Virginia Salary Calculator

Understanding Virginia's Salary Structure and How to Calculate Your Earnings

When it comes to understanding your salary and earnings, especially in the state of Virginia, it's essential to have a clear grasp of the various factors that can impact your income. From calculating your base pay to considering additional earnings like overtime, bonuses, and tips, there are several aspects to consider. In this comprehensive guide, we will walk you through the process of calculating your Virginia salary, ensuring you have all the information you need to make informed financial decisions.

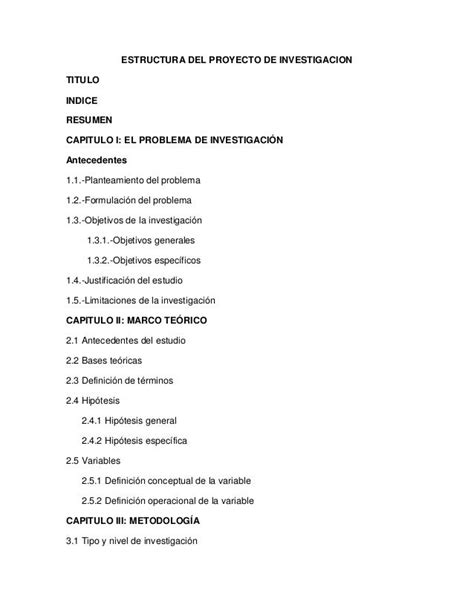

Step-by-Step Guide to Calculating Your Virginia Salary

1. Determine Your Base Pay

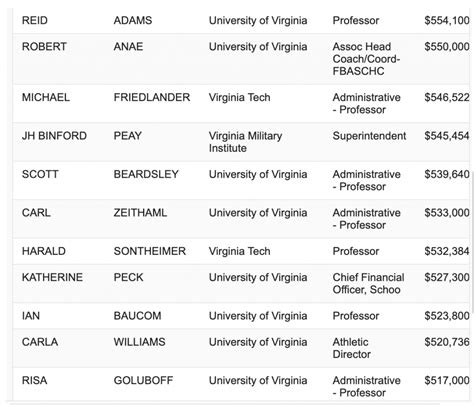

The foundation of your salary calculation is your base pay, which is typically determined by your job role, experience, and the going rate for your industry in Virginia. Here's how you can estimate your base pay:

- Research salary ranges for your specific job title and location in Virginia. Online resources, government websites, and industry-specific publications can provide valuable insights.

- Consider your experience and qualifications. More senior roles or those requiring specialized skills often command higher salaries.

- Negotiate your salary during the hiring process. Don't be afraid to discuss your expectations and advocate for a fair wage.

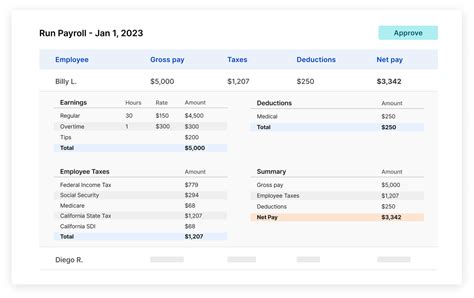

2. Calculate Overtime Pay (If Applicable)

If you work in an industry that frequently requires overtime, understanding how it impacts your earnings is crucial. In Virginia, overtime pay is calculated at 1.5 times your regular hourly rate for all hours worked beyond the standard 40-hour workweek. Here's a simple formula to calculate your overtime earnings:

Overtime Earnings = (Overtime Hours) x (1.5 x Regular Hourly Rate)

For example, if you work 45 hours in a week and your regular hourly rate is $20, your overtime earnings would be:

Overtime Earnings = (5 hours) x (1.5 x $20) = $150

3. Consider Bonuses and Commissions

Many jobs offer additional earnings in the form of bonuses, commissions, or performance-based incentives. These can significantly boost your overall salary. To calculate your total earnings, including bonuses:

- Check your employment contract or speak with your HR department to understand the bonus structure and eligibility criteria.

- Calculate your bonus earnings based on the specified formula or percentage. For instance, if you earn a 10% bonus on your base salary, calculate it as:

- Bonus Earnings = (Base Salary) x (Bonus Percentage)

4. Tips and Gratuities (For Service Industry Workers)

If you work in the service industry, such as restaurants or hospitality, tips and gratuities can contribute a significant portion of your income. To estimate your earnings from tips:

- Keep a record of your daily or weekly tip earnings.

- Calculate your average tip income over a specific period (e.g., a month) to get a more accurate estimate.

- Add this amount to your base pay and other earnings to determine your total salary.

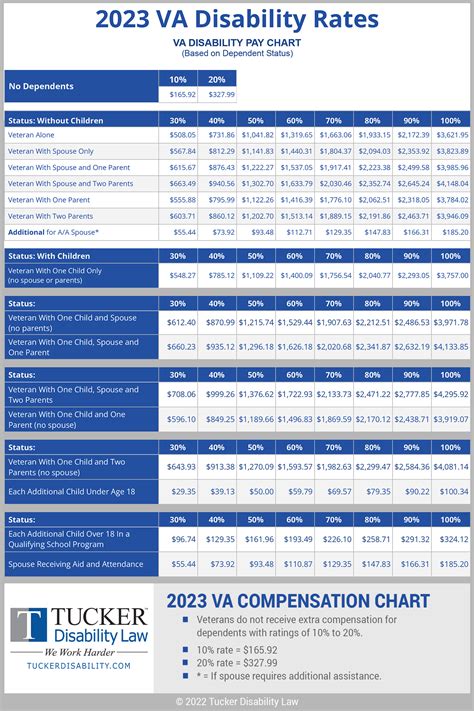

5. Tax Considerations

Understanding your tax obligations is crucial when calculating your take-home pay. Virginia has a progressive income tax system, which means your tax rate increases as your income rises. Here's a simplified breakdown of Virginia's income tax brackets:

| Tax Bracket | Tax Rate |

|---|---|

| Up to $3,000 | 2% |

| $3,001 - $5,000 | 3% |

| $5,001 - $10,000 | 5% |

| Over $10,000 | 5.75% |

To estimate your tax liability, you can use an online tax calculator or consult a tax professional. Remember that federal taxes and other deductions, such as Social Security and Medicare, will also impact your take-home pay.

Tips for Maximizing Your Earnings

- Stay updated on industry trends and negotiate for salary increases or promotions when appropriate.

- Consider pursuing additional certifications or skills to enhance your earning potential.

- Explore opportunities for career advancement within your organization or by seeking new job prospects.

- If eligible, contribute to retirement plans or invest in tax-advantaged accounts to grow your wealth over time.

Common Misconceptions and Pitfalls to Avoid

When calculating your salary, it's essential to avoid common pitfalls and misconceptions. Here are a few things to keep in mind:

- Overtime Misconceptions: Some employers may try to avoid paying overtime by misclassifying employees as exempt. Familiarize yourself with the Fair Labor Standards Act (FLSA) to understand your rights and eligibility for overtime pay.

- Bonus Calculations: Ensure you understand the bonus structure and eligibility criteria. Some bonuses may be based on company performance or individual goals, so clarify the details with your employer.

- Tax Withholding: Avoid over-withholding taxes by reviewing your W-4 form and adjusting your withholding allowances to align with your expected tax liability.

Conclusion

Calculating your Virginia salary involves considering various factors, from your base pay and overtime to bonuses and taxes. By following the step-by-step guide provided, you can gain a clearer understanding of your earnings and make informed decisions about your financial well-being. Remember to stay informed about industry trends, negotiate for better compensation, and explore opportunities for growth to maximize your earning potential in Virginia.

How often should I review and update my salary calculations?

+

It’s a good practice to review your salary calculations annually, especially during performance reviews or when negotiating salary increases. Additionally, significant life changes, such as a new job or a promotion, warrant an update to your calculations.

Are there any online tools or calculators that can assist with salary calculations in Virginia?

+

Yes, there are several online resources and salary calculators available that can provide estimates based on your job title, location, and industry. These tools can be a great starting point for understanding salary ranges and averages in Virginia.

What if my employer doesn’t pay me the correct overtime rate?

+

If you believe your employer is not paying you the correct overtime rate, you should first review your employment contract and any relevant company policies. If the issue persists, consider seeking legal advice or contacting the relevant labor authorities in Virginia.

Are there any industries or professions exempt from overtime pay in Virginia?

+

Yes, certain industries and professions, such as certain agricultural workers, independent contractors, and some executive, administrative, and professional employees, may be exempt from overtime pay requirements. It’s essential to understand your rights and eligibility based on your specific job role and industry.

How can I negotiate a higher salary or better bonus structure with my employer?

+

To negotiate a higher salary or improved bonus structure, it’s crucial to research industry standards and gather evidence of your value to the company. Prepare a strong case highlighting your achievements, contributions, and unique skills. Schedule a meeting with your supervisor or HR department to discuss your concerns and present your case.