and discipline are key. Stay focused, stay motivated, and you'll soon be debt-free!

How long does it take to complete the debt snowball method?

+

The time it takes to complete the debt snowball method varies depending on your income, expenses, and the amount of debt you have. On average, it can take several months to a few years to pay off all your debts using this method. However, by consistently following the strategies outlined in this guide, you can accelerate your progress and reach your goals sooner.

Can I use the debt snowball method for all types of debt?

+

Yes, the debt snowball method can be applied to various types of debt, including credit card debt, personal loans, student loans, and even medical bills. It is a versatile strategy that can help you tackle multiple debts simultaneously.

What if I have a large debt with a low-interest rate? Should I still use the debt snowball method?

+

While the debt snowball method prioritizes paying off smaller debts first, it’s important to consider your overall financial situation. If you have a large debt with a low-interest rate, it might be more beneficial to focus on that debt first to save on interest charges. Assess your financial goals and priorities to determine the best approach for your unique situation.

Is it possible to combine the debt snowball method with other debt repayment strategies?

+

Absolutely! The debt snowball method can be combined with other debt repayment strategies, such as the debt avalanche method (prioritizing debts with the highest interest rates) or debt consolidation. Find a balance that works best for your financial goals and preferences.

How can I stay motivated during the debt repayment process?

+

Staying motivated throughout your debt repayment journey is crucial. Here are some tips to keep your motivation high: celebrate milestones, set short-term goals, surround yourself with a supportive network, and visualize your progress. Remember, every step you take towards becoming debt-free is a step towards financial freedom.