16 Missouri Paycheck Calculator Tips: Essential Guide To Mastering Your Earnings

Calculating your earnings accurately is crucial, especially when it comes to understanding your paycheck. In Missouri, like many other states, there are specific rules and regulations that govern how wages are calculated and distributed. This guide will provide you with 16 essential tips to help you master your earnings and ensure you receive the correct compensation for your hard work.

Understanding Your Paycheck Components

Before diving into the calculation process, it's important to familiarize yourself with the various components of a Missouri paycheck. Here's a breakdown of what you can expect to see:

- Gross Pay: This is your total earnings before any deductions.

- Net Pay: The amount you take home after all deductions have been made.

- Taxes: Federal, state, and local taxes are typically deducted from your gross pay.

- Withholdings: These include deductions for social security, Medicare, and any other mandatory contributions.

- Benefits: If you have enrolled in company-provided benefits, such as health insurance or retirement plans, their costs may be deducted from your paycheck.

- Other Deductions: Look out for any additional deductions, such as union dues or voluntary contributions.

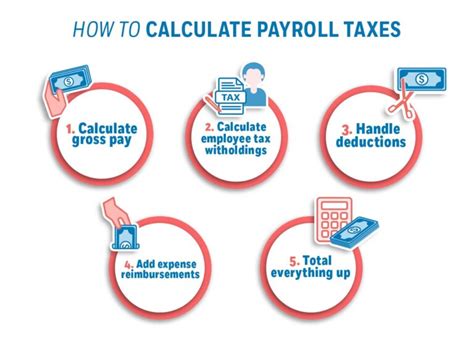

Step-by-Step Guide to Calculating Your Earnings

Now, let's walk through the process of calculating your earnings in Missouri. Follow these steps to ensure accuracy:

-

Determine Your Pay Rate:

- If you are an hourly employee, multiply your hourly rate by the number of hours worked.

- For salaried employees, divide your annual salary by the number of pay periods in a year.

-

Calculate Overtime (if applicable):

- In Missouri, overtime is paid at 1.5 times the regular rate for hours worked beyond 40 in a workweek.

- Multiply your overtime rate by the number of overtime hours worked.

-

Add Up Your Earnings:

- Sum up your regular pay and any overtime pay to calculate your gross earnings.

-

Subtract Deductions:

- Deduct federal, state, and local taxes based on your filing status and income level.

- Subtract mandatory withholdings for social security and Medicare.

- If applicable, deduct the cost of benefits and any other authorized deductions.

-

Calculate Net Pay:

- Your net pay is the amount remaining after all deductions have been made.

Key Considerations for Accurate Calculations

To ensure the accuracy of your earnings calculations, keep the following considerations in mind:

-

Pay Periods:

- Missouri allows for various pay periods, including weekly, biweekly, semi-monthly, and monthly.

- Make sure you are calculating your earnings based on the correct pay period.

-

Overtime Eligibility:

- Understand the eligibility criteria for overtime pay in Missouri.

- Not all employees are entitled to overtime, so check your employment contract or consult with your HR department.

-

Tax Withholdings:

- Review your W-4 form to ensure the correct amount of tax is being withheld from your paycheck.

- Consider adjusting your withholdings if your personal circumstances change.

-

Deduction Accuracy:

- Double-check the accuracy of all deductions on your paycheck stub.

- If you notice any discrepancies, contact your employer or payroll department promptly.

Maximizing Your Earnings

In addition to accurate calculations, there are strategies you can employ to maximize your earnings in Missouri:

-

Overtime Opportunities:

- If your job allows for overtime, consider taking on additional hours to boost your earnings.

- However, ensure you maintain a healthy work-life balance and prioritize your well-being.

-

Bonus and Incentive Programs:

- Some companies offer bonus structures or incentive programs to reward employees for their performance.

- Familiarize yourself with these programs and work towards qualifying for additional earnings.

-

Skills Development:

- Investing in your professional development can lead to increased earnings over time.

- Consider taking courses, attending workshops, or pursuing certifications relevant to your field.

Staying Informed and Seeking Assistance

To ensure you are up-to-date with the latest regulations and best practices, consider the following:

-

Paycheck Calculation Tools:

- Utilize online paycheck calculators or payroll software to double-check your calculations.

- These tools can provide valuable insights and help identify any errors.

-

Employment Laws:

- Stay informed about Missouri's employment laws, including minimum wage, overtime regulations, and employee rights.

- Understanding your rights can help you advocate for fair compensation.

-

Consulting Experts:

- If you have complex payroll or tax-related questions, consider seeking advice from a professional accountant or payroll specialist.

- They can provide personalized guidance based on your specific circumstances.

Common Misconceptions and Pitfalls

To avoid potential pitfalls and misconceptions, be aware of the following:

-

Overtime Misunderstandings:

- Overtime pay is not automatic. It depends on your job role, industry, and the number of hours worked.

- Clarify with your employer if you are eligible for overtime and understand the criteria for its calculation.

-

Tax Withholding Overestimations:

- Overestimating your tax withholdings can result in a larger tax refund, but it may also mean you are giving the government an interest-free loan.

- Aim for a balanced approach by reviewing your W-4 form and adjusting your withholdings accordingly.

-

Deduction Errors:

- Payroll errors can occur, leading to incorrect deductions on your paycheck.

- Regularly review your pay stubs and report any discrepancies to your employer promptly.

Conclusion

Calculating your earnings accurately is an essential skill for any employee. By following the tips outlined in this guide, you can ensure you receive the correct compensation for your hard work. Remember to stay informed about Missouri's payroll regulations, utilize available resources, and seek professional advice when needed. With a clear understanding of your paycheck components and accurate calculations, you can maximize your earnings and make the most of your financial situation.

What is the minimum wage in Missouri?

+

As of my last update in January 2023, the minimum wage in Missouri is $9.45 per hour. However, it’s important to note that some municipalities, such as St. Louis and Kansas City, have higher minimum wages.

Are there any specific regulations for overtime pay in Missouri?

+

Yes, Missouri follows the federal Fair Labor Standards Act (FLSA) regarding overtime pay. Overtime is paid at 1.5 times the regular rate for hours worked beyond 40 in a workweek. However, certain exemptions may apply depending on your job role and industry.

How often do employers in Missouri issue paychecks?

+

Employers in Missouri have the flexibility to choose the pay period frequency. Common pay periods include weekly, biweekly, semi-monthly, and monthly. It’s important to understand your pay period to accurately calculate your earnings.