Ultimate Guide: Generate Your Nj Paycheck Now

Understanding your paycheck is crucial, especially when it comes to knowing how much you're earning and what deductions are being made. In this ultimate guide, we will walk you through the process of generating your NJ paycheck, step by step. By the end of this article, you'll have a clear understanding of your earnings and the various components that make up your paycheck.

Step 1: Gather Necessary Information

Before you begin, ensure you have the following details at hand:

- Your employee ID or social security number.

- The name of your employer.

- Your pay rate or salary information.

- Any applicable deductions or benefits you are enrolled in.

Step 2: Access Your Pay Stub

Your pay stub is a detailed record of your earnings and deductions for a specific pay period. To access it, follow these steps:

- Log in to your employer's payroll system or portal. This is usually an online platform where you can view and manage your payroll information.

- Look for the "Pay Stub" or "Payroll" section. It may be under the "My Documents" or "Employee Self-Service" tab.

- Select the pay period for which you want to generate your paycheck. You can choose from the available dates or use the search function to find a specific pay period.

- Once you've located the correct pay stub, download it or view it in a printable format.

If you prefer a paper copy, you can print the pay stub directly from the payroll system. However, it's recommended to keep digital records for easy access and reference.

Step 3: Understanding Your Pay Stub

Your pay stub contains valuable information about your earnings and deductions. Let's break down the key sections:

Employee Information

This section includes your personal details, such as your name, employee ID, social security number, and contact information. It ensures that the pay stub is specific to you and your employment.

Pay Period and Dates

Here, you'll find the start and end dates of the pay period covered by this pay stub. It helps you identify the specific time frame for which you are being paid.

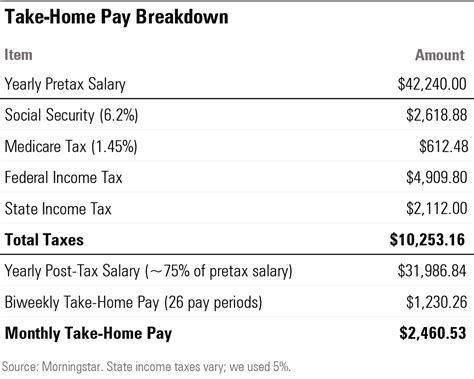

Earnings

The earnings section details your gross income for the pay period. It includes your regular pay, overtime pay, bonuses, or any other additional earnings. Make sure to review this section carefully to ensure accuracy.

Deductions

Deductions are amounts withheld from your gross pay. This section breaks down the various deductions, such as federal and state taxes, social security, Medicare, health insurance premiums, retirement contributions, and any other voluntary deductions you may have opted for.

Net Pay

Your net pay, also known as take-home pay, is the amount you receive after all deductions have been made. It represents the actual money you'll have in your pocket or bank account after paying your taxes and other obligations.

Step 4: Calculate Your Withholdings

Understanding your withholdings is essential to ensure you're not overpaying or underpaying your taxes. Here's a simple calculation to estimate your withholdings:

- Multiply your gross pay by your federal income tax rate.

- Add the Social Security tax (6.2%) and Medicare tax (1.45%) to the amount calculated in step 1.

- Subtract any pre-tax deductions, such as health insurance or retirement contributions, from the total in step 2.

- The resulting amount is a rough estimate of your federal and state tax withholdings.

Note: This calculation provides a basic estimate. For a more accurate calculation, consult with a tax professional or use online tax calculators.

Step 5: Review and Verify

Once you've generated your paycheck and calculated your withholdings, it's crucial to review and verify the following:

- Ensure your personal information, such as name and address, is correct.

- Check that your pay rate or salary matches your employment contract or agreement.

- Verify the accuracy of your earnings, including regular pay, overtime, and any additional income.

- Compare your calculated withholdings with the deductions on your pay stub. Ensure they align with your expectations and any changes you've made to your withholding allowances.

If you notice any discrepancies or have questions, contact your employer's payroll department for clarification.

Step 6: Save and Organize

Properly saving and organizing your pay stubs is essential for future reference and tax purposes. Here's how you can do it effectively:

- Save your pay stubs in a secure digital folder or use payroll management apps to store and access them easily.

- Consider creating a backup by printing or scanning your pay stubs and storing them in a physical file.

- Organize your pay stubs chronologically or by pay period to make it easier to locate specific information when needed.

By keeping accurate records, you'll have a clear financial history and be prepared for tax season or any other financial matters.

Conclusion

Generating your NJ paycheck is a straightforward process once you understand the necessary steps. By following this ultimate guide, you can easily access and comprehend your pay stub, calculate your withholdings, and ensure the accuracy of your earnings and deductions. Remember to keep your pay stubs organized and secure for future reference. Understanding your paycheck empowers you to make informed financial decisions and plan for your future.

FAQ

What is a pay stub, and why is it important?

+A pay stub is a detailed record of your earnings and deductions for a specific pay period. It provides valuable information about your gross pay, deductions, and net pay. It’s important as it helps you understand your income, track your withholdings, and ensure the accuracy of your payroll information.

How often should I review my pay stub?

+It’s recommended to review your pay stub at least once a month to ensure accuracy and identify any discrepancies. Additionally, it’s a good practice to review your pay stub whenever there are changes to your pay rate, deductions, or benefits.

Can I access my pay stub online if my employer doesn’t provide a digital option?

+If your employer doesn’t offer an online payroll system, you can request a paper copy of your pay stub. However, it’s becoming increasingly common for employers to provide digital access to pay stubs for convenience and environmental reasons.

What should I do if I find errors on my pay stub?

+If you notice any errors or discrepancies on your pay stub, contact your employer’s payroll department immediately. Provide them with specific details about the error and any supporting documentation. They will assist in rectifying the issue and ensuring accurate payroll processing.

Can I use my pay stubs for tax purposes?

+Yes, pay stubs are crucial for tax purposes. They provide the necessary information to calculate your taxable income and ensure accurate tax filings. Keep your pay stubs organized and easily accessible during tax season.